Bitcoin, the leading cryptocurrency, continues to captivate investors’ attention as it breaks out of a bull flag pattern. Notably, according to a prominent crypto market analyst, this bullish pattern could send the Bitcoin price to a new all-time high.

Meanwhile, amid recent volatility driven by factors like the U.S. Spot Bitcoin ETF outflux last week, renewed confidence in Bitcoin’s potential is evidenced by robust fund inflows. So, let’s take a look at the analysts’ insights and how they may aid Bitcoin prices to reach new heights.

Bitcoin’s Bullish Momentum Fuels Speculation of Record Highs

Bitcoin’s recent ascent to a new all-time high of $73,750 in mid-March underscored its resilience amid market fluctuations. However, subsequent volatility, partly attributed to outflows in the U.S. Spot Bitcoin ETF, temporarily dampened investor sentiment.

But the momentum seems to have reversed this week with a resurgence in ETF fund flows signaling renewed optimism among Wall Street players towards Bitcoin. In addition, the regaining institutional interest also reignites speculation of further price appreciation.

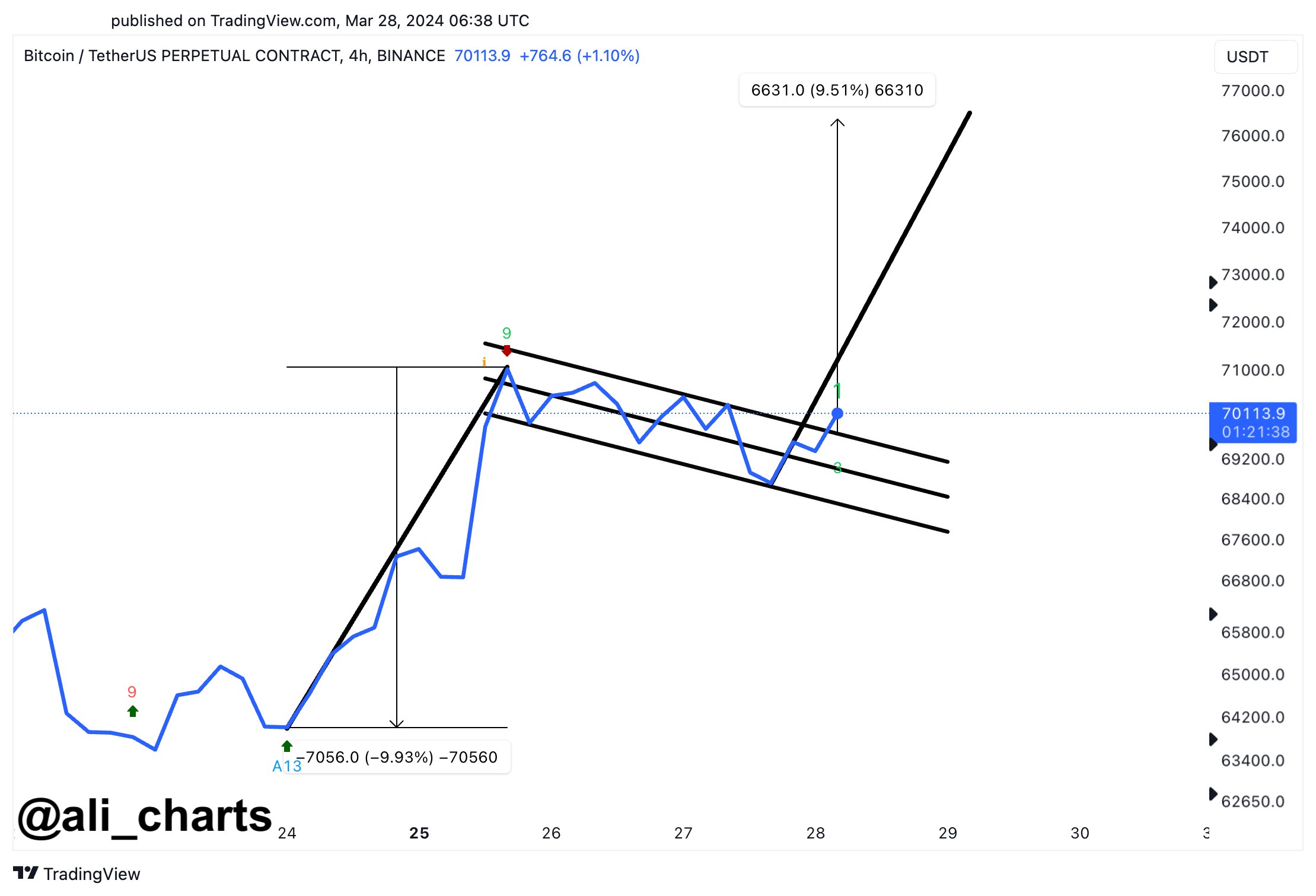

Meanwhile, amid the speculations, Ali Martinez, a prominent crypto market analyst, highlights Bitcoin’s potential breakout from a bull flag pattern on the 4-hour chart. Notably, Martinez predicts that if Bitcoin maintains its position above $70,000, a surge of nearly 10% to $77,000, is imminent.

This forecast aligns with growing anticipation among crypto enthusiasts for Bitcoin to achieve new record highs. Besides, the upcoming Bitcoin Halving event also bolsters market confidence, especially due to the historically associated price rallies after the event.

Also Read: Top Reasons Why Pepe Coin Might Hit New ATH

Price & Performance Amid Optimistic Scenario

The bullish sentiment surrounding Bitcoin is further bolstered by predictions from industry experts. Notably, FOX journalist Eleanor Terrett recently said that Valkyrie CIO Steven McClurg forecasts Bitcoin’s price to reach an impressive $150,000 within the year. Such optimistic projections underscore confidence in Bitcoin’s long-term value proposition and its potential to disrupt traditional financial markets.

In addition, Bitcoin Futures Open Interest (OI) indicates growing interest and investment activity in Bitcoin derivatives. According to CoinGlass data, Bitcoin Futures OI surged by 1.73% to 545.73K BTC, equivalent to $38.56 billion, in the last 24 hours. Notably, the CME Exchange leads with a notable 2.17% increase in Bitcoin Futures OI, signaling increasing participation and confidence in Bitcoin’s future trajectory.

Meanwhile, as of writing, the Bitcoin price was up 0.90% and traded at $70374.24, while its trading volume rose 21.59% to $41.78 billion from yesterday. Over the last 24 hours, the BTC price saw a high of $71,727.68 and a low of $68,381.93, reflecting the still-continuing volatility in the market.

Also Read: Cardano’s Charles Hoskinson Defends ADA & Ripple Against Forbes “Zombie” Tag

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: