VIX 101: The fear index that’s shaping the market

Andjela Radmilac · 2 days ago

CryptoSlate’s latest market report dives deep into the VIX to explain its significance, historical context, recent trends, and implications for the crypto industry.

Andjela Radmilac · 2 days ago

CryptoSlate’s latest market report dives deep into the VIX to explain its significance, historical context, recent trends, and implications for the crypto industry.

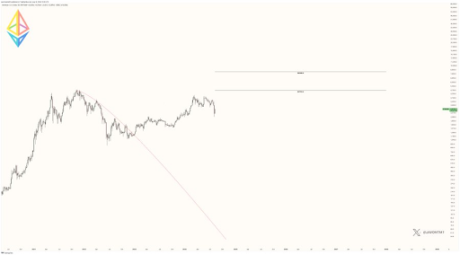

Crypto analyst Javon Marks has predicted that Ethereum (ETH) could enjoy a 75% breakout and rise to $4,723. The analyst also explained why this parabolic rally is possible for the second-largest crypto by market cap.

Marks mentioned in an X (formerly Twitter) post that Ethereum’s price is poised to rise to $4,723 as bull divergences continue to hold within a massive climb since breaking out. He added that the 75% move to this target and above can take place with the breakout and divergence holding.

From the chart he shared, Marks also suggested that Ethereum’s price could rise to $8348. However, the analyst didn’t provide a timeline for when ETH will reach this price target. Crypto analyst Altcoin Daily also recently predicted that Ethereum could rise above $8,000 as he put his peak price target for ETH in this bull run at $8,800. Crypto analyst Poseidon also believes that Ethereum’s price can rise as high as $8,000.

Meanwhile, crypto analyst DavidOnCrypto has provided a timeline for when Ethereum could reach $8,000, stating that it will happen in the next six months. He claimed that ETH’s move from its current price level to $8,000 would foreshadow the move that Bitcoin enjoyed as it rose from $25,000 to $70,000.

Ethereum investors will undoubtedly be wary of such price targets, considering how much the crypto token has underperformed compared to Bitcoin since the start of the year. However, crypto analysts like Roman have assured that Ethereum’s time will come when it will make that parabolic run in this market cycle.

The analyst explained that it wasn’t unusual for Ethereum’s price to lag while Bitcoin hit new highs. He alluded to 2020 when ETH was down 80% from its all-time high (ATH) while the flagship crypto broke its ATH. Roman predicted that Ethereum would make its run by year-end, as that is when he believes liquidity will begin to shift from Bitcoin to Ethereum and other altcoins.

Crypto analyst Crypto Kaleo recently stated that he is confident that Bitcoin’s dominance has hit cycle top. This represents a positive for Ethereum’s price as Crypto Kaleo noted that altcoins will begin to gain ground starting with the “king” ETH. He added that the real altcoin season begins when Bitcoin’s dominance drops beneath 50%.

Meanwhile, Grayscale’s Ethereum Trust (ETHE), which has recently contributed much of the selling pressure on Ethereum, recorded its first zero-flow day since converting to a Spot Ethereum ETF.

This is undoubtedly a positive for Ethereum, especially considering that Grayscale’s Bitcoin Trust (GBTC) recorded 78 consecutive outflow days before registering its first day without an outflow. On the other hand, ETHE achieved this feat on the fourteenth day of trading as a Spot Ethereum ETF.

Featured image created with Dall.E, chart from Tradingview.com

In case, you are looking for a cool and interesting way to earn a quick buck, Here’s a platform that pays you for filling out simple surveys. Toluna Group lets you take surveys for forming a database for market research.

[polls_shortcode postid=”52287″]

Toluna is a worldwide survey technology provider and claims to be the “ World’s Largest social voting community” which has more than nine million survey takers.

In this review, you will get a detailed insight into Toluna, Let’s look into this review article now:

| Name | Toluna |

| Owner | Frederic-Charles Petit |

| Founded Year | 2000 |

| Headquarters | Paris, France |

| Type | Online Surveys |

| Apps | iPhone & Android Devices |

| Support | Email, Phone |

| Website | www.toluna.com |

Toluna is a community survey platform that offers online surveys in return for rewards. This is a Paris( France) based company, managed by the Toluna Group and a well known market research company preferred by brands around the world. With more than 9 million survey takers, for the people who want to make money by taking surveys, Toluna is a preferred option.

The users that register on Toluna and take up these surveys are known as “Toluna Influencers”. These surveys completed are used by the major brands to help them figure out their business plan. It is one of the world’s most popular survey sites which has a very strong subscriber base and an effective portfolio of clients.

With 16+ offices globally, Toluna team aims to provide better products and quality to the consumers. They do it by surveying for the brands and thus it helps in dealing with customer satisfaction and to improve their business plan.

Toluna provides its membership to 49 countries. The number of surveys that are available depends on your location.

Step 1: You can fill up the registration form online and sign up for Toluna.

Step 2: After the Toluna login, you will be asked to verify your account by providing your personal details. Further, you are good to take the online surveys.

Toluna Influencers are paid in the form of points which can be redeemed further in the form of gift cards, vouchers, etc. There are two types of Toluna surveys available listed below:

You can update your personal information by logging into your account. Select “Account” in the top right corner and then click the Edit option. You can also view your account activity such as credits purchased, surveys launched, and the current status of your subscription.

In cases where you forget your password, you can do it by Clicking the Sign in button at the top right side. Then click the “forgot your password” option and follow the instructions further which you will be able to retrieve your password.

There are 8 ways to earn in Toluna which are as follows:

There are 3 ways to redeem the points in Toluna which are listed below:

You need to reach of minimum of 30,000 points which are listed below:

As per the Toluna reviews, it has been found that Toluna is a legitimate business. Despite its long wait times, it has a noted record of paying its clients and further issuing them good rewards.

It is a company that offers to pay on each survey you take. It has been very popular and has become one of the people’s number one choices regarding online surveys. They also have a base of around 13 million users and is on a rapid expansion

Toluna also has an A+ rating in the Better Business Bureau(BBB) with only around 31 customer complaints. Further, it has a 3.8 rating on the Trustpilot with more than 2,100 Toluna reviews.

There are a lot more positive reviews compared to the criticism. It has great customer service for which it accounts as one of the legit organizations that pay people in response to the online surveys.

It is to be acknowledged that Toluna is a legitimate business which pays its users based on the surveys they take.It is one of the top rated companies with a trusted community of 1+ million members which make it highly recommended.

It is an honest way to make full time income on the internet by taking surveys. It has no hidden costs and in turn you will learn how to build a flourishing business online in Toluna. It also allows you to choose surveys in categories which you are interested in.

Thus finally it is advisable that Toluna is worth giving a try. You can take it as a fun experience and further you will enjoy it a lot. If you are looking to earn income by taking up online surveys, then Toluna is definitely on the top lists which are trusted.

No, Signing up for Toluna is completely free. Sign up today and access its features free of cost

Toluna Influencers are compensated in points, which can be exchanged for a variety of items such as gift cards, competition entries, or plain old cash.

It is dependent on the targeting and the screening questions. The more of these questions you have, the longer your survey may take to complete.

You need to have at least 60000 points.

Go to rewards, convert your points into cash through, 60000points=$20.

Toluna is a safe and reliable platform. It is not a scam, and millions of people from all over the world have taken their surveys for over ten years. However, your experience with the site may vary from that of other survey takers.

( votes)

Source link

Asia’s top automobile manufacturer’s latest research details how Ethereum can turn vehicles into public infrastructure as Korean police crack $2M drug case,and more!

A Decentralized Finance (DeFi) wallet allows users to store,manage,trade crypto,and,most importantly,interact with decentralized applications (dApps) and Web3 projects. These could range from decentralized exchanges (DEXs),liquid staking platforms,and lending protocols to NFTs and SocialFi apps.

DeFi wallets give users complete control and ownership over their crypto. But let’s clarify a few things first. There are custodial wallets and centralized exchanges that offer custodial services,meaning the exchange safeguard your assets.

However,some popular centralized exchanges like Binance,Crypto.com,and Bitget provide non-custodial wallets that can be integrated into their platforms,allowing you to move assets back and forth between your exchange account and your DeFi wallet.

The difference between a regular crypto wallet and a DeFi wallet is that the former is designed to support a much wider array of coins and blockchain networks. The latter is tailored to meet DeFi users’ demands for yield farming,lending,trading,and other activities that require a powerful wallet.

DeFi Wallets share similar characteristics with regular crypto wallets:

To wrap up,DeFi wallets are tailored for the DeFi world and provide you with unique features and opportunities that regular crypto wallets don’t. However,they have their setbacks,which will be covered throughout the article.

Below are some of the top DeFi wallets to consider. These were selected based on their functionalities,key features,security levels,and more. Without further ado,let’s jump in.

Developed by Consensys,a company specializing in Ethereum-based tools and infrastructure,MetaMask is one of the best DeFi wallets in the industry. It supports a wide range of tokens and blockchain networks.

MetaMask was designed to enable users to seamlessly access Ethereum-based decentralized applications (dApps) and DeFi projects. It allows you to manage different Ethereum-based tokens,including standards such as ERC-721 and ERC-1155,which are widely used for NFTs and other digital collectibles.

Although it might not be the most user-friendly wallet initially,MetaMask offers significant versatility as a DeFi wallet once you become familiar with its features. It processes over 100M transactions monthly from over 17,000 dApps,so you’ll have plenty of options.

The wallet supports over 500,000 coins,NFTs,and Ethereum Virtual Machine (EVM)-compatible blockchain networks such as Binance Smart Chain (BNB) and Polygon (MATIC). Additionally,MetaMask provides staking options for MATIC and ETH in its Stake section.

Although the wallet supports other networks,it remains the most prominent and widely used DeFi wallet in Ethereum’s ecosystem.

MetaMask is regarded as one of the best DeFi wallets security-wise,employing multiple security mechanisms to protect users’ funds and identities. Key features in this regard include:

Trust Wallet allows you to buy,sell,and swap cryptocurrencies,collect and trade Non-Fungible Tokens (NFTs),and explore thousands of dApps on Ethereum and the Binance Smart Chain (BNB) ecosystem.

All these features are accessible within the wallet’s dashboard,and available for mobile devices and desktop browsers.

Trust Wallet employs several security measures to protect your funds and data. These include biometric access,auto-lock timers to prevent unauthorized access,encrypted private keys,12-word seed phrases,and two-factor authentication (2FA). It is generally considered a secure wallet,scoring 3.9 and 4.0 out of 5.0 on GetApp and Trust Pilot,respectively.

However,like all hot wallets,Trust Wallet is susceptible to risks such as hacking attempts,phishing scams,and address poisoning. While the wallet is non-custodial,it doesn’t hurt to enable 2FA. You can connect Trust Wallet to a hardware wallet like Ledger for added security.

Phantom,the most popular self-custody wallet on Solana with millions of active users,is also one of the best DeFi wallets for exploring not only Solana but also other ecosystems like Ethereum,Polygon,and even Bitcoin.

One of the main features that makes this wallet stand out is its simplicity of use. You can store,trade,swap,and stake crypto through your phone or using the browser extension for Chrome,Firefox,or Brave.

Further,almost all the dApps within the Solana network support Phantom,including some of the best Solana DEXs by total value locked.

Fun fact:CryptoPotato has conducted several interviews with Phantom’s CEO,Brandon Millman,also one of the co-founders. You can find them here and here.

Phantom has been audited by several security firms. You can watch all the reports here.

Phantom has also offered a $50,000 bug bounty to white-hat hackers who find vulnerabilities or bugs that may result in the loss of user funds. Moreover,Phantom automatically detects and hides spam NFTs and their media,as well as fungible tokens with a URL in the name.

Another perk of using Phantom is that they actually offer a decent customer support team. It’s global and works 24/7.

As we mentioned,you can always integrate your Phantom wallet into your Ledger device,adding a security touch.

Edge is a mobile,non-custodial wallet released in 2018. It allows you to store,manage,and trade crypto and explore various dApps on your phone,whether it’s iOS or Android.

Edge aims to offer a user-friendly and secure platform for storing,managing,and interacting with various cryptocurrencies and DeFi protocols.

One of its most notable features is the ability to take out Bitcoin collateralized loans and deposit borrowed dollars directly into your bank account. This is achieved thanks to an integration with liquidity protocol Aave.

While Edge Wallet offers convenience for daily transactions,it is not the most secure option for storing large amounts of cryptocurrency due to mobile wallets’ inherent vulnerabilities. It is best suited for managing smaller amounts of cryptocurrency for everyday use.

Private keys are stored locally on the user’s device and are secured using a hash of the username and password. These credentials are never shared with or stored on Edge servers. If you happen to lose your phone,you can quickly regain access by installing Edge on a new device and synchronizing the wallet.

Coinbase Wallet is a secure,non-custodial wallet designed for storing and managing cryptocurrencies. It supports a vast range of over 100,000 digital assets,including NFTs,and provides access to dApps. The wallet is compatible with various networks,including Bitcoin,Ethereum,and Layer-2 solutions like Arbitrum and Optimism.

Unlike MetaMask,Coinbase Wallet is a good starting point for beginners. It is designed for easy use,with straightforward installation and setup. However,it’s also an extensive wallet for DeFi enthusiasts.

There are plenty of things to do with Coinbase Wallet:staking,managing NFTs,swapping assets,and accessing thousands of dApps and Web3 projects.

For a more detailed outlook on how to set it up,check out our fully-fledged Coinbase Web3 Wallet guide.

Coinbase Wallet enjoys some of the highest standards of crypto security in the industry,and it is backed by the Coinbase exchange.

It’s a non-custodial wallet,meaning you own your private keys. You’ll get a 12-word seed phrase to access your accounts on new devices (so don’t lose it).

Guarda is a popular non-custodial wallet available across multiple platforms — mobile,desktop,and browser extensions.

This wallet lets you send,receive,manage,store,exchange,and stake cryptocurrency assets,including Cardano,Tezos,Tron,and more. Additionally,it supports blockchains such as Bitcoin,Ethereum,Ripple,and Binance Coin,offering robust functionality and security for digital asset management.

One of Guarda Wallet’s most notable features is the Token Generator. This mechanism simplifies the process of creating ERC-20 tokens on the Ethereum blockchain. You just set the token’s name and total supply and deploy the contract. The smart contracts are thoroughly audited and secure,ensuring they meet ERC-20 standards.

Guarda Wallet is one of the best DeFi wallets for security. It was launched over five years ago with no reported security incidents or breaches.

It’s an open-source,non-custodial wallet with high-level security and encryption mechanisms,including AES-256 (Advanced Encryption Standard) for data protection. It also provides biometric authentication through fingerprint and face ID for mobile apps.

You can also connect it to a hardware device such as Ledger (Nano S and X)

Binance Web3 Wallet is a self-custody cryptocurrency wallet also developed by Binance. It offers a secure and convenient way to interact with DeFi and manage,store,and trade coins,tokens,and NFTs on some of the most popular blockchain networks.

The wallet supports many blockchain networks besides Binance Smart Chain,including Ethereum,Polygon,and Avalanche. This allows you to manage their assets across different ecosystems seamlessly.

This wallet is integrated with the Binance ecosystem. Therefore,you should be able to set it up through the Binance dashboard on the application. You can switch between the exchange and the wallet directly through the app,regardless if you’re on mobile or desktop.

Further,the integration allows you to transfer funds between your Binance exchange account and your Web3 Wallet,which is quite a handy feature for daily use.

The wallet uses advanced multi-party computation (MPC) technology to secure your assets without needing a seed phrase. This mitigates the risk of centralized storage of private keys. To be more specific,Binance Web3 Wallet creates three “key-shares.” Each key-share is secured with a recovery password and stored separately on your device,cloud storage,and the Web3 Wallet.

Crypto.com DeFi Wallet,developed by the renowned cryptocurrency platform Crypto.com,is a non-custodial wallet crafted to facilitate seamless interactions with the DeFi ecosystem,enabling you to engage with various dApps and Web3 projects.

The wallet integrates with the broader Crypto.com ecosystem,enabling easy transfers between the Crypto.com exchange and the DeFi Wallet,similar to how Binance Web3 Wallet works with the Binance exchange.

Crypto.com conducts frequent security audits and maintains several compliance certifications to uphold high-security standards for its products. The app is also compatible with hardware wallets,allowing you to connect it to Ledger and manage your tokens from there.

For mobile users,the wallet supports biometric authentication,including fingerprint and face recognition.

Argent is a mobile non-custodial wallet tailored for DeFi and non-fungible tokens (NFTs) on the Ethereum and Starknet blockchains. It provides a user-friendly interface for managing digital assets and interacting with DeFi applications.

The wallet simplifies Layer 1 and Layer 2 network interactions with features like gasless transactions,easy recovery without seed phrases,and integrated DeFi services such as lending,borrowing,and earning interest.

Argent provides several advanced security measures to protect your assets,starting with multi-sig,biometric authentication through fingerprint or Face ID,as well as Two-Factor Authentication to add a security touch to your account.

Argent also provides an interesting security feature called Guardians. As the name implies,Guardians are people and devices you choose to help keep your wallet secure and recover in case you lose access to it.

Exodus is a versatile,non-custodial cryptocurrency wallet supporting over 50 blockchain networks. It is available as a desktop wallet,browser extension,and mobile app for iOS and Android. The multi-platform accessibility allows you to manage your digital assets conveniently across different devices.

Exodus does not employ certain standard security features in most crypto wallets nowadays.

The wallet’s security is as robust as the device it is installed on,and it is that simple. You’re responsible if your device is lost,compromised,or left unattended with the wallet visible;the funds within the wallet are at risk.

Exodus does not provide additional security mechanisms such as two-factor authentication (2FA),security locks,or scam alerts.

Trezor is a household name in the crypto industry. One of its latest products is the Trezor Safe 3,which features advanced security and extensive cryptocurrency support. It is also one of the best hardware wallets overall.

Let’s quickly go through some of the key aspects that set Trezor Safe 3 apart:

Trezor Safe 3 comes with a certified EAL6+Secure Element chip for enhanced security,supports the anonymous web browser Tor and uses Coinjoin to anonymize Bitcoin transactions. Further,it’s also compatible with the Shamir backup standard,allowing multiple recovery methods for private keys.

The wallet supports over 8,000 coins and tokens,including major assets like Bitcoin,Solana,Ethereum,Cardano,Ripple,and Binance Coin,as well as ERC-20 and SLP tokens. Note that Cosmos and Avalanche are not supported. It’s also compatible with software wallets like Exodus,MetaMask,and Yoroi.

Works with Linux,Microsoft,Mac,and mobile devices on iOS and Android through the Trezor Suite Lite app.

The Ledger Nano S Plus is a hardware wallet designed to store cryptocurrencies and non-fungible tokens (NFTs) securely. It supports over 5,500 digital assets and includes various security and usability features.

Here’s a detailed look at what the Ledger Nano S Plus offers:

Ledger Nano S Plus comes with a Secure Element chip certified to CC EAL5+standards. It was also independently certified by the National Agency for the Security of Information Systems in France,highlighting its robustness.

Ledger Nano S Plus supports over 5,500 cryptocurrency coins,tokens,and NFTs. It also supports various token standards,including ERC-20,ERC-721,TRC-20,TRC-10,BEP-2,and SLP.

The wallet provides a dynamic and user-friendly interface. Moreover,it works with over 50 wallets to access dApps and Web3 applications,and you can install up to 100 applications on it.

Bitget Wallet,formerly BitKeep,is a feature-rich DeFi wallet offering a secure and user-friendly platform for managing your crypto and dApps. Like Binance and Crypto.com,it’s part of the Bitget crypto exchange ecosystem. It has over 12 million users in 168 countries,making it a prominent multi-chain wallet in the Web3 space.

Bitget has ensured its wallet meets high-security standards by applying some of the following features:

DeFi wallets can be categorized into two main types:software (hot) wallets and hardware (cold) wallets. Each type offers distinct features and security levels.

Hot wallets are software applications connected to the internet,available on various devices such as browser extensions,mobile apps,and desktop programs. They offer various features for managing assets across multiple networks and accessing various dApps.

Web Wallets

Installed as browser extensions on browsers like Chrome,Firefox,and Opera. Web wallets provide flexibility and accessibility,allowing users to manage,store,and transact cryptocurrencies directly through a web browser. They often support dApps,Web3 applications,and NFTs,making them versatile for various digital asset activities.

Mobile Wallets

Available for iOS and Android devices,mobile wallets offer convenience for managing,storing,and transacting digital assets on the go. However,users should be aware of security risks,such as malware and the potential loss of their mobile devices,and should be cautious about signing malicious transactions.

Desktop Wallets

These are software programs installed on computers. Desktop wallets typically offer more features than browser extensions,including integrated staking and advanced security measures. However,they require a certain level of technical proficiency to use and are often dedicated to specific cryptocurrencies,limiting their support for a broader range of coins.

Cold wallets are physical devices that resemble pen drives. They store private keys offline,providing enhanced security by isolating them from the internet and minimizing the risk of hacking and online attacks. Hardware wallets offer the highest level of security for crypto funds but are less dynamic and flexible than software wallets.

Let’s do a quick rundown on hardware wallets:

Related:9 Tips For Securing Your Bitcoin and Crypto Wallets You Must Follow

What is the best crypto DeFi Wallet?

It’s hard to gauge exactly which wallet is best for DeFi because that would depend on your intended purpose. However,MetaMask is widely regarded as one of the best DeFi wallets altogether,especially if your focus is on Ethereum.

What is the best decentralized wallet to use?

The term “decentralized wallet” is not accurate because all crypto wallets are developed by a team that’s actively backing and working on them. They may be open-source,but it’s hard to classify them as truly decentralized.

Are DeFi wallets safe?

DeFi wallets are as safe as the crypto security measures that you employ. If you do everything necessary to maintain proper online hygiene,don’t click on phishing links,and store your private keys correctly – they are perfectly safe.

Is Binance a DeFi wallet?

Binance is a centralized cryptocurrency exchange. However,it has developed a wallet called Binance Web3 Wallet,which is quickly becoming one of the more popular options for DeFi users in the Binance ecosystem.

Is MetaMask a DeFi wallet?

Yes,MetaMask is a DeFi wallet. It is one of the veterans in the space and currently the biggest hot wallet on the market.

These were some of the top DeFi wallets to check out in 2024. However,keep in mind that the best wallet is the one that suits your needs.

Some DeFi wallets are more suitable for beginners,while certain wallets like Binance Web3 Wallet are more complex but offer powerful features for those who know how to use them.

LIMITED OFFER 2024 at BYDFi Exchange:Up to $2,888 welcome reward,use this link to register and open a 100 USDT-M position for free!

Share this article

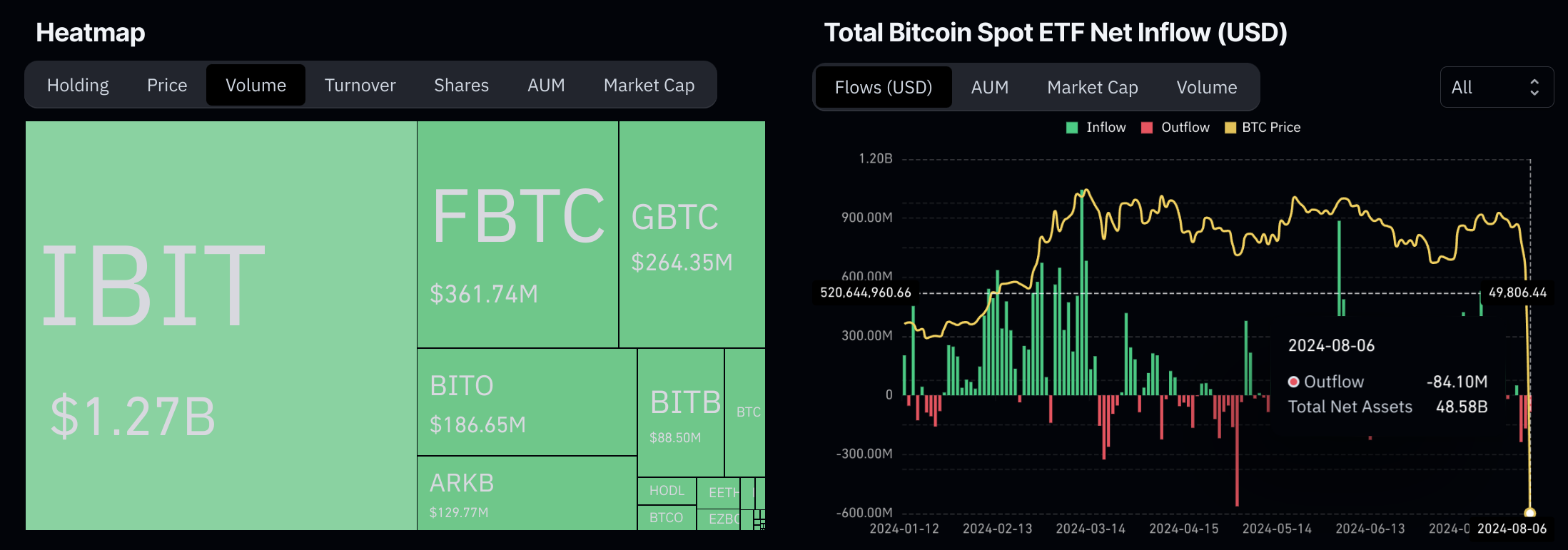

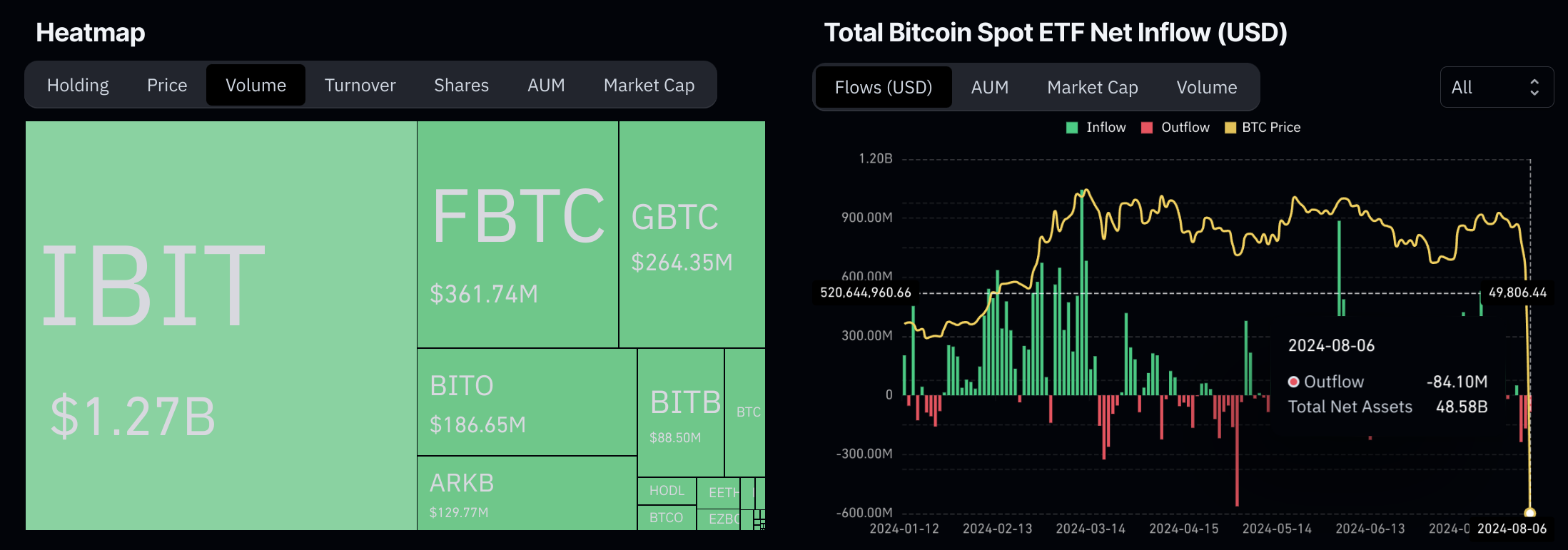

Trading volume for Bitcoin exchange-traded funds surged to $5.7 billion on August 6,surging from the prior 48 hours as crypto markets experienced heightened volatility. Outflows have since calmed down at $84.1 million,according to data from Coinglass,with net assets remaining at the $48 billion threshold.

The spike in ETF trading coincided with an 8% drop in Bitcoin’s price since August 4. Ethereum saw an even steeper 21% decline after major funds like Jump Trading and Paradigm reportedly sold hundreds of millions of dollars worth of ETH. Alex Thorn,head of research at Galaxy Digital,reported that Bitcoin ETF trading volume exceeded $1.3 billion within just 20 minutes of market open. The iShares Bitcoin Trust led activity with over $1.27 billion in volume.

Bitcoin and Ethereum prices are rebounding after hitting six-month lows on Monday,with Bitcoin dipping below $50,000 and Ethereum experiencing its largest single-day drop in three years. The sell-off coincided with a broader market downturn affecting global stocks.

Despite the market turbulence,net flow data from CoinGlass indicates that most ETF holders maintained their positions. Analysts believe the sell-off was exacerbated by broader macroeconomic concerns,including weak US employment data and volatility across asset classes. For context,the S&P 500 index has fallen over 5% since August 1.

JPMorgan Chase analysts report that spot Bitcoin ETF trading volumes more than doubled on Monday to over $5.2 billion,surpassing the January debut. Spot Ethereum ETFs saw inflows exceeding $49 million across all funds.

Bernstein analysts highlight that unlike previous cycles,Bitcoin ETFs now provide a highly liquid investment avenue,trading around $2 billion daily. They anticipate increased asset allocation to Bitcoin as more wirehouses approve these products in the coming months.

The surge in Bitcoin ETF volume suggests some investors viewed the price dip as a buying opportunity. However,market structure remains fragile according to Markus Thielen of 10x Research,who expects new crypto investment to slow until conditions stabilize.

“It’s unlikely that significant players will invest amid high volatility and unpredictable prices,” Thielen said. “Many still need to exit positions and deleverage their portfolios,” explaining their assessment.

The doubling of Bitcoin ETF volume highlights how quickly institutional capital can flow in and out of crypto markets during periods of volatility. It also demonstrates the growing importance of ETFs as a vehicle for Bitcoin exposure among traditional investors.

Share this article

Asset management firm Grayscale has projected positive growth for Bitcoin (BTC),Ethereum (ETH),and other crypto assets on the back of macroeconomic factors. Although assets declined last month compared to first-quarter figures,the company noted that a swing in bullish factors could ignite market growth. Grayscale remains bullish on Bitcoin and other assets as the firm also rolled out new investment products.

In a recent market report,Grayscale Research highlighted factors for the decline in crypto assets making an upward projection in Bitcoin. According to the firm,Bitcoin will re-test its all-time if the United States economy avoids recessions while maintaining a path to a soft landing. Pointing to macro factors,analysts restated the users adopting Bitcoin as a haven from inflationary risk.

“At the same time,the firm believes that there is very little tolerance for a deep economic downturn,and is expecting policymakers to print and spend at the first sign of trouble. The undisciplined approach to monetary and fiscal policy is one reason why some investors choose to invest in Bitcoin;a period of economic weakness could therefore reinforce the longer-term Bitcoin investment thesis.”

Crypto assets slowed at the start of August following the US Employment report which came in weaker-than-expected. Grayscale explained that the drawback might not be tighter like in previous cycles because of the shift in several US politicians ahead of the elections.

Also Read:Bitcoin Sees Strong US Buying Pressure Amid US Recession Fears

This year,institutional investors have increased their appetite in the market driving up sentiments. The launch of Bitcoin ETFs by the United States Securities and Exchange Commission (SEC) led to major investments within the industry. Several traditional firms also increased their Bitcoin exposure.

Another significant factor for the Grayscale position is crypto becoming a major election issue with candidates leaning towards the sector. Recently,crypto bills have also made progress in Congress as policy watchers maintain pressure.

Also Read:CBOE Resubmits Bitcoin ETF Options Trading Application,Q4 Approval Likely?

Disclaimer:The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Essential’s aim is to offer an “intent-centric,declarative approach.”This differs from traditional blockchain in that it leverages users’“intents”for desired outcomes rather than usual transaction-based interactions where users must specify exact instructions,according to an emailed statement on Tuesday.

Qiibee CEO and founder Gabriele Giancola argued that brands must fully commit to Web3 to reap its benefits.