Source link

Dydx Introduces Major Chain Upgrade With New Features – Technology Bitcoin News

Immutable shuts NFT marketplace, why Web3 gaming needs its own Steam: Nifty Newsletter

Immutable has wound down its NFT marketplace to allow marketplaces within its ecosystem to flourish.

Trump speech at Bitcoin 2024 triggers $24M in long liquidations amid market volatility

Trump speaking at Bitcoin 2024. Source: Bitcoin Magazine Livestream.

Key Takeaways

- Trump’s speech at Bitcoin 2024 led to a sharp increase and then a drop in Bitcoin prices.

- Nearly $24 million in Bitcoin longs were liquidated during the speech.

Share this article

Bitcoin prices experienced significant volatility during former U.S. President Donald Trump’s speech at Bitcoin 2024 in Nashville, where he unveiled plans to establish a “strategic national bitcoin stockpile” if re-elected.

The price of Bitcoin (BTC) saw dramatic swings as traders reacted to Trump’s remarks. Prior to the speech, Bitcoin rose above $69,000. However, the price subsequently dropped to as low as $66,700 before rebounding to over $68,000, according to data from CoinGecko.

Trump’s announcement of plans to create a national Bitcoin reserve if elected aligned with market expectations leading up to the event. The former president’s comments sparked a flurry of trading activity, with nearly $24 million in long positions liquidated during the speech alone.

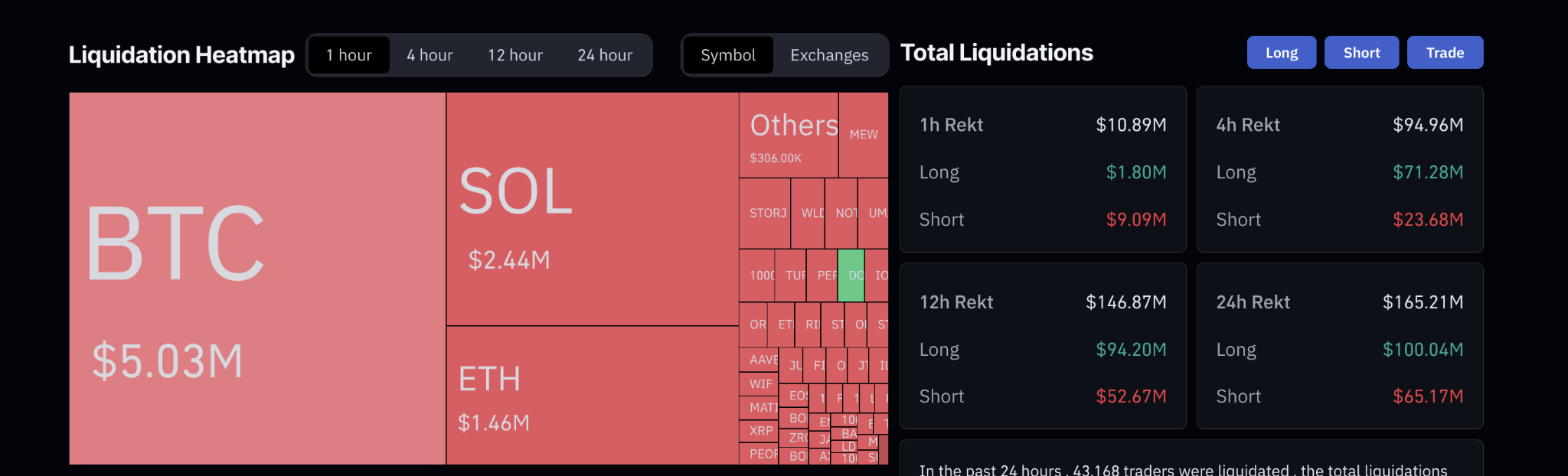

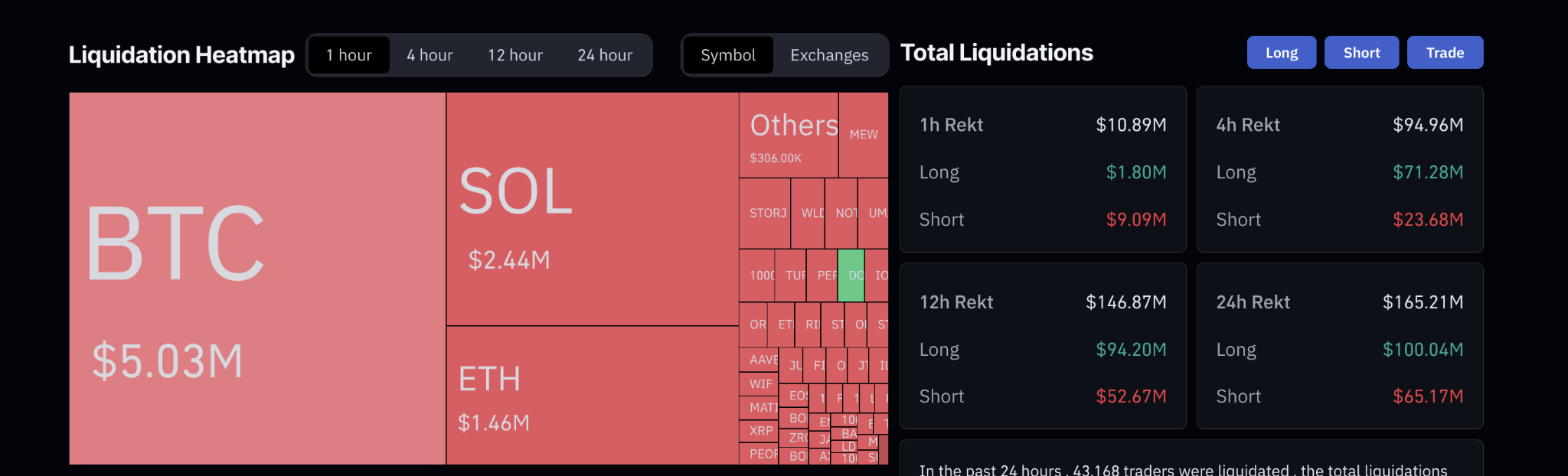

Liquidation data

Data from Coinglass indicates that BTC experienced the highest liquidation value at $5.03 million, followed by SOL with $2.44 million, and ETH with $1.46 million within the selected timeframe. This indicates a significant volume of forced selling in these cryptocurrencies, with BTC being the most affected.

On the right side, the sheet details total liquidations for various periods. In the past hour, total liquidations reached $10.89 million, with $1.80 million in long positions and $9.09 million in short positions. Over four hours, liquidations amounted to $94.96 million, with long positions accounting for $71.28 million and short positions for $23.68 million.

The 12-hour liquidation total was $146.87 million, with $94.20 million in long positions and $52.67 million in short positions. For the 24-hour period, liquidations totaled $165.21 million, with long positions at $100.04 million and short positions at $65.17 million. These figures highlight that liquidations have been more significant for long positions across all timeframes, indicating higher losses for long traders.

The broader crypto market mirrored Bitcoin’s price movements throughout the event. This volatility highlights the significant impact high-profile political figures and policy announcements can have on crypto markets.

The rapid price fluctuations and substantial liquidations underscore the ongoing sensitivity of cryptocurrency markets to regulatory and political developments. Trump’s proposal for a national Bitcoin stockpile represents a potential shift in the relationship between traditional government institutions and digital assets, should it come to fruition.

Earlier this month, Donald Trump advocated for all future Bitcoin mining to be conducted in the US to counter central bank digital currencies and enhance national energy dominance.

Analysts also observed a notable rise in Bitcoin options implied volatility, speculating about significant announcements by Trump at the upcoming Bitcoin 2024 conference.

Donald Trump’s proposed policy for a weaker US dollar if re-elected was analyzed for its potential to elevate Bitcoin values, marking a shift from traditional strong dollar policies.

Share this article

Saudi Arabia’s Riyadh may be crypto’s sleeping giant: Crypto City Guide

While crypto may still operate in a gray space in Saudi Arabia, the country’s talent pool and burgeoning gaming sector hold promise for Web3.

Breaking: Morgan Stanley Reveals Massive Bitcoin ETF Holdings In Q2

The US banking giant Morgan Stanley has recently revealed massive investments into the US Spot Bitcoin ETF in the second quarter of 2024. In the latest SEC filing, the banking behemoth disclosed that it held 5,500,626 shares of BlackRock iShares Bitcoin Trust as of June end, which was worth around $190 million. Notably, this filing comes just after Goldman Sach’s revelation of a large-scale investment into the Bitcoin investment instrument.

Morgan Stanley Reveals Massive Bitcoin ETF Investments

The latest Morgan Stanley SEC filing showed that the leading banking firm has invested heavily into BTC ETF through BlackRock’s iShares Bitcoin Trust (IBIT). The 13F filing showed that the bank holds around 5.5 million shares of IBIT, valued at $187.79 million as of June 30. This marks a new position for the banking giant, putting it on the top five holders list of IBIT.

Meanwhile, the decision to allocate such a massive part of its portfolio to Bitcoin through this ETF reflects the bank’s confidence in the crypto’s future potential. Besides, it also aligns with a broader trend among institutional investors who are shifting focus towards Bitcoin as a hedge against inflation and market uncertainties.

In addition, the recent disclosure comes a day after Goldman Sachs, another banking behemoth, revealed a substantial investment into Bitcoin ETF. According to their 13F filing, Goldman Sachs holds around 7 million iShares Bitcoin Trust and 1.5 million Fidelity’s FBTC shares. The timing of these latest disclosures from two of the leading financial institutions reflects the increasing focus on Bitcoin in traditional finance.

Institutional Interest In Bitcoin

Morgan Stanley’s latest investment into the Bitcoin landscape is not an isolated event. For context, the revelation comes just after the Wisconsin Investment Board revealed increasing its stake in BlackRock’s IBIT.

Meanwhile, these significant investments by major financial players suggest a shifting attitude towards Bitcoin and its role in the global economy. The trend of increasing exposure to Bitcoin through ETFs could signal the beginning of broader adoption of cryptocurrencies within the institutional investment community.

While Bitcoin has long been seen as a speculative asset, its inclusion in the portfolios of major banks like Morgan Stanley and Goldman Sachs indicates a growing recognition of its potential as a long-term investment. This shift is likely to have a ripple effect throughout the financial sector, encouraging other institutions to follow suit.

In addition, Morgan Stanley also recently started offering Bitcoin ETF to its qualified clients. This positions him as one of the first Wall Street banks to provide Bitcoin products to its selective clients.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

The future of Web 3.0 gaming—Blockchain Futurist Conference

According to a 2024 OnePoll survey of 2,000 adults, 52% of respondents said they were unaware of what blockchain gaming was.

The Protocol: Memecoin Trading Is Suddenly Trump.fun

TRUMP.FUN – Former President Donald Trump’s speech just a couple weeks ago at the Bitcoin Nashville conference now seems like a distant memory. Not only has he been overtaken by Vice President Kamala Harris as the frontrunner in this year’s U.S. presidential election – at least in the eyes of punters on the prediction-betting site Polymarket – but his name and family members are now regularly getting dragged into conversations about memecoins. It started last week when one of his sons, Eric Trump, tweeted that he has “fallen in love with Crypto / DeFi. Stay tuned for a big announcement,” as related by CoinDesk’s Krisztian Sandor. Then on Thursday, a newly launched cryptocurrency on Solana (SOL) called Restore the Republic, or RTR, rumored to be the official token of Donald Trump, began trading, shooting to a $155 million market capitalization within hours after the launch. Eric Trump then warned users of “fake tokens” and said that the “only official Trump project has not been announced.” RTR tumbled 95%. His brother, Donald Trump Jr., tweeted that while he loves “how much the crypto community is embracing Trump,” traders should “beware of fake tokens claiming to be part of the Trump project.” Then there was the former president’s Spaces session on Monday with X owner Elon Musk, during which the pair notably didn’t even mention Bitcoin or crypto. According to The Block, the omission sent prices tumbling for the tokens with names like MAGA Hat and Doland Tremp. The crypto news site Decrypt reported that some 10,000 tokens were launched during the Spaces on the meme coin launchpad Pump.fun, where the $2 issuance fee was completely eliminated earlier this week – making it that much easier and cheaper to launch a token. Based on one account posted on X, after Trump uttered the phrase “rough people” about five times in a row, there were at least 10 distinct memecoins launched with the name “ROUGH PEOPLE.” Some memecoin traders complained that using Pump.fun was “not fun anymore” because there were “10,000 scams.” But for at least one commenter, watching the action felt almost like a news feed: “I don’t even need to watch the space when there’s pump fun.”

Coinshares Weighs Trump and Harris’ Impact on Bitcoin Ahead of 2024 Election – Bitcoin News

Source link

Why Goldman Sachs Is Betting Big on Bitcoin ETFs: $419M Investment Revealed

Goldman Sachs, one of the biggest banking players, is taking serious moves into the cryptocurrency world. According to their latest filing with the SEC, Goldman Sachs now holds a massive $419 million in various Bitcoin ETFs. Let’s explore their motives and playout behind crypto investments.

A Closer Look at Their Portfolio

One of the standout investments in their portfolio is BlackRock’s iShares Bitcoin Trust (IBIT). Goldman Sachs owns almost 7 million shares of this fund. Their holding of IBIT is worth about $238 million. That’s a lot of faith in Bitcoin! Since its launch earlier this year, IBIT has been a hit among institutional investors. It quickly climbed the ranks in daily trading volumes. This clearly indicates that even traditional finance giants like Goldman Sachs are seeing Bitcoin as a key player in the financial world.

Diversifying with Fidelity and Others

But that’s not all. BlackRock is not the only ETF Goldman Sachs has invested in. They’ve diversified their crypto investments. They hold 1.5 million shares of Fidelity’s Bitcoin ETF (FBTC), which is worth nearly $80 million. This approach shows that Goldman Sachs is serious about staying in the game while also managing their risks.

They have diversified their portfolio to more ETFS. Goldman Sachs also has stakes in other well known Bitcoin ETFs from companies like Bitwise and Grayscale. With all these investments combined, the bank’s total holdings in Bitcoin ETFs reach an impressive $419 million as of June 30, 2024.

The Growing Institutional Interest

This big move from Goldman Sachs comes at a time when more and more institutional investors are jumping on the Bitcoin ETF bandwagon. Over 500 institutional investors have already invested in these ETFs. This shows that Bitcoin is becoming more accepted in traditional finance circles.

Recently, Bitcoin ETFs have seen a surge in interest. For instance, BlackRock’s IBIT and Bitwise’s BITB pulled in $34.6 million and $16.5 million respectively in just one week. On the other hand, Fidelity’s FBTC added $22.6 million. However, not all ETFs are doing as well, some are even losing value. Grayscale’s GBTC, for example, saw outflows of $28.6 million on August 13.

Goldman Sachs Joins the Big Leagues

Goldman Sachs’ investment in Bitcoin ETFs places it alongside other major banks like JP Morgan and Morgan Stanley. Even though Goldman’s CEO, David Solomon, once called Bitcoin “speculative,” he now admits it could be a store of value, much like gold.

By investing heavily in Bitcoin ETFs, Goldman Sachs is positioning itself to benefit from Bitcoin’s potential. This way they don’t have to own the cryptocurrency. This strategy is becoming more common as traditional financial institutions look for ways to get involved in the crypto space while managing the risks.

What This Means for the Future

In short, Goldman Sachs’ $419 million investment in Bitcoin ETFs is a strong signal that the bank sees a bright future for Bitcoin. This move highlights the growing demand for digital assets among institutions and shows that Bitcoin is gaining more and more acceptance in the mainstream financial world. As more and more financial institutions are starting to embrace Bitcoin, it’s clear that this digital asset has a huge potential for growth.

US government transfers 10,000 Silk Road BTC to Coinbase Prime, Bitcoin price holds steady

A Bitcoin (BTC) address that received 10,000 BTC from a US government wallet two weeks ago moved the entire stash to a Coinbase Prime deposit wallet today, according to on-chain data.

The BTC moved in the transaction is part of the crypto seized from the now-defunct dark web market Silk Road. The amount is equivalent to over $592 million and was moved to a Coinbase Prime hot wallet.

On Apr. 2, the US government moved 31,800 BTC to another wallet and has been distributing this amount to different addresses since then.

Notably, according to on-chain data platform Arkham Intelligence, the US government still holds over $1 billion in Silk Road-related BTC.

The US authorities seized 50,000 BTC tied to the Silk Road when they arrested James Zhong in November 2022. Zhong is accused of hacking the dark web market in 2012 and stealing the seized amount.

The last known selling movement related to Silk Road’s BTC stash happened in March 2023, when the US sold 9,861.17 BTC.

Resilience amid potential ‘government dump’

“Government dump” movements became notorious within the crypto community after the German government sold nearly 50,000 BTC seized after closing the piracy platform Movie2k. The episode lasted 23 days and caused Bitcoin’s price to fall 17% between mid-June and mid-July.

However, this time Bitcoin is showing resilience amid the US government movement. Despite falling 4% over the past 24 hours, the price variation over the last hour is positive 0.5%.

A report published by CoinGecko in late July revealed that governments around the world hold nearly 483,400 BTC, with the US government taking the top rank with a total stash of 213,297 BTC.

Removing 10,000 BTC from the recent US government movement and considering the current price of $59,160.64, the total amount held by sovereign states is nearly $28 billion.

The post US government transfers 10,000 Silk Road BTC to Coinbase Prime, Bitcoin price holds steady appeared first on CryptoSlate.