Investors who purchased NFTs just a few years ago may have reason to regret their decision.

Investors who purchased NFTs just a few years ago may have reason to regret their decision.

Share this article

Spot crypto exchange-traded funds (ETF) in the US represent nearly 1.9% of the total global flows year-to-date, with BlackRock’s IBIT and Fidelity’s FBTC among the Top 15.

Bloomberg senior ETF analyst Eric Balchunas shared that global ETF year-to-date flows are at $911 billion. BlackRock’s spot Bitcoin (BTC) ETF IBIT is in third place, with roughly $20.5 billion in flows, bested only by Vanguard S&P 500 ETF (VOO) and its own iShares Core S&P 500 ETF.

Meanwhile, Fidelity’s FBTC registered $9.8 billion and bolsters the 14th largest amount of inflows.

According to Farside Investors’ data, US-traded spot Bitcoin ETFs amount to $17.5 billion in net flows in 2024. However, they are diminished by the $440 million of outflows registered so far by spot Ethereum (ETH) ETFs.

Balchunas is an active voice when it comes to praising the performance of the spot Bitcoin ETFs launched this year, both in volume and inflows. In March, the analyst voiced his surprise when the BTC ETFs surpassed $10 billion in daily volume. “These are bananas numbers for ETfs under 2mo old.”

Moreover, during the early July price crash caused by the German government selling nearly 50,000 BTC, Balchunas was again taken aback when Bitcoin ETFs registered positive net flows on daily, weekly, and monthly timeframes.

As reported by Crypto Briefing, BlackRock’s Ethereum ETF ETHA surpassed $1 billion in inflows yesterday. This is a major milestone to hit as spot Ethereum ETFs are nearing one month since launch.

Yet, these funds’ performance is still lackluster when compared to the resilience shown by Bitcoin ETFs. In the latest edition of the “Bitfinex Alpha” report, Bitfinex analysts point out different reasons behind this disparity.

The first is the selling pressure created by market maker Jump Trading, which offloaded over 83,000 ETH in the market as of Aug. 9. Additionally, Wintermute and Flow Traders have also sold Ethereum, which raises the total amount dumped to 130,000 ETH.

Notably, these selling movements come as the market faces a liquidity crunch, making it harder to absorb large ETH dumps. Furthermore, Grayscale’s ETHE nearly $2.5 billion in outflows is another significant factor holding Ethereum ETFs down.

Lastly, the sudden interest rate increase in Japan, the uncertainty around the US presidential election outcome, and the Middle East tensions paint a macroeconomic picture that dampens the risk appetite, directly impacting ETH’s performance.

As a result, investors seem to avoid ETH for the time being and thus have a direct influence over Ethereum ETFs’ net flows.

Share this article

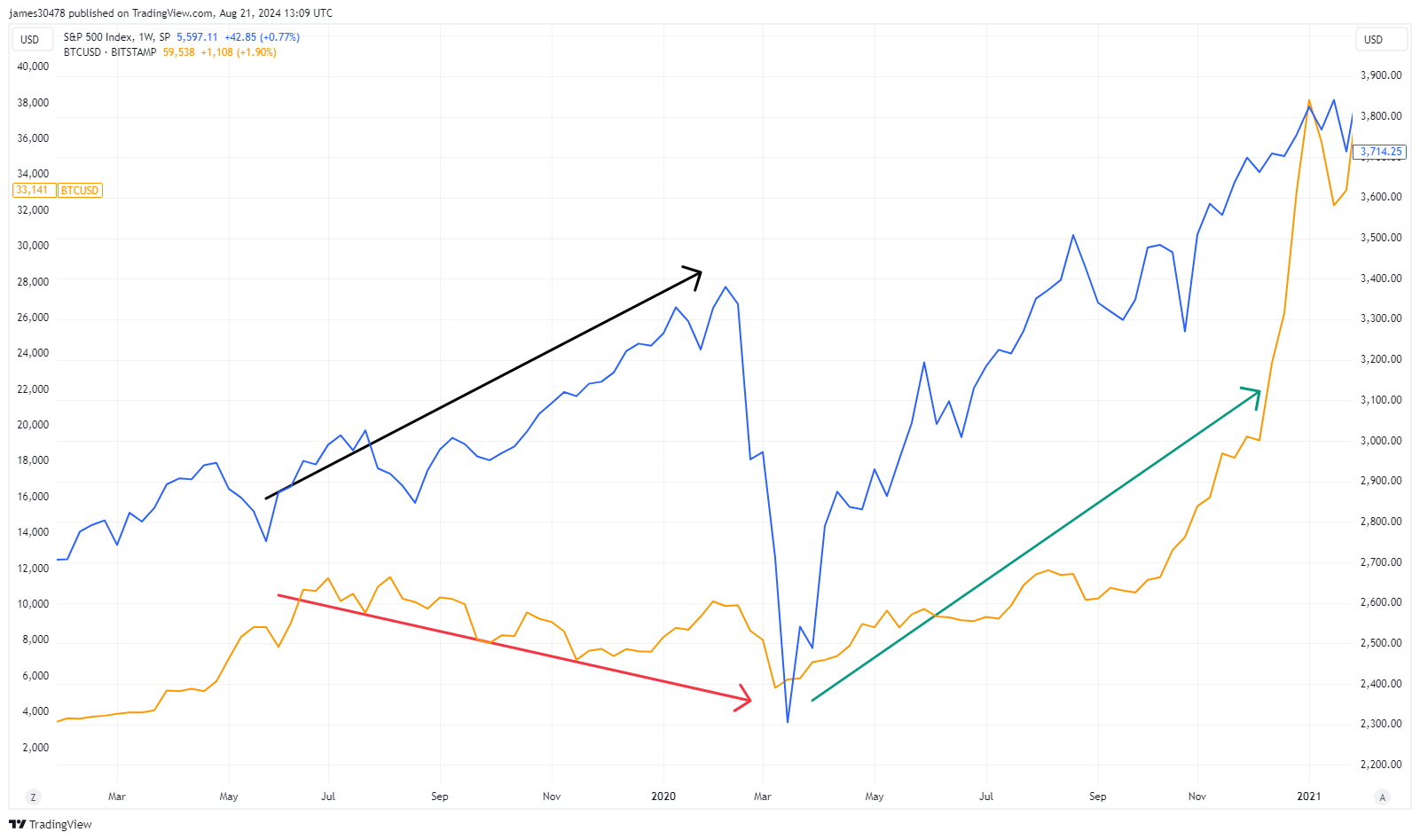

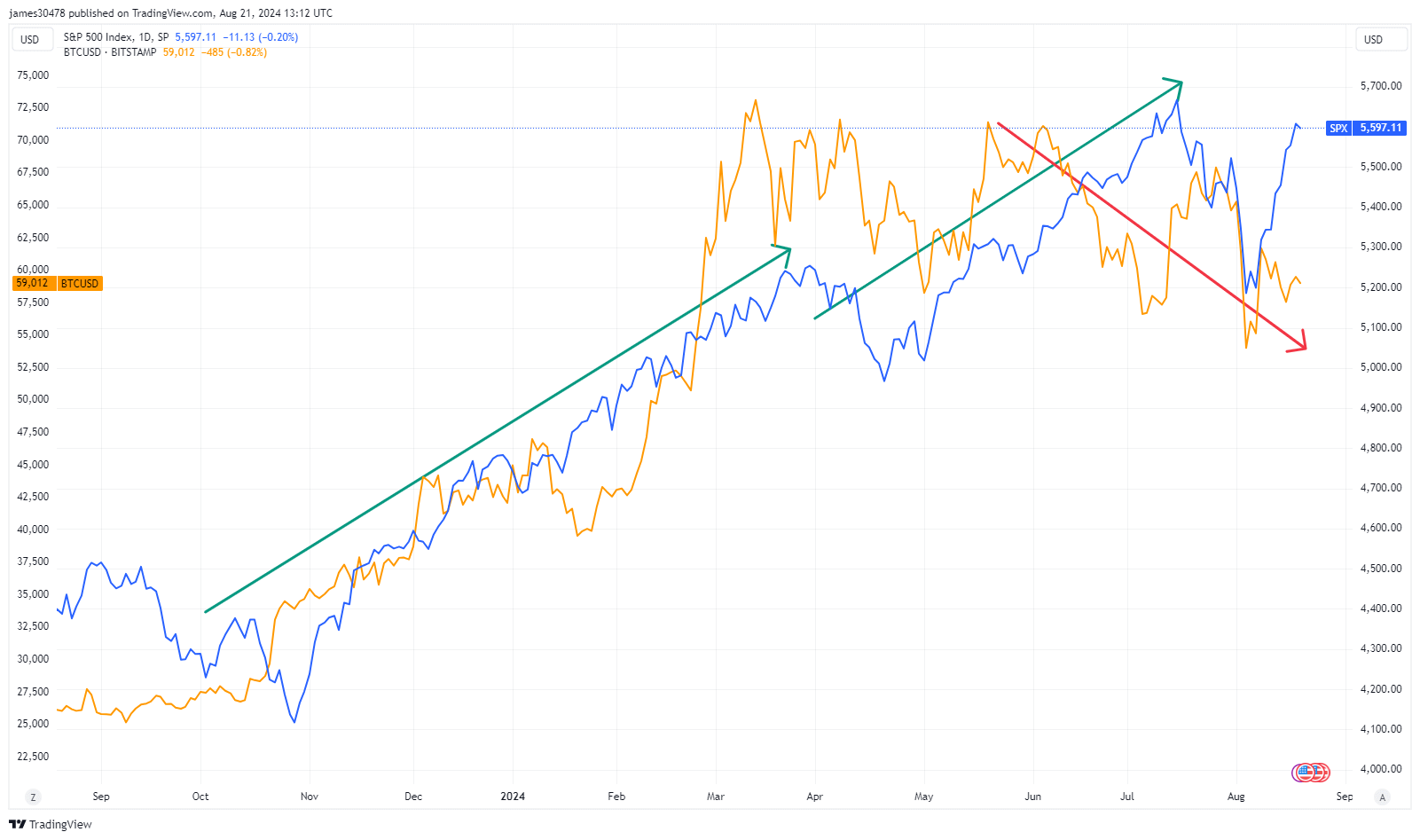

Bitcoin and the S&P 500 are currently diverging, a trend that has occurred before, most notably in 2019 leading into the COVID-19 pandemic. Back then, the S&P 500 rose from around 2,900 to 3,400, while Bitcoin fell from approximately $11,000 to below $10,000. This divergence began in June 2019, with both assets eventually converging after the market upheaval in March 2020.

The current divergence, which also started in June, mirrors past patterns where market stress, like the yen carry trade unwind, led to significant sell-offs similar to COVID-19. With Bitcoin and the S&P 500 reaching new all-time highs in March, the question now is whether Bitcoin will again realign with the S&P 500 as market conditions evolve. CryptoSlate has explored these dynamics, drawing on historical parallels to understand the potential trajectory of these assets.

The post Bitcoin and S&P 500 divergence echoes pre-COVID trends, potential realignment ahead appeared first on CryptoSlate.

The National Bitcoin Office (ONBTC), a part of the Presidential office of El Salvador, has recently made a significant announcement. Today, the ONBTC today revealed that it is readying to initiate a nationwide Bitcoin instruction and certification drive, scoping in on the country’s civil servants. This decision comes as an effort to revolutionize the country’s ongoing Bitcoin investment plans, echoing a bustle across the broader market.

According to an official announcement by the ONBTC on X today, August 21, the nation will soon start offering BTC instructions and certification to nearly 80,000 public servants. This effort aims to educate and certify a substantial number of Salvadoran civil servants about BTC. In turn, the effort seeks to ensure that government employees remain well-versed in the flagship crypto-related operations.

Meanwhile, the ONBTC also plans to amalgamate open-source BTC-related courses into public school curriculums. Notably, two particular courses to be initially rolled out in schools include “Mi Primer Bitcoin” (My First Bitcoin) and “Node Nation.”

The two courses facilitate the basics of BTC, blockchain technology, and technical aspects such as operating a BTC node. Altogether, this development echoed optimism nationwide, with El Salvador further reinforcing its commitment towards the flagship coin.

Additionally, it’s worth noting that El Salvador previously revealed plans for a whopping $1.6 billion investment in the Bitcoin city. Meanwhile, the crypto’s price tackles market turbulence, stirring further investor speculations globally.

Despite the token gaining significant traction globally, market bears have prevented the coin from scaling new heights post-halving. At press time, the BTC price rested at $59,349, a 2% dip in the past 24 hours. Its intraday lows and highs are $58,610.88 and $60,976.82, respectively.

Coinglass data shows a 2.5% dip in BTC futures OI to $30.62 billion today. However, the derivatives volume soared 9% to $57.24 billion, fueling contrasting market sentiments.

Simultaneously, Mt Gox again shifted a whopping 1,265 BTC to Bitstamp today, per SpotonChain data, aligning with the coin’s slumping movement. Nevertheless, it’s also worth mentioning that Galaxy Digital bagged a whopping $82 million worth of BTC recently.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Tether teams up with the UAE’s Phoenix Group and Green Acorn Investments to launch a dirham-backed stablecoin, which aims to improve international trade and remittances.

Tether plans to add a new stablecoin pegged to the United Arab Emirates’ Dirham to its suite of stablecoins, according to an announcement on Aug. 21.

Per details of the planned launch, Tether will collaborate with Phoenix Group PLC, a UAE-based multi-billion dollar tech behemoth. The new stablecoin initiative will also involve Green Acorn Investments Ltd.

“We are thrilled to be working with Tether on bringing a UAE Dirham-pegged stablecoin to the market and are confident of its potential in transforming the digital economy for users across the region and beyond,” Seyedmohammad Alizadehfard, co-founder and Group CEO of Phoenix Group, said.

When launched, the Dirham-pegged stablecoin will join a host of Tether tokens that include the world’s largest stablecoin USDT. Other products are the Euro-pegged EURT, Chinese yuan-pegged CNHT, Mexican peso-pegged MXNT, and Tether Gold (XAUT).

Tether is seeking regulatory approval for the fiat-backed cryptocurrency, with application made with the UAE Central Bank.

“The United Arab Emirates is becoming a significant global economic hub, and we believe our users will find our Dirham-pegged token to be a valuable and versatile addition,” Tether CEO Paolo Ardoino noted in a statement.

As well as launching the range of fiat-backed digital assets, Tether has aggressively expanded its flagship product USDT.

Currently the top stablecoin with a market cap of over $116 billion, USDT native access is live on major blockchains, including Ethereum and TRON.

The latest blockchain network to see USDT expansion is Aptos.

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Source link

Despite a cross-border market correction, the Fantom price has recorded a positive action in its chart, suggesting an increase in the bullish sentiment. Moreover, with the recent price pump, this altcoin has successfully reclaimed the $0.40 level.

With this, questions like “Will FTM rise back up?” and “How high will the Fantom price go?” are on a constant rise. Planning on investing in this crypto token but concerned about its prospects?

Fear not, as in this article, we have uncovered the market sentiments, price action, and potential short-term price targets of the Fantom (FTM) token.

After trading under a bearish sentiment for a brief period, the Fantom token has successfully regained bullish momentum above its crucial support trendline of $0.2325. Further, it has jumped 3.88% within the past day with a trading volume of $95.669 million.

Moreover, it has added 8.25% in the past 24 hours and has surged ~57% over the past 16 days. Notably, with a circulating supply of 2,803,634,836 FTM tokens, it has secured the 58th position with a market capitalization of $1.127 billion.

The Relative Strength Index (RSI) has displayed a constant rise in the FTM price chart, with its average trendline displaying a similar action. This indicates an increase in the bullish sentiment for the altcoin in the market.

Further, the MACD indicator has recorded a constant green histogram in the 1D time frame. Moreover, its averages show a rising pattern. This suggests that the Fantom token will continue to gain value in the future.

If the market holds the FTM coin price above its support level of $0.390, the bulls will prepare to test its resistance level of $0.5375. Maintaining the price at that level will push its value toward its upper resistance level of $0.680 in the coming time.

For the Fantom (FTM) price to achieve the $1 mark, it will require a record jump of 147.83%, considering its present trading price of $0.4035.

On the flip side, if the bears regain power over the bulls, this could result in the Fantom price plunging toward its crucial support level of $0.2325.

Key takeaways

Bitcoin is underperforming again following a positive start to the week. The world’s leading cryptocurrency by market cap is trading below $60k after losing 3% of its value in the last 24 hours.

At press time, the price of Bitcoin stands at $59,409 and could dip lower if the bears remain in control. The bearish performance comes after Mt.Gox moved over $700 million worth of bitcoins to an unknown wallet. Traders are anticipating more selloff in the market as Mt.Gox distributes more bitcoins to its creditors.

The broader market is bearish, but the adoption of cryptocurrencies continues to pick up pace, both among retail and institutional investors.

Poodlana is one of the projects that is gaining traction among investors. It is a Solana-based meme coin focused on introducing the glamor of high fashion to the crypto world.

By focusing on promoting the ethos of community while providing utility to users, Poodlana could become one of the leading dog-themed meme coins in the world. The team will leverage Poodlana’s popularity in Japan, Korea, and China to build a strong community for this project.

The Poodlana presale has officially ended, with $8 million raised during the event. The project didn’t waste time getting its token listed on a centralised cryptocurrency exchange.

MEXC, a leading crypto exchange, announced earlier this week that POODL, Poodlana’s native token, is now live on its trading platform. Currently, only the POODL/USDT pair is live on MEXC, but the crypto exchange could list more pairs, such as POODL/BTC and POODL/ETH, in the coming weeks or months.

Poodlana didn’t adopt a lock-up period, which means its tokens are now available to investors. Per their tokenomics, Poodlana will have 1 billion POODL tokens, with 50% going presale.

The remaining 50% will be divided among marketing (15%), rewards (5%), partnerships (5%), treasury (10%), and liquidity (15%).

Poodlana’s team kept their promise and unlocked 100% of their tokens immediately after the presale. The unsold tokens would be burned, ensuring the token’s deflation.

If you missed buying the Poodlana tokens during the presale, you can still purchase them from crypto exchanges. At the moment, POODL is only available on MEXC but could be listed on other exchanges soon.

Meme coins have become a crucial part of the cryptocurrency ecosystem, with several having a market cap of $1 billion or more. With POODL still in its early days, this could be the perfect opportunity to invest in the project.