Crypto exchange Kraken’s subsidiary is a major beneficiary of the spot Bitcoin exchange-traded funds (ETF) in the United States and Hong Kong, as per a latest report by Bloomberg. The company predicts $1 billion of assets under management (AUM) in spot Bitcoin and Ether ETFs in Hong Kong, as well as other markets to see the listing of spot crypto ETFs.

Kraken’s CF Benchmarks Gains 50% of Crypto Benchmarking Market

CF Benchmarks, a subsidiary of crypto exchange Kraken, saw a massive increase in demand for its indices amid a boon in spot Bitcoin ETFs. The United States and Hong Kong are major financial hubs bringing exposure of already established institutional investors base to Bitcoin.

The company said it represents almost 50% market share in the crypto benchmarking market as a result of launch of spot Bitcoin ETFs in the U.S. in January and in Hong Kong last year. It provides data for about $24 billion in crypto ETFs, primarily BlackRock’s iShares Bitcoin ETF with $16.2 billion AUM.

CF Benchmarks expects its revenue to almost double this year, as per the rising demand for spot Bitcoin ETF. The last available revenue data indicates it reached £6 million ($7.5 million) in 2022. In addition, the firm plans to expand headcount by around a third to more than 40. Kraken acquired CF Benchmarks in 2019.

South Korea and Israel Are Next in Crypto ETFs Race

CF Benchmarks chief executive officer Sui Chung sees them working with crypto ETFs issuers in South Korea and Israel next. South Korea has one of the largest crypto users, with high trading volumes impacting crypto prices.

“South Korea is a market where ETFs have become the wrapper of choice for long-term savings. It is also a market where digital assets have gained a high degree of adoption,” said Sui Chung.

The company expects Hong Kong-based spot Bitcoin and Ether ETFs to witness $1 billion in funds under management by year-end.

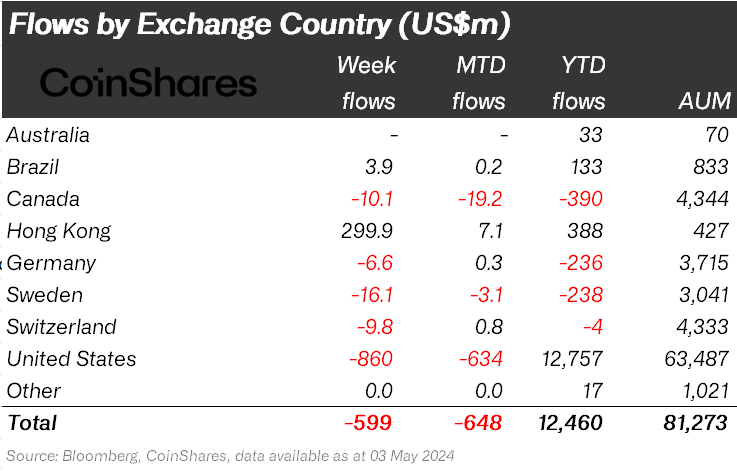

CoinShares head of research James Butterfill revealed Hong while other markets suffer outflows from digital asset products, Hong Kong saw $300 million in inflows so far this week.

Also Read:

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: