Nvidia became the third company to enter the $3 trillion club, leaving behind Apple to set its position as the second-largest U.S. stock exchange-listed company. Nvidia (NVDA) share price hit a new all-time high of 1,224.50 and triggered bullish signals for technology stocks and Bitcoin and AI coins. Is Bitcoin rally to $100,000 more likely after Nvidia’s giant leap?

Analyst Says Nvidia Rally Strengthened Bitcoin $100K Move

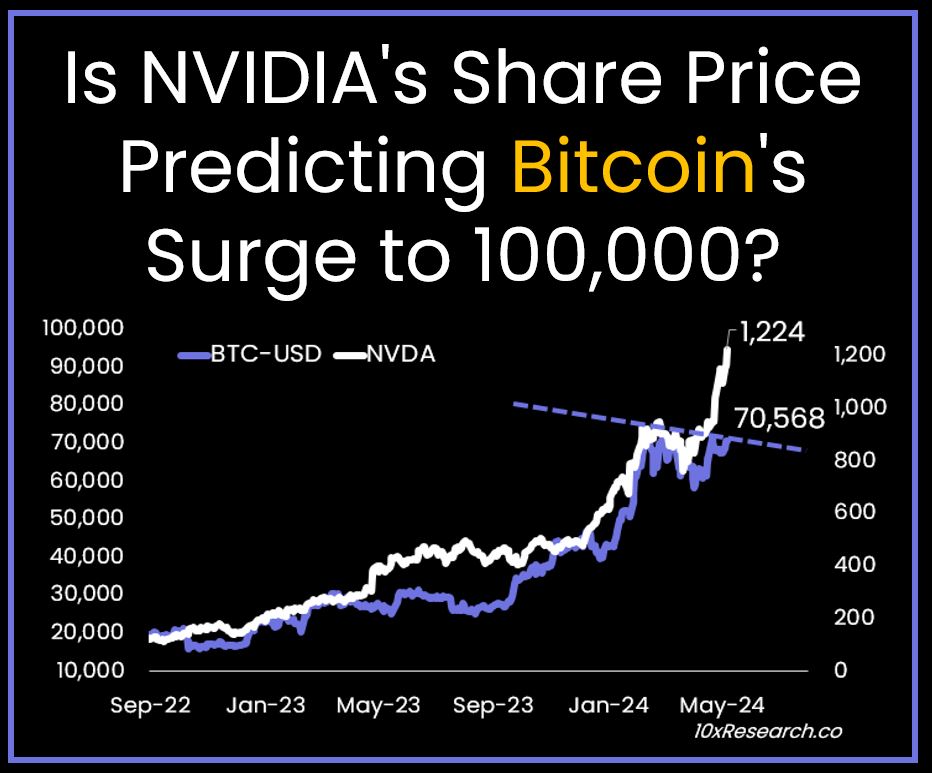

Markus Thielen, CEO of 10XResearch, on June 6 said a massive surge in Nvidia share price hints at high odds of Bitcoin price hitting $100K. He further bolstered his earlier prediction that BTC price is expected to hit a new all-time high by next week.

Since a rise in the correlation between Bitcoin and US markets due to ongoing mainstream adoption, Nvidia and BTC prices have moved almost similarly. Markus Thielen believes a breakout of $70,568 has set Bitcoin on a path to hit $100K.

NVDA price trading at 1,237.21, up 1.05% in a pre-market rally on Thursday. The price soared over 32% in a month and 154% year to date. Analysts at Bank of America raised their price for Nvidia stock to $1,500 from the previous NVDA price target of $1,320.

This shift underscores the growing investor enthusiasm for companies at the forefront of the artificial intelligence (AI) revolution.

Also Read: Cardano, Shiba Inu, Jasmy Grabs Interest Of Big Whales, Trigger Buy Signal

Multiple Factors Confirms BTC Price Rally

BTC price is trading sideways today, with the price currently trading at $70,915. The 24-hour low and high are $70,390 and $71,735, respectively. Furthermore, the trading volume has decreased by 27% in the last 24 hours, indicating a decline in interest among traders.

CryptoQuant data reveals institutional investors have shifted towards reaccumulation over the past two weeks, NVT golden cross hints local bottom, and Bitcoin Volatility Index (SMA-30d) and Adjusted MVRV (30DMA/365DMA) metrics highlight slowdown in price swings.

Analyst Willy Woo predicted a $1.5 billion Bitcoin short liquidation if BTC price hits $72,000 and set to a rally towards $75,000.

Also Read: Cathie Woods Ark Invest Has Strong AI Exposure Despite Trimming Nvidia

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: