The U.S. Bureau of Labor Statistics released the much-awaited Consumer Price Index (CPI) inflation data for February, which showed that US inflation comes in hotter at 3.2%. The crypto and stock market investors worried as they looked for further cues on Fed rate cuts.

After a shocking hotter CPI inflation last month of 3.1%, the probability of Fed rate cuts was pushed to June, with experts even predicting rate cuts starting in September. The CME FedWatch data indicates over 60% odds of 25 bps rate cuts in June and a further 25 bps rate cut in July.

US CPI Comes in Hot in February

The US annual inflation rate in the US came in at 3.2%, against the expected 3.1%, higher than January’s figures and maintaining levels not seen since 2021. However, consumer prices increased by 0.4% from the previous month, a slight uptick from 0.3%, primarily driven by a surge in gasoline prices.

Meanwhile, annual core CPI inflation further slowed to 3.8%, down from 3.9% last month, but higher than expected 3.7%. The monthly rate comes higher than market expectation at 0.4%, in line with 0.4% in January. The February report reflects a continued gradual disinflation process in the US, although the inflation rate remains high.

US equity futures and European stocks are steady after the key CPI data, with traders expecting market volatility. US dollar index (DXY) moving near 102.85 but volatility is expected. Moreover, the US 10-year Treasury yield that fell to 4.087% has increased to 4.110% after CPI.

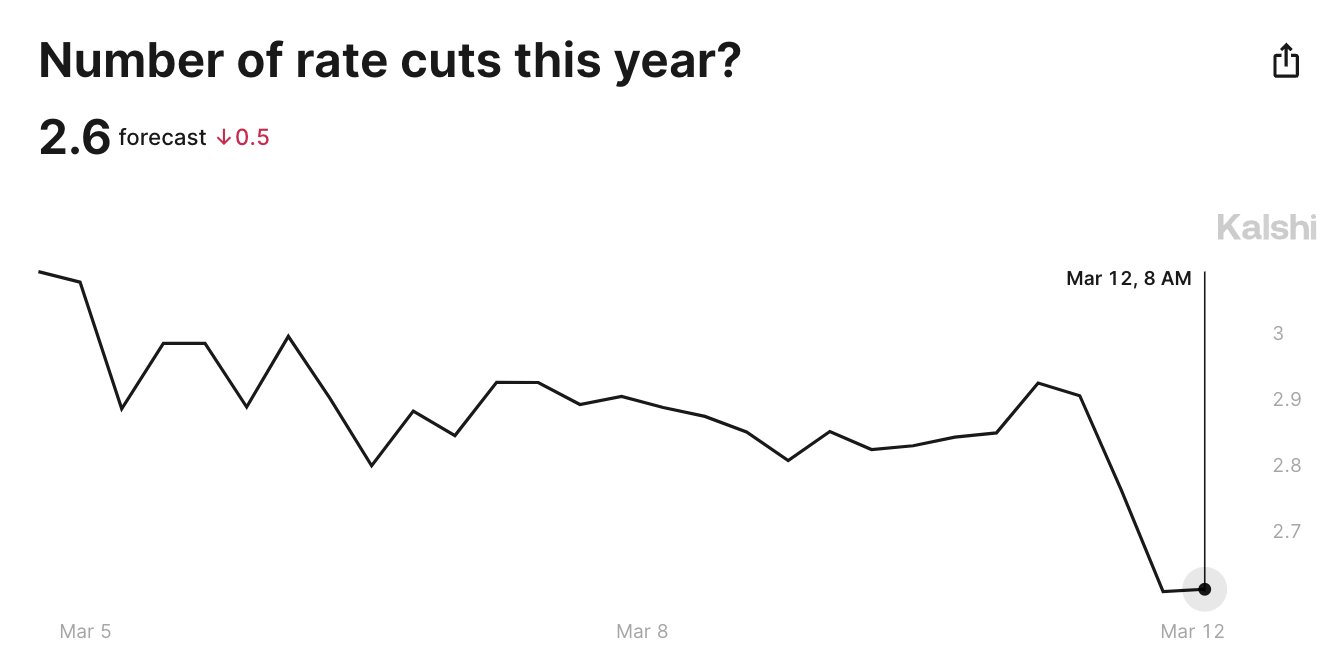

According to Kalshi, prediction markets are expecting less than 3 interest rate cuts in 2024 after the CPI increased for two straight months. Fed Chair Jerome Powell earlier said the FOMC expects three rate cuts in 2024.

Also Read: Binance Waives Fees For DOGE, SHIB, PEPE, BONK, WIF, FLOKI Meme Coins

BTC Price to $75K?

BTC price remains volatile after the CPI release, with the price currently trading above $72K. The 24-hour low and high are $71,339 and $72,850, respectively. Furthermore, the trading volume has increased slightly in the last few hours.

Meanwhile, JPMorgan CEO Jamie Dimon says the Fed should hold off on cutting interest rates amid lack of clarity on the state of the economy. “I think the chance of a soft landing in the next year or two is half,” Dimon said. “The worse case would be stagflation.”

While the equity market remains under stress, traders can eye for Bitcoin as an inflation hedge and BTC price can sustain with a further rally.

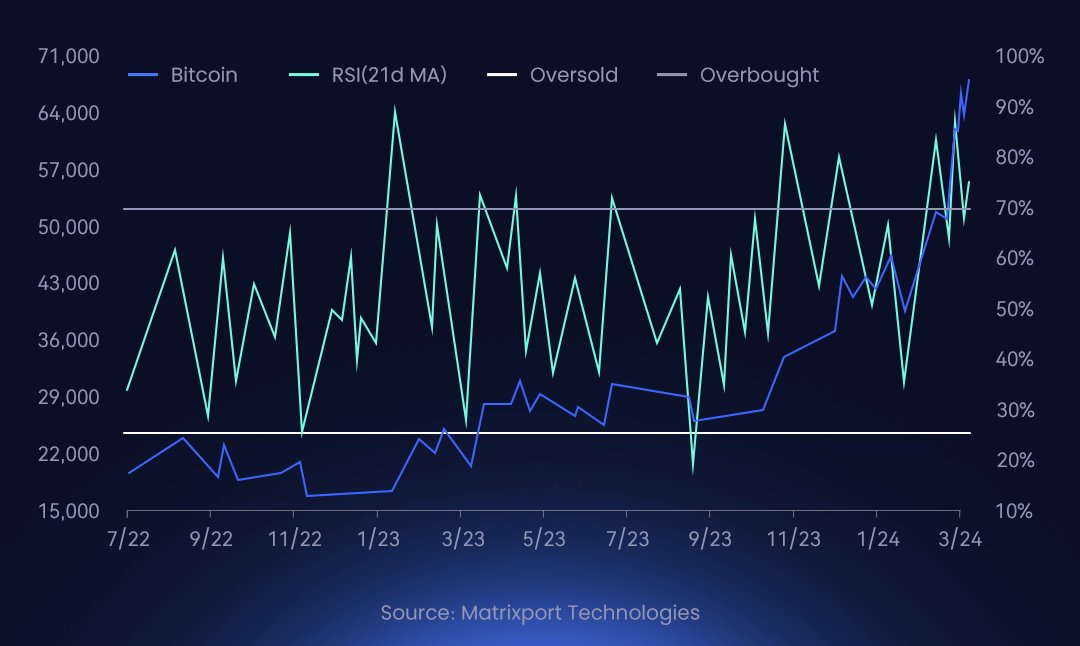

However, Matrixport predicts consolidation in the next few weeks, as per the risk-reward analysis. They added that bull market will continue but divergence between a declining RSI and higher Bitcoin price signals need for a consolidation before a rally.

Also Read: CoinShares Acquires Valkyrie Bitcoin ETF To Strengthen US Presence

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: