The Ripple XRP price rally stalls near a key level after the recent market crash and it seems that the macro risks and long-term bearish setup continue to spoil the bullish prospects for the coin so let’s read more today in our latest ripple news.

The Ripple XRP price rally risks exhaustion as the price tests a resistance level with a history of triggering a 65% price crash. The XRP price gained 30% and increased to $0.36 on June 24, a few days after rebounding from the $0.28 price range which was the lowest level since January 2021. the token’s retracement rally can extend to $0.41 next as per the cup-and-handle pattern shown in the charts.

The indicator’s profit target is the same as XRP’s 50-day exponential moving average and the bullish reversal setup tends to meet the profit target at a 61% success rate as per analyst Thomas Bulkowski. It seems that XRP’s case falls in the 39% failure spectrum because of the conflicting technical signals presented by the 200 4-h exponential moving average. The XRP pattern served as a strong distribution signal in the past and in April 2022, the token tried to break above the same wave resistance multiple times but faced rejections on every try and dropped 65%.

The ongoing breakout stalled midway after XRP retested the 200-4H EMA as the resistnace on June 23 but now the token awaits further bias confirmation while risking the price decline similar to what happened in April. XRP’s overbought RSI now above 70 raised the possibility of an interim price correction. The downside scenario on the shorter-timeframe chart came in line with some giant bearish setup on the longer timeframe chart. XRP entered a breakdown stage after the exiting of the descending triangle structure in May.

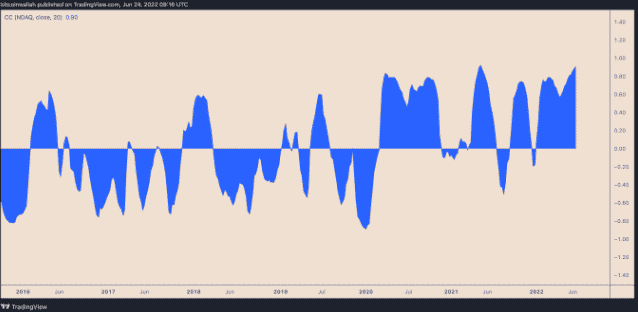

The triangle breakdown should have it drop by as much as the structure’s maximum height which put its downside target near $1.86. Macro risks by the FED hawkish policy further enhance the XRP bearish bias and the pair typically traded lower in tandem with the riskier assets in 2022 with the correlation coefficient sitting at 0.90 on the NASDAQ composite on June 24. With that being said, XRP could rebound to $0.91 by the end of the year if the ongoing retracement continues further. The token bounced after testing long-term ascending trendline support.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]