The cryptocurrency industry, led by Bitcoin (BTC) and Ethereum (ETH), has been attempting to recover from the recent global market crash. The rising correlation divergence between major stock indexes and Bitcoin has increased fear of further crypto capitulation.

While Bitcoin price has hovered around $58k in the past 24 hours, Japan’s NIKKEI 225 Index jumped nearly 4 percent on Friday.

Trouble Looming From Japan

According to most researchers, the recent global market crash emanated from Japan’s sudden rise in interest rates after nearly two decades of retaining them in the negative zone. The Japanese government has kept its interest rates below zero for around 17 years to stimulate its economy.

However, the notable rise in global inflation has compelled the Bank of Japan (BoJ) to increase its interest rates twice this year, although they remain relatively low compared to their peers.

Carry Trade Re-emergence

As the Japanese Yen weakened over 5 percent in the past week, analysts have warned that there has been a significant spike in carry trades, alternatively known as currency hedging.

“Global central banks are now shifting toward easing, barring the BOJ, which will keep rates low relative to peers. That means the carry trade is poised to return, provided equity markets and the Chinese currency remain stable,” Mary Nicola, Markets Live Strategist, noted.

Notably, traders are waiting for BoJ Governor Kazuo Ueda’s speech before the parliament on August 23, which will coincide with Fed Chair Jerome Powell’s talk at Jackson Hole.

Suppose Ueda sounds dovish while Powell appears hawkish in terms of the economic outlook. In that case, the differences between the US and Japan’s interest rates will remain elevated, thus attracting more investors to enter carry trades.

Impact on Bitcoin Price Action

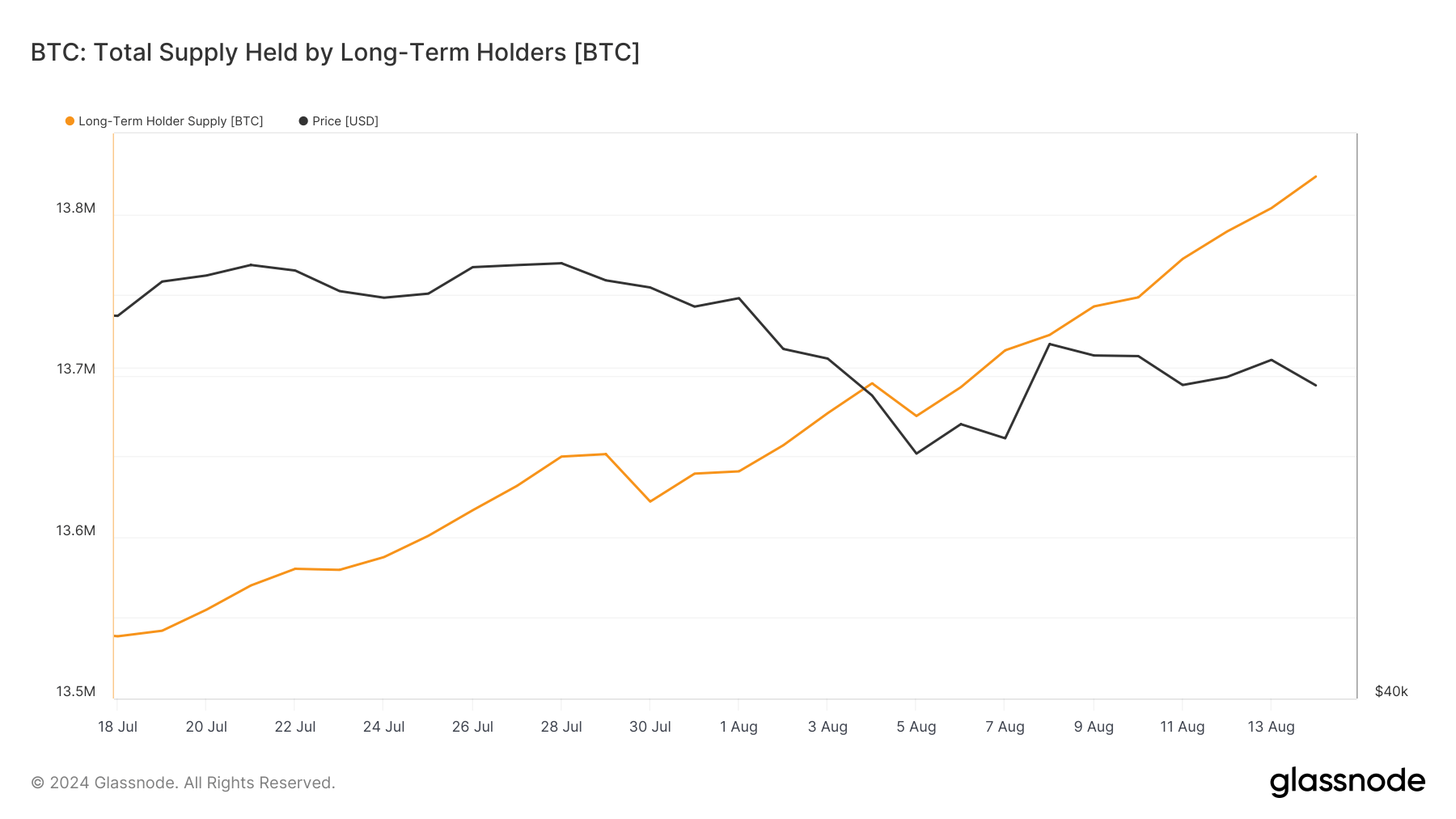

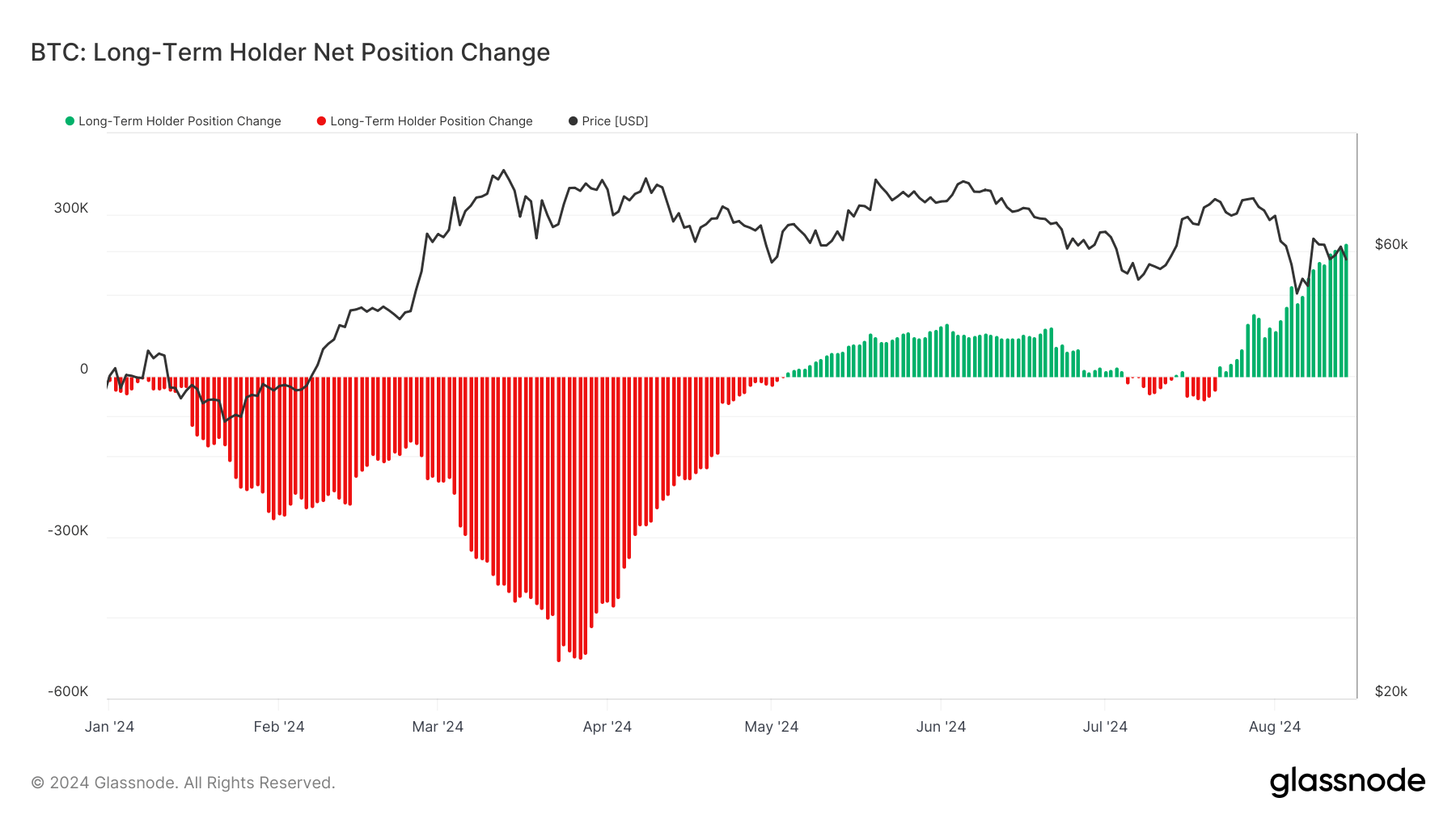

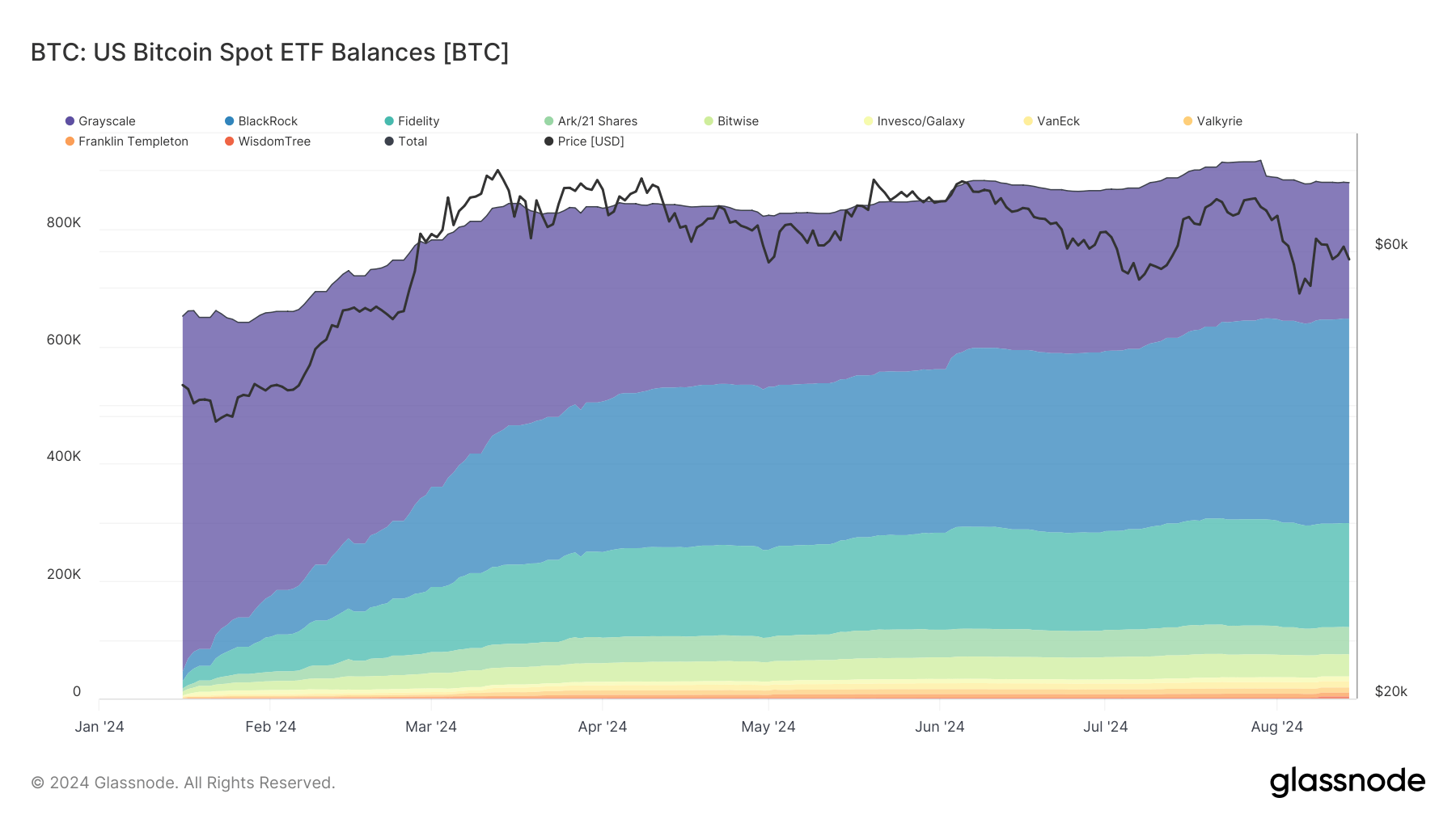

Bitcoin price has been trapped in a falling trend since March this year despite institutional investors’ notable spike in demand.

However, a possible market crash triggered by the ballooning carry trades could highly impact the entire crypto industry. Nonetheless, the anticipated interest rate cuts in the United States are a recipe for a major crypto-bullish uproar at the end of this year.