Bitcoin price slips to $60,000 today, sparking concerns in the broader crypto market. Following the downturn trend in BTC price, several other major cryptos also witnessed a decline today.

However, what has piqued the market interest is the potential reason behind the recent dip. Besides, the discussions further intensify, especially after the recent pump in Bitcoin over the weekend.

Why Bitcoin Slips To $60K Today?

The recent decline in Bitcoin price to $60,000 raised eyebrows across the cryptocurrency landscape. However, amid this, a new report by 10X Research sheds light on the key factors driving this sluggish performance in the flagship crypto.

Their report outlines that the weekend pump was likely a technical reset, alleviating oversold conditions in the short term. This reset paved the way for the downtrend to resume as longer-term technical signals point to a potential topping formation.

In addition, the report suggests that despite short-term bullish sentiments driven by factors such as U.S. Presidential Election tailwinds and anticipated interest rate cuts, these were overshadowed by deeper technical and structural concerns. Analysts from 10X Research highlight the significant role of on-chain signals, market flows- particularly from Bitcoin miners’ inventory, and market structure data in this downturn.

These factors collectively contributed to a bearish outlook for Bitcoin, outweighing temporary bullish influences. Besides, one crucial aspect noted was the impact of low trading volumes over the weekend.

During these periods, even modest buying activity can trigger stop orders, leading to liquidations and amplifying price movements. This phenomenon was evident in the recent weekend’s upward surge, which swiftly turned into a correction as the upside risk from short covering diminished and downside pressures took hold.

Also Read: Fidelity & Sygnum Taps Chainlink For Tokenized Asset Data

What’s More?

Another significant driver of Bitcoin’s price decline is the impending expiration of substantial Bitcoin and Ethereum options. Data from Deribit indicates that Bitcoin options with a notional value exceeding $1.04 billion are set to expire on July 5, with a put/call ratio of 0.80 and a maximum pain price of $63,000.

On the other hand, Ethereum options worth $479.30 million, featuring a put/call ratio of 0.38 and a max pain price of $3,450, are also due to expire on the same date. These expiries are generating uncertainty, prompting traders to adjust their positions ahead of the deadline. The approaching expiry date increases market volatility, as participants hedge their bets and recalibrate strategies in response to the significant options contracts that are about to mature.

In addition, the July 2 outflow in the U.S. Spot Bitcoin ETF following a 5-day winning streak also weighed on the investors’ sentiment. According to recent data, the U.S. Spot Bitcoin ETFs recorded an outflow of nearly $14 million on Tuesday, following an influx of about $130 million in the prior day.

Further Liquidation Ahead?

Several market experts appear to have remained bullish despite today’s slump. However, it’s worth noting that the liquidation warning from 10X Research as well as from other prominent analysts have weighed on the sentiment.

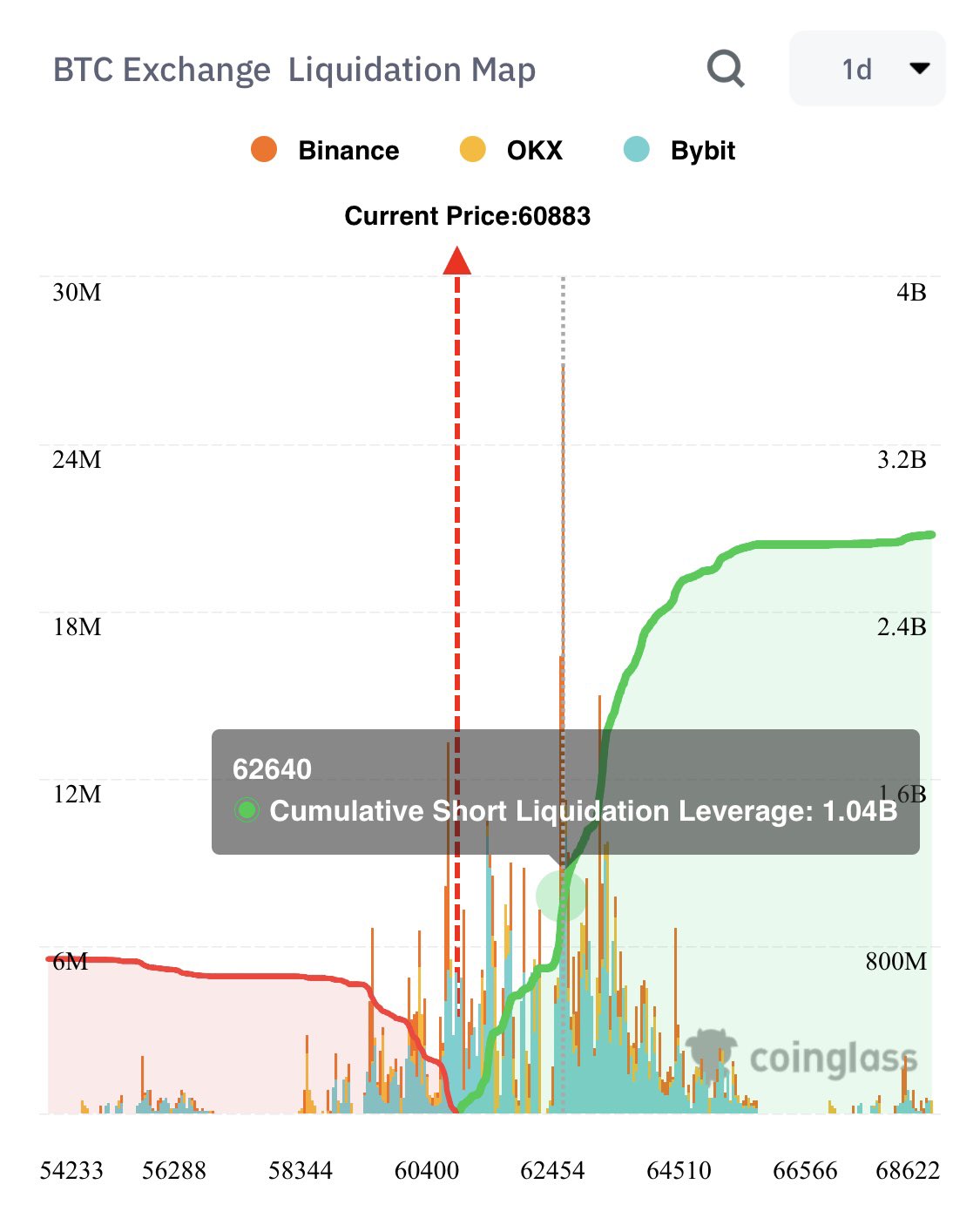

For context, Ali Martinez said that Bitcoin may recover from its current phase while revealing a warning. Martinez, while analyzing the Bitcoin Exchange Liquidation Map, said that BTC risks witnessing over $1 billion in liquidation if it reaches the $62,600 level.

As of writing, Bitcoin price was down more than 3% and hovers near the $60,500 range. Its one-day trading volume rose 7% to $23.54 billion, while the crypto has touched a 24-hour high of $63,015.03. Furthermore, CoinGlass data showed a slump of more than 4% in Bitcoin Futures Open Interest from yesterday.

Also Read: Binance Announces Delisting Of Key Crypto Pairs, Brace For Market Impact

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: