Singapore isn’t in a rush to list crypto ETFs, according to SGX CEO this week as Philippines charges two over a $6M XRP hot wallet hack.

Singapore isn’t in a rush to list crypto ETFs, according to SGX CEO this week as Philippines charges two over a $6M XRP hot wallet hack.

Source link

Growth in its DeFi ecosystem and the upcoming Binance Launchpool addition have put wind in Toncoin’s sails.

U.S.-listed mining companies produced a larger share of bitcoin in July than June, accounting for 21.1% of the total network versus 20.7% in May, the report said. August will be a more difficult month for the miners as the price of bitcoin has dropped about 5% while the network hashrate has started to grow again, the report added.

Binance is finally back in India after a seven month ban. This has served as a 78th Independence day gift to the Indian crypto community. Let’s explore the journey of Binance from a ban to fully function and what this means for the Indian crypto ecosystem.

India banned Binance and other 8 offshore Crypto exchanges on 12 Jan 2024. The Ministry of Electronics and Information Technology (MeitY) took this action. This ban came after the show cause notice to these nine offshore VDA providers by the Financial Intelligence Unit (FIU) on December 28, 2023. Including Binance this ban was imposed on Bitstamp, Kucoin, Huobi, MEXC Global, Kraken, Gate.io, Bitfinex and Bittrex.

These crypto companies received the show cause notice under Section 13 of the Prevention of Money Laundering Act, 2002 (PMLA). According to the government authorities of India, these exchanges received the notice for operating illegally in India. In Jan, 2024, Indian Authorities blocked URLs of these Offshore Crypto Exchanges. Apps store and Play store also removed their applications.

Binance is not the first offshore VDA provider to perform registration with IND-FIU. On March 23, KuCoin officially announced that they have registered with FIU. They had to pay a penalty of $41,000 in order to resume their operations in India. KuCoin got their website URL unblocked in May. The same month, it was announced that Binance had also processed the registration with FIU, however a penalty was pending. Later it came to light that FIU has penalized Binance with a sum of $2.2 Million.

While most of the Crypto exchanges do not wish to lose the Indian trader community, OKX declared exiting India on 30th April, 2024. It is interesting to note that OKX was not among the nine offshore exchanges to receive the notice from the Indian government.

Coinpedia was the first to report this update. On July 30, we reported that Binance URL was accessible in India. We tested the URL across various Indian cities, it tested positive in most Indian cities. One day before India’s 78th Independence day, Binance URL became completely accessible across PAN India. However, the apps were still missing from stores. Binance app became visible on Android Play Store and Apple App Store early morning 15 August. Binance, in a blog post shared all the details of their registration with Indian Authorities and their return to India.

The CEO of Binance, Richard Teng, posted on X showing how thrilled the company is to be registered with FIU-IND. Wishing India a happy Independence day he stated that this is the 19th Global regulatory milestone for Binance.

Now that Binance is fully functional in India, they will deduct the 1% TDS on crypto transactions according to Section 194S of the IT Act. This rule came into effect from 1 July, 2022. Registration of Binance with FIU also means that the exchange will have to report any kind of suspicious transaction to the FIU. The exchange may require its Indian users to re-perform the KYC in accordance with the Indian Anti Money Laundering laws.

This is one step forward towards making India make a strong presence in the Crypto world, however the community does not appreciate the 30% tax in Crypto.

Last night, Aug. 14, at a Crypto4Harris event, Senate Majority Leader Chuck Schumer and other prominent Democrats expressed strong support for crypto, underscoring the importance of regulatory clarity and bipartisan collaboration to shape the industry’s future.

Schumer emphasized that Congress has a responsibility to enact common-sense and sound regulations for crypto, aiming to bring both sides of the aisle together to pass sensible legislation. He indicated his goal is to get a comprehensive crypto bill into law by the end of the year. Schumer compared crypto regulation to artificial intelligence regulation, noting that both technologies can thrive with the proper regulations.

He also highlighted the need for collaboration between Congress and the industry to provide regulatory clarity, warning that failing to regulate crypto could drive the industry overseas to countries with little to no regulation. Schumer highlighted that the U.S. must be the global leader in crypto and, with Democrats in the Senate majority, bipartisan legislation for sensible regulation is achievable.

Governor Jared Polis of Colorado highlighted his state’s pioneering role in adopting crypto for various state services, including taxes, DMV fees, and hunting licenses. He mentioned that Colorado embraces regulatory sandboxes and sees crypto as part of broader innovation efforts. Polis pointed out that Democrats aim to empower people through blockchain technology and noted that Colorado is exploring ways to integrate blockchain more deeply into state functions.

He also referenced historical events like Mt. Gox and FTX to stress the importance of proper regulation, adding that Vice President Harris, who hails from California—a hub of Silicon Valley innovation—is well-positioned to embrace and advance innovation in this space.

Senator Debbie Stabenow discussed her collaboration with Senator Kirsten Gillibrand on regulatory aspects of crypto, with the goal of ensuring that innovation can flourish while protecting consumers. Stabenow emphasized that Democrats in the Senate are serious about enacting crypto legislation and are committed to keeping crypto innovation in the US.

She highlighted that a bill supported by many in the crypto industry is in the works, which would establish rules for trading cryptocurrencies and empower the Commodity Futures Trading Commission (CFTC) to protect consumers while allowing blockchain technology to thrive. Stabenow mentioned that Schumer was supportive of this bill, which they aimed to pass by September, but noted that GOP opposition had delayed progress. She expressed confidence that Vice President Harris will help enable thoughtful progress in crypto regulation.

Congressman Adam Schiff also addressed the significance of new technologies like crypto for job creation and economic growth, particularly in California. He advocates for a comprehensive framework to prevent crypto from moving overseas, where it would face fewer safeguards and more bad actors. Schiff emphasized the importance of collaborating with Vice President Harris to ensure that effective regulation is in place.

Anthony Scaramucci, founder of SkyBridge Capital, noted that Congressman Ro Khanna has organized two significant meetings on crypto with the White House. Scaramucci emphasized the desire for positive, bipartisan regulation, highlighting the importance of avoiding tribalism.

Other Democratic lawmakers also voiced their support for crypto regulation. Congressman Wiley Nickel pointed out that only Donald Trump has called crypto a scam among the three main presidential candidates. Nickel is working to ensure that with Harris’s involvement, there will be a “crypto reset.”

Congresswoman Yadira Caraveo acknowledged bipartisan agreement on the need for better oversight in crypto and expressed her belief that Harris will take a forward-looking approach to regulation. Similarly, Congressman Darren Soto expressed excitement about Harris’s familiarity with technology and her potential to repeal SEC Rule 21. Soto supports the passage of the FIT Act and emphasizes the importance of recognizing crypto’s role, particularly in remittances.

Congressman Dan Goldman, representing a district in Lower Manhattan, which he referred to as the crypto capital of the world, spoke from his experience as a prosecutor. He highlighted the complexities of securities and commodity regulations and argued that killing crypto would be akin to killing the internet in the 1990s. Goldman believes the US needs to lead in crypto innovation and expressed eagerness to work with Harris, who also understands regulation from her time as a prosecutor.

Congressman Steven Horsford, Chair of the Congressional Black Caucus, sees significant opportunities to generate wealth through crypto. He emphasized the importance of democratizing this opportunity equitably and believes Harris has the chance to reset the conversation around crypto.

At the state level, Delaware State Senator Sarah McBride, who is running for US Congress, advocated for democratizing access to finance through crypto, noting that we are at an inflection point. George Whitesides, a Congressional candidate from California and former CEO of Virgin Galactic, shared his belief that American innovators must be allowed to lead in the crypto space. He mentioned accepting Bitcoin as a payment ten years ago as an early indicator of his commitment to the industry.

Shomari Figures, a Congressional candidate from Alabama, highlighted the need for his state to take advantage of the opportunities presented by crypto. Figures are committed to supporting sensible crypto regulations and ensuring that Alabama does not remain at the bottom of the list in this emerging industry.

Political commentator Brian Krassenstein created an in-depth summary of the event and commented,

“Bitcoin is the future and democrats are usually ahead of republicans in embracing new technologies.

It’s time for Democrats to embrace Bitcoin and for America to get a leg up on other adversary nations.”

Meanwhile, the founder of the AI platform Irreverent Labs, Rahul Sood, argued,

“I’ve been here long enough to know democrats hate crypto or don’t understand it and don’t want to. It’s the party of Warren.”

Founder of crypto-focused investment firm Coinfund, Jake Brukhman, commented,

“I heard some pleasantries spoken. Things like “we must level the playing field of crypto”. It was a bit offensive, actually…

A lack of self-awareness and acknowledgement of the reality of the crypto founder. We’ll just move forward and happily “make this a bipartisan issue” even though Harris-backed policies made it partisan in the first place.”

However, Laura Brookover, a litigator from Consensys, remarked,

“We’ve heard from 3 Dem Senators and lots of Dem Reps on this Crypto4Harris town hall — explicitly saying that (1) the US needs to lead on crypto tech and (2) govt policy must support crypto innovation.

Feels like we’re finally at a tipping point for the Dems. And that would mean Sen Warren’s reign over Dem crypto policy is over.”

From the community’s reaction, it is clear that it is split over the debate as to whether the Democrat Party is doing enough to walk back what is seen by many to have been 4 years of aggressive policy against the crypto industry.

Still, the Crypto4Harris event showcased a unified Democratic push toward establishing a regulatory framework that balances consumer protection with the need to foster innovation within the U.S. With Schumer’s leadership and Harris’s involvement, the prospects for meaningful crypto legislation appear strong, may signal a pivotal moment for the industry in the US.

Source link

Share this article

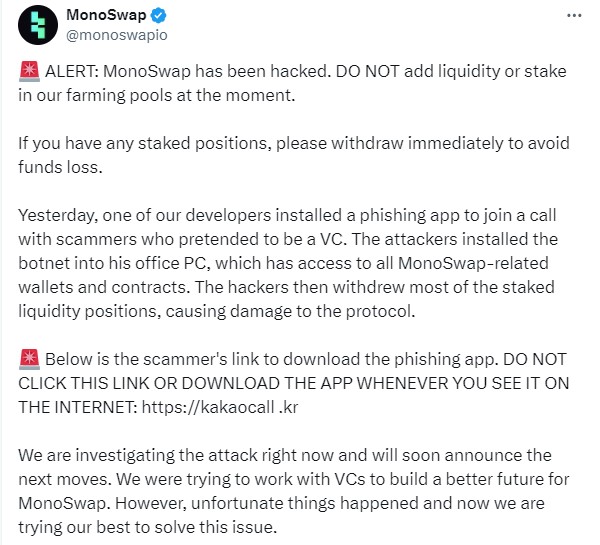

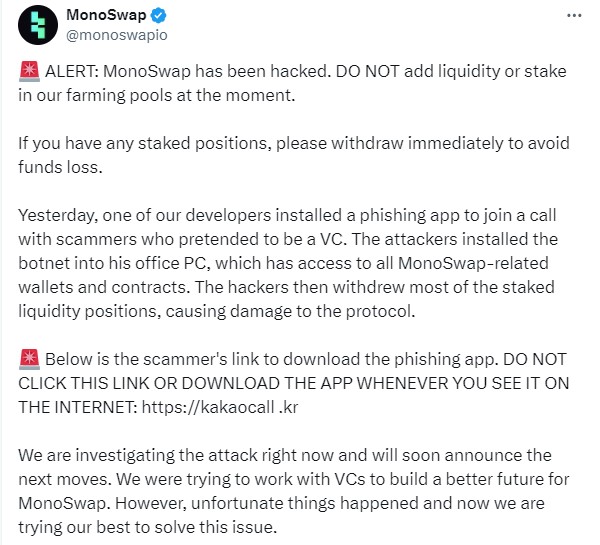

MonoSwap, a decentralized exchange (DEX) operating on the Blast framework, was hit by a phishing attack that resulted in staked liquidity losses, said the project in a recent statement. Users are advised to immediately withdraw all staked positions to prevent further losses, as well as avoid adding liquidity or staking in farming pools.

According to MonoSwap, the breach originated from a phishing attack targeting one of its developers. A malicious actor, posing as a venture capitalist, convinced the developer to install a phishing application.

Once installed, the app enabled hackers to gain control over the platform’s financial operations. They proceeded to drain a substantial portion of the staked liquidity from MonoSwap’s farming pools. The exact amount of stolen funds has not been publicly disclosed.

MonoSwap is currently investigating the attack and will provide updates on the next steps.

This is a developing story. We’ll give an update on the matter as we learn more.

Share this article

VanEck and 21Shares submit updated Ether ETF filings, Goldman Sachs to launch tokenization products, and Messi promotes memecoin.

Source link