With eyes on the US CPI inflation data, Bitcoin and the broader crypto market have staged a strong recovery in the recent short covering. The Bitcoin price has surged another 3% today shooting past $61,000 levels amid the strong stablecoin inflows happening over the past week.

Bitcoin Traders Bet on $2.5 Billion Stablecoin Inflow

Bitcoin traders are expecting a potential bullish impact regarding the $2.5 billion stablecoin inflows happening over the past week. As per the data from 10X Research, Tether and Circle have been behind in issuing the USDT and USDC stablecoins over the past which which suggests that institutional investors are ready to inject fresh capital into the market.

The traders believe that this could potentially be the reason behind the recent Bitcoin short covering. Furthermore, inflows into the spot BTC ETFs have also picked up recently suggesting the growing institutional demand for the BTC asset class. Banking giant Goldman Sachs submitted a disclosure to the Bitcoin ETF trading activity for the second quarter revealing its $418 million to these investment products.

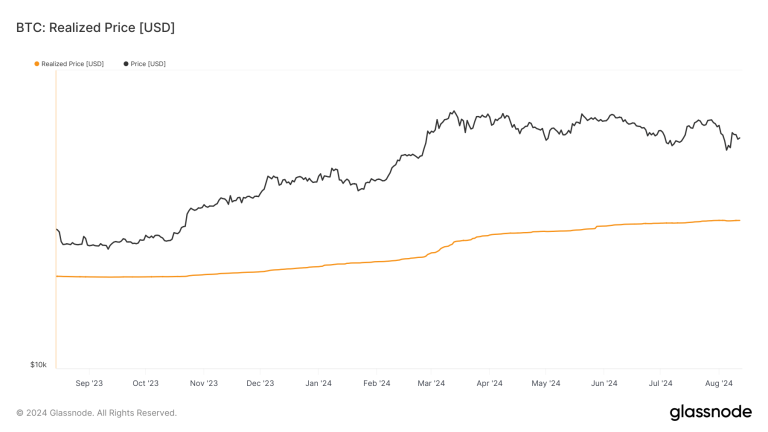

10x Research noted that money flows have paused since April 2024, which has led to a subsequent price correction for BTC. However, the resurgence in the money flows through the rising USDT and USDC supply has provided some boost to the broader crypto market. Furthermore, the on-chain shows that Tether has minted more than $1 billion in USDT in the last 24 hours while further transferring them to centralized exchanges (CEXs) including binance, Coinbase, Kraken, etc.

The #TetherTreasury minted 1B $USDT on #Ethereum and transferred 183.2M $USDT to #Cumberland for CEX deposits in the past 13 hours!

Cumberland has received 953M $USDT from Tether and injected 906.7M $USDT into various CEXs, including #Coinbase, #Kraken, #OKX, #Binance, and… https://t.co/XLlzMYRG3X pic.twitter.com/qEUJJ0KWI1

— Spot On Chain (@spotonchain) August 14, 2024

Crypto Market Recovery Amid USDT, USDC Flows

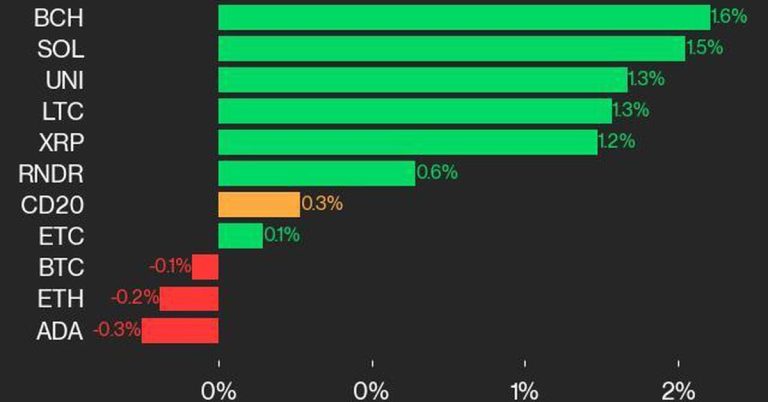

The Bitcoin price has staged a strong recovery this week gaining more than 10% on the weekly charts amid the liquidity resurgence. Furthermore, the broader crypto market has seen similar similar upside with Ethereum leading the altcoin market.

The macro developments this week would be key in deciding the future trajectory of the crypto market from here onwards.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Despite Western restrictions imposed after Russia invaded Ukraine, billions of dollars and euros in banknotes have flowed into the country. This suggests that Russia has found ways to circumvent these restrictions. Despite official efforts to reduce reliance on foreign currency, Russian citizens still prefer dollars and euros. Russia Successfully Skirts Western Sanctions Dollar and euro […]

Despite Western restrictions imposed after Russia invaded Ukraine, billions of dollars and euros in banknotes have flowed into the country. This suggests that Russia has found ways to circumvent these restrictions. Despite official efforts to reduce reliance on foreign currency, Russian citizens still prefer dollars and euros. Russia Successfully Skirts Western Sanctions Dollar and euro […]

Mercado Bitcoin, one of the largest Brazil-based cryptocurrency exchanges, has launched a loan product allowing users to receive credit in Brazilian reais secured by crypto collateral. The credits will be limited to 30% of the total held in crypto in the exchange, and liquidations will not be automatically executed, being examined on a case-by-case basis […]

Mercado Bitcoin, one of the largest Brazil-based cryptocurrency exchanges, has launched a loan product allowing users to receive credit in Brazilian reais secured by crypto collateral. The credits will be limited to 30% of the total held in crypto in the exchange, and liquidations will not be automatically executed, being examined on a case-by-case basis […]