KeyTakeaways:

- SEC accuses Elon Musk of securities fraud over delayed disclosure of Twitter stock purchases.

- The lawsuit seeks financial penalties, including forfeiture of Musk’s $150 million in profits.

- SEC’s legal action follows prior lawsuits related to Musk’s Twitter acquisition in 2022.

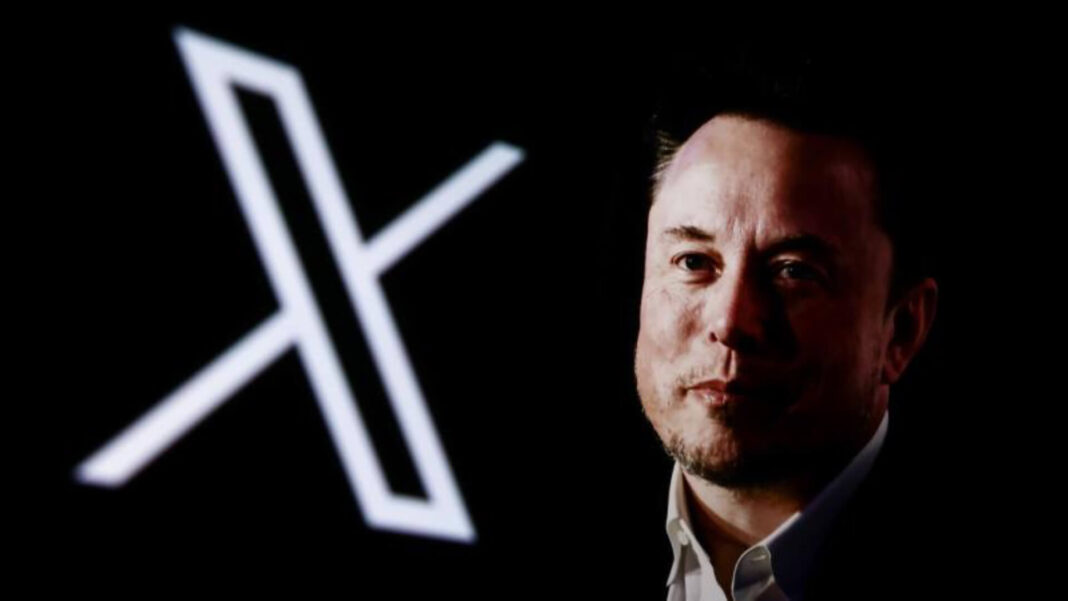

The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against Elon Musk, accusing him of securities fraud over his delayed disclosure of stock purchases during his 2022 acquisition of Twitter, now known as X.

The SEC claims Musk violated federal regulations by failing to disclose his significant stake in Twitter on time, allowing him to buy shares at a lower price and allegedly saving him $150 million.

Musk reportedly accumulated more than 5% of Twitter’s shares by March 2022, a threshold that triggers a disclosure requirement under SEC rules. According to the lawsuit, Musk did not inform the public about his stock purchases until 11 days later, giving him an advantage over other investors.

His public disclosure on April 4, 2022, revealed that he held over 9% of the company, coinciding with an announcement that Twitter would join the exchange. Following this, Twitter’s stock price surged by more than 27%.

The SEC has called for Musk to forfeit any profits from the delayed disclosure and pay civil penalties. Additionally, the agency is seeking a jury trial to determine whether Musk violated securities laws.

In response, Musk’s legal team dismissed the allegations, labeling the lawsuit a “sham.” His attorney, Alex Spiro, argued that the case revolves around a bureaucratic issue and that the alleged failure to submit a form has minimal consequence.

This lawsuit adds to the mounting legal challenges Musk faces related to his $44 billion acquisition of Twitter. It comes at a time of significant regulatory change. Gary Gensler’s tenure as SEC Chair ends on January 20, 2025, with President-elect Donald Trump expected to introduce regulatory reforms.

Musk’s relationship with the SEC has been fraught with tension, as evidenced by previous legal battles, including a 2022 lawsuit over Musk’s handling of his Twitter acquisition, which is still ongoing.