KeyTakeaways:

- US banks could begin offering tokenized assets and crypto custody services by 2025.

- The repeal of SAB 121 is expected to unlock new opportunities for crypto adoption.

- Major financial institutions offering crypto custody could lead to increased liquidity and stability.

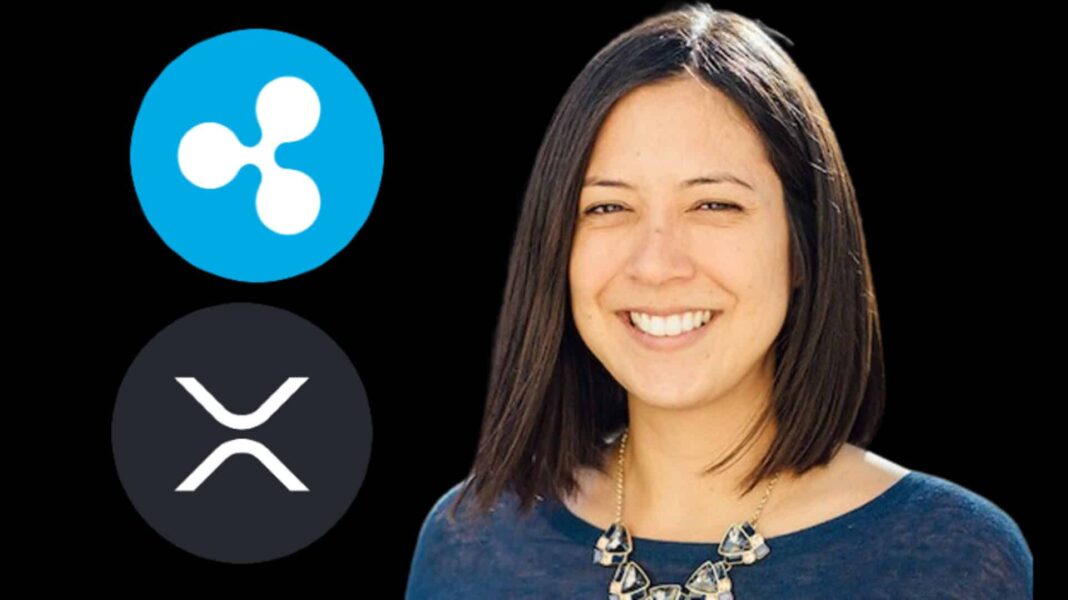

Ripple President Monica Long is optimistic that major US banks will launch tokenized asset projects and crypto custody solutions by 2025, contingent on the clarity of regulations. In a recent statement, Long noted that 15 of the world’s 25 largest banks have already piloted tokenized asset initiatives.

She further highlighted that several banks could introduce market-ready offerings in the US as early as 2025, assuming regulatory approval.

Long’s remarks came amid a shift in the US government’s stance on crypto regulations. Upon taking office, President-elect Donald Trump is expected to issue executive orders, including repealing the controversial SAB 121 policy.

This policy required banks holding digital assets to account for them as liabilities. Trump’s decision to repeal this regulation could allow banks to enter the crypto space more confidently.

The Ripple President emphasized that removing the SAB 121 policy would be a critical step in facilitating the broader adoption of tokenized assets in the financial sector.

As the market becomes more accessible, Long believes tokenized assets could play an integral role in reshaping the future of finance. Her predictions align with the growing interest in digital assets among institutional investors.

Financial analyst Frank Chaparro also weighed in on the issue, suggesting that allowing banks to hold crypto assets in custody could significantly boost liquidity.

He explained that credit and increased liquidity would be powerful market stability and growth drivers. This development could address volatility concerns that have long affected the crypto market.

Trump’s expected regulatory changes further support the potential for the crypto industry to see greater stability.

As major financial institutions move toward offering crypto custody services, analysts anticipate that this will help stabilize prices and attract a broader investor base. Ripple’s XRP token, in particular, is expected to benefit from the evolving regulatory landscape.