Source link

$1.1M Penalty Slammed on Mosaic Exchange in Crypto Fraud Scandal – Regulation Bitcoin News

Crypto Daybook Americas: Massive Selloff Doesn’t Stop BTC Institutional Adoption

By Omkar Godbole (All times ET unless indicated otherwise)

“I don’t understand how can anyone think BTC is not a bargain at these prices…,” Andre Dragosch, head of research – Europe at Bitwise, said on X Monday as BTC’s price dipped below $90,000.

While the comment may appear overly optimistic to macro bears, it is not without justification. Even as the DXY, Treasury yields, and Fed rate expectations look to destabilize risk assets, corporate and institutional demand for BTC continues to strengthen.

Intesa Sanpaolo, Italy’s largest bank by market capitalization, has reportedly purchased BTC, snapping up 11 BTC for $1 million. That could accelerate crypto adoption in the European Union’s third-largest economy, which already has 1.4 million citizens holding cryptocurrencies.

If that’s not enough, corporate Treasury purchases of BTC have already reached 5,774 BTC in the first two weeks of January, outpacing the supply of new BTC.

To Dragosch’s credit, BTC has bounced to over $96K, hinting at an end of the price weakness that began a month ago at record highs above $108K. As usual, that has brought cheer to all corners of the crypto market, with AI, gaming and meme sub-sectors leading the charge.

The recovery, supported by ongoing institutional adoption and rumors of President-elect Donald Trump planning to issue an executive order addressing crypto-accounting SEC rules on day one, suggests that bears may find it difficult to assert their influence.

Prices may move into six figures if Tuesday’s U.S. producer price index points to softer inflation in the pipeline, weakening the hawkish Fed narrative. Note that the dollar index’s rally has already stalled amid reports that Trump’s tariffs will be gradual and smaller than initially feared.

What to Watch

- Crypto

- Macro

- Jan. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s PPI data.

- PPI MoM Est. 0.3% vs. Prev. 0.4%.

- Core PPI MoM Est. 0.3% vs. Prev. 0.2%.

- Core PPI YoY Est. 3.7% vs. Prev. 3.4%.

- PPI YoY Est. 3.4% vs. Prev. 3%.

- Jan. 14, 8:55 a.m.: U.S. Redbook YoY for the week ended on Jan. 11. Prev. 6.8%.

- Jan. 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Consumer Price Index Summary.

- Core Inflation Rate MoM Est. 0.2% vs. Prev. 0.3%.

- Core Inflation Rate YoY Est. 3.3% vs. Prev. 3.3%.

- Inflation Rate MoM Est. 0.3% vs. Prev. 0.3%.

- Inflation Rate YoY Est. 2.8% vs. Prev. 2.7%.

- Jan. 16, 2:00 a.m.: The U.K.’s Office for National Statistics November 2024’s GDP estimate.

- GDP MoM Est. 0.2% vs. Prev. -0.1%.

- GDP YoY Prev. 1.3%.

- Jan. 16, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ending on Jan. 11. Initial Jobless Claims Est. 214K vs. Prev. 201K.

- Jan. 17, 5:00 a.m.: Eurostat releases December 2024’s Eurozone inflation data.

- Inflation Rate MoM Final Est. 0.4% vs Prev. -0.3%.

- Core Inflation Rate YoY Final Est. 2.7% vs. Prev. 2.7%.

- Inflation Rate YoY Final Est. 2.4% vs. Prev. 2.2%.

- Jan. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s PPI data.

Token Events

- Governance votes & calls

- Compound DAO is discussing the creation a new unit responsible for managing APR incentive campaigns to attract large conservative investors.

- Maple Finance DAO is discussing using 20% of the fee revenue the protocol will generate in Q1 to buy back SYRUP tokens and distributed them to SYRUP stakers.

- Unlocks

- Jan. 14: Arbitrum (ARB) to unlock 0.93% of its circulating supply, worth $70.65 million.

- Jan. 15: Connex (CONX) to unlock 376% of its circulating supply, worth $84.5 million.

- Jan. 18: Ondo (ONDO) to unlock 134% of its circulating supply, worth $2.19 billion.

- Token Launches

- No major token launches scheduled today.

- Jan. 15: Derive (DRV) will launch, with 5% of supply going to sENA stakers.

Jan. 16: Solayer (LAYER) to host token sale followed by five months of points farming. - Jan. 17: Solv Protocol (SOLV) to be listed on Binance.

Conferences:

Token Talk

By Francisco Rodrigues

- Holoworld AI has announced the start of Agent Market, a Solana-based token launchpad allowing users to create, trade, and interact with on-chain AI agents and their tokens without coding skills. The marketplace has integration with multiple social channels including X, allowing for agents to be deployed on these channels after launch.

- Despite enduring a steep correction, AI tokens have outperformed every other basket class within the cryptocurrency space so far this year, owing their returns to a significant surge seen in the first week of the year. CCData’s basket performance shows that year-to-date, AI tokens are up 2.5%, while the second-best performing class, exchange tokens, is up less than 0.5%.

- On the other end of the spectrum, real world asset (RWA) tokens are down more than 14% , significantly underperforming memecoins, which dropped roughly 10% in this month’s correction.

- Usual Protocol, the popular decentralized finance protocol that came under fire last week over an unexpected change in its redemption mechanism, has activated its Revenue Switch for USUALx holders.

- Solana-based token launchpad Pump.fun has moved 122,620 SOL worth over $21 million to Kraken, bringing their total deposited funds to 1.785 million SOL worth $362 million, Onchain Lens revealed.

- The FTX estate has executed its monthly SOL redemption transfer, unstaking 182,421 SOL and moving the funds to 20 different addresses. Since November, FTX has redeemed over $500 million in SOL, and it still holds $1.18 billion in its staking address.

Derivatives Positioning

- Large cap tokens, excluding XLM, XRP and HYPE, have seen a decline in perpetual futures open interest in the past 24 hours.

- Front-end BTC and ETH options risk reversals show neutral sentiment despite the price recovery. Near-dated and long-term options show a bias for calls.

- Block flows featured large purchase of calls at $95K and $98K expiring in the next two weeks and an ETH bull call spread, involving March 28 expiry calls at $5.5K and $6.5K.

Market Movements:

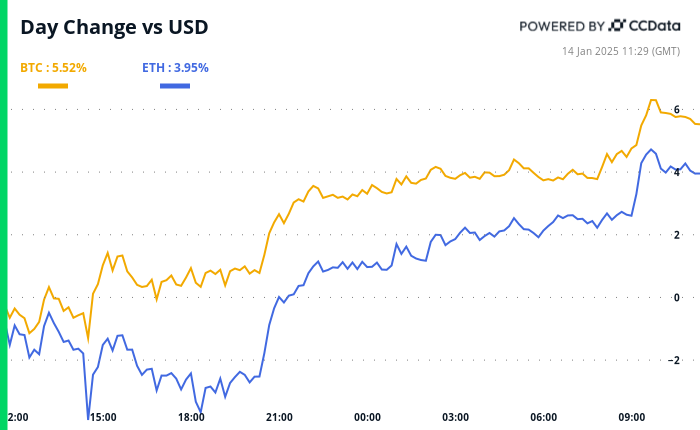

- BTC is up 2.56%% from 4 p.m. ET Tuesday to $96,615.50 (24hrs: +6.44%)

- ETH is up 3.84% at $3,233.91 (24hrs: +5.76%)

- CoinDesk 20 is up 4.69% to 3,463.07 (24hrs: +6.84%)

- Ether staking yield is up 15 bps to 3.12%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is down 0.35% at 109.57

- Gold is up 0.22% at $2,679.50/oz

- Silver is up 0.76% to $30.32/oz

- Nikkei 225 closed -1.83% at 38,474.30

- Hang Seng closed +1.83% at 19,219.78

- FTSE is up 0.17% to 8,237.93

- Euro Stoxx 50 is up 1.03% to 5,005.29

- DJIA closed on Monday +0.86% at 42,297.12

- S&P 500 closed +0.16 at 5,836.22

- Nasdaq closed -0.38% at 19,088.10

- S&P/TSX Composite Index closed -0.93% at 24,536.30

- S&P 40 Latin America closed +0.49% at 2,192.57

- U.S. 10-year Treasury was unchanged at 4.79%

- E-mini S&P 500 futures are up 0.54% to 5,906.00

- E-mini Nasdaq-100 futures are up 0.71% to 21,096.00

- E-mini Dow Jones Industrial Average Index futures are up 0.37% to 42,682.00

Bitcoin Stats:

- BTC Dominance: 58.52

- Ethereum to bitcoin ratio: 0.033

- Hashrate (seven-day moving average): 773 EH/s

- Hashprice (spot): $54.3

- Total Fees: 7.77 BTC/ $721,654

- CME Futures Open Interest: 174,105 BTC

- BTC priced in gold: 35.6/oz

- BTC vs gold market cap: 10.14%

Technical Analysis

- Despite the overnight bounce, BTC’s price remains in the Ichimoku cloud, a momentum indicator created by Japanese journalist Goichi Hosada.

- A crossover above the cloud would signal a renewed bullish outlook.

Crypto Equities

- MicroStrategy (MSTR): closed on Monday at $328.40 (+0.15%), up 3.19% at $338.89 in pre-market.

- Coinbase Global (COIN): closed at $251.20 (-2.93%), up 3.18% at $259.20 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$26.04 (-3.8%)

- MARA Holdings (MARA): closed at $17.19 (-3.75%), up 3.61% at $17.81 in pre-market.

- Riot Platforms (RIOT): closed at $11.77 (-1.92%), up 3.65% at $12.20 in pre-market.

- Core Scientific (CORZ): closed at $13.6 (-3.13%), up 1.6222.22$13.82 in pre-market.

- CleanSpark (CLSK): closed at $10.19 (+0.99%), up 3.24% at $10.52 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.22 (-3.85%), up 7.29% at $23.84 in pre-market.

- Semler Scientific (SMLR): closed at $52.70 (+2.61%), up 4.19% at $54.91 in pre-market.

- Exodus Movement (EXOD): closed at $33.58 (-11.09%).

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$284.1 million

- Cumulative net flows: $35.94 billion

- Total BTC holdings ~ 1.131 million.

Spot ETH ETFs

- Daily net flow: -$39.4 million

- Cumulative net flows: $2.41 million

- Total ETH holdings ~ 3.535 million.

Source: Farside Investors, as of Jan. 13.

Overnight Flows

Chart of the Day

- The chart shows performance of various crypto market sub-sectors in 2024.

- Memecoins witnessed a staggering 254% gain last year, outperforming the broader market and bitcoin by a big margin.

While You Were Sleeping

- Is Bitcoin Bottom In? BTC’s Price Action is Inverse of December Peak Above $108K (CoinDesk): Bitcoin dipped below $90K on Monday as investment banks speculated about potential Fed rate hikes, but it rebounded to $94K, suggesting the price may have temporarily bottomed after recent volatility.

- Crypto Bank Sygnum Gets Unicorn Status With $58M Round (CoinDesk): Sygnum, a Switzerland and Singapore-based digital asset bank, achieved unicorn status after raising $58M to support European and Hong Kong expansion, enhanced Bitcoin offerings, and acquisition plans.

- Sony’s Layer-2 Blockchain “Soneium” Goes Live (CoinDesk): Sony has launched “Soneium,” a layer-2 blockchain on Ethereum, leveraging Optimism’s OP Stack to connect web2 and web3 audiences while supporting gaming, finance, and entertainment applications.

- As the U.S. Dollar Soars, Here Are Europe’s Biggest Winners and Losers (CNBC): The strong U.S. dollar, fueled by higher yields and capital flows, weakens the euro and pound, increasing costs for net importers like Germany and the U.K., while benefiting Norway’s oil exports.

- China Will ‘Try Very Hard’ to Slow Yuan’s Fall, UBS’ Wang Says (Bloomberg): UBS says a weaker yuan will offer limited export benefits, as Beijing seeks to slow its decline amid US tariff threats, a strong dollar, and risks of capital outflows.

- BOJ Set to Discuss Whether to Raise Rates Next Week (The Wall Street Journal): Deputy Gov. Himino says the Bank of Japan will discuss a potential rate hike on Jan. 23-24, noting inflation trends align with projections. His remarks lifted bond yields, while the yen briefly weakened before recovering.

In the Ether

Up Network and DreamSmart launch world’s first Web3 AI glasses

The glasses aim to provide a faster online user experience via AI agents and extended reality features, which may usher in a “post-smartphone era.”

Cryptocurrency Market Today: BTC, XRP, and AIXBT Lead Recovery Ahead of US CPI Inflation Data

The cryptocurrency market today witnessed a broad recovery, with Bitcoin (BTC) regaining momentum and crossing the $97K mark after dipping to a low of $89K earlier this week. Traders are now focused on the U.S. Consumer Price Index (CPI) inflation data, set to be released today, which could significantly impact market direction in the coming days.

Ripple’s XRP continued its upward trend, gaining 12% in the last 24 hours, making it the best-performing coin among the top 10 cryptocurrencies. AIXBT also posted strong gains, rising by 43%, contributing to the overall positive market sentiment.

The global crypto market cap climbed to $3.38 trillion, up 2.45% over the last 24 hours. However, the trading volume saw a sharp drop of 29%, standing at $123 billion. The Fear and Greed Index remained neutral at 51, reflecting a cautious yet balanced market sentiment as investors anticipate the CPI report’s impact.

Cryptocurrency Market Today: BTC, ETH, XRP, and SOL Show Bullish Signs

The cryptocurrency market today is showing signs of recovery after a month of downward momentum. Bitcoin (BTC) reclaimed the $97K level, while Ethereum (ETH) and Solana (SOL) gained approximately 2% in the last 24 hours. XRP remained the top performer, surging 12%. Meanwhile, long-time Bitcoin holder Anthony Pompliano has urged former U.S. President Donald Trump to consider creating a Bitcoin national reserve to strengthen economic stability.

Bitcoin Price Today

Bitcoin price today was trading at $96,975, marking a 2.5% increase over the last 24 hours. The 24-hour low and high for BTC stood at $94,757 and $97,504, respectively.

According to Farside Investors, BTC ETFs recorded an inflow of $9.7 million. WisdomTree led the purchases, adding $10 million to its holdings, while Bitwise offloaded $9 million. BlackRock’s ETF data is still anticipated, keeping market participants watchful.

Ethereum Price Today

Ethereum price today was trading at $3,210, reflecting a 1.5% increase over the last 24 hours. The 24-hour low and high for ETH stood at $3,158 and $3,256, respectively. ETH ETFs saw an inflow of $1.15 million, with Bitwise accounting for the entire purchase, signaling renewed interest in Ethereum investment products.

XRP Price Today

XRP price today saw a notable surge of 12%, trading at $2.80. The 24-hour low and high stood at $2.517 and $2.869, respectively.

In the cryptocurrency market today, Ripple CEO Brad Garlinghouse criticized SEC Chair Gary Gensler for the agency’s regulation-by-enforcement approach. This comes as Ripple braces for the SEC’s appeal hearing scheduled for January 15, which is expected to impact XRP’s future market movement.

Solana Price Today

Solana price today was up by 2.5%, trading at $187. The 24-hour low and high were $184.3 and $190, respectively.

Top Cryptocurrency Gainer Prices Today

As per crypto prices today, here are the top 5 crypto gainers over the last 24 hours:

aixbt by Virtuals (AIXBT)

Price: $0.6412

24-hour gain: +43%

DeXe (DEXE)

Price: $16.09

24-hour gain: +18%

ai16z (AI16Z)

Price: $1.33

24-hour gain: +15%

Raydium (RAY)

Price: $5.39

24-hour gain: +13.88%

Kaspa (KAS)

Price: $0.1371

24-hour gain: +13.5%

The cryptocurrency market today shows significant recovery, with altcoins like AIXBT and DEXE leading the gains ahead of the CPI inflation data.

Top Cryptocurrency Loser Prices Today

As per crypto prices today, here are the top 5 crypto losers over the last 24 hours:

Fartcoin (FARTCOIN)

Price: $1

24-hour loss: -6.6%

Movement (MOVE)

Price: $0.822

24-hour loss: -5.47%

Ondo (ONDO)

Price: $1.14

24-hour loss: -4.44%

Sui (SUI)

Price: $4.51

24-hour loss: -3.52%

Bitget Token (BGB)

Price: $6.43

24-hour loss: -2.65%

Despite the overall recovery in the cryptocurrency market today, these coins experienced declines in the last 24 hours.

Meme Crypto Prices Today

The meme cryptocurrency market today has also shown bullish momentum, with Dogecoin (DOGE) price up by 6% and now trading at $0.36. Similarly, Shiba Inu (SHIB) price was up by 2.5%, now trading at $0.00002168.

Other notable meme coins like PEPE, BONK, and FLOKI are also up by 2 to 4% in the last 24 hours. This positive trend follows the recovery in the broader cryptocurrency market today, reinforcing the growing interest in meme coins.

Besides this, the hourly chart also looks bullish, with Bitcoin price up by 0.2% in the last hour. Major altcoins have also seen positive momentum in the last hour. XDC Network took the lead with a 4% gain in the last 24 hours. In more positive news, Bitwise CIO highlighted three key trends driving corporate Bitcoin adoption.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Options platform Deribit attracts potential buyers amid crypto M&A boom

Options trading platform Deribit has reportedly drawn interest from potential buyers and is working with FT Partners to explore strategic opportunities, Bloomberg News reported on Jan. 14, citing sources familiar with the matter.

The platform has seen a meteoric rise in trading activity, with its total trading volume nearly doubling to $1.2 trillion in 2024. As of this year, Deribit services institutional clients directly through its Dubai-based entity, Deribit FZE, while a Panamanian subsidiary manages retail clients.

The sources said that FT Partners, initially retained in early 2023 to arrange secondary stock sales for Deribit’s investors, has expanded its role to include assessing potential bids for the entire firm.

While Deribit has not officially up for sale, the company acknowledged receiving interest in strategic investments from various parties. The company said in a statement:

“Over time, we have received interest in strategic investments from a variety of parties, which we will not disclose.”

Kraken has reportedly explored acquiring Deribit but ultimately decided not to proceed. One source estimates Deribit’s valuation could range from $4 billion to $5 billion. FT Partners and Kraken declined to comment.

According to CoinGlass data, Deribit had registered over $26 billion in monthly trading volume for Bitcoin (BTC) and Ethereum (ETH) options contracts as of Jan. 13.

Surging M&A moves

The interest in Deribit comes amid a surge in crypto-related mergers and acquisitions (M&A), fueled in part by a post-election rally in digital asset markets.

Publicly announced M&A activity in the crypto sector climbed to $1.2 billion in the fourth quarter of 2024, a sharp increase from $400 million during the same period a year earlier, according to Architect Partners.

Recent deals include crypto brokerage FalconX acquiring derivatives startup Arbelos Markets and acquisitions by MoonPay and Chainalysis.

President-elect Donald Trump’s favorable stance toward digital assets has further buoyed the industry. He has promised to position the US as a global hub for crypto innovation.

With significant interest from potential buyers and a thriving business model, Deribit is poised to play a central role in the next phase of crypto M&A development.

Mentioned in this article

SEC Delays Decision on Bitwise 10 Crypto Index ETF Until March – Regulation Bitcoin News

Source link

Fundstrat’s Tom Lee Calls for Bitcoin’s End of Year Target as High as $200K- $250K

The consolidation between $90,000 and $100,000 for bitcoin (BTC), continues to play with investor sentiment, swinging from fear to greed.

On Monday, bitcoin fell below $90,000, while it is above $96,500 on Tuesday, up over 8% . Bitcoin bull Tom Lee, head of research at Fundstrat, told CNBC on Monday that he sees this current correction in bitcoin as normal.

“Bitcoin is down 15% from its highs for a volatile asset, which is a normal correction,” he said.

Glassnode data shows that bitcoin in this current cycle has seen relatively mild drawdowns of around 15%-20%, much smaller than previous bull market drawdowns, which saw as much as 30%-50% drawdowns, showing the asset is becoming more mature.

According to Lee, $70,000 is a line in the sand, which is a strong support level. They refer to a methodology called Fibonacci levels, or retracement periods, essentially where bitcoin pulls back from where it started its rally. Lee also believes the $50,000 level can be tested if the prior $70,000 levels do not hold. Common Fibonacci levels from the all-time high that analysts look for are 23.6%, 38.2%, 50% and 61.8%

Despite a short-term correction, Lee still thinks bitcoin will be one of the standout assets for 2025 and remains bullish on end-of-year targets of $200,000 to $250,000.

CryptoPunks NFT floor price spikes 13% on rumors of IP sale

Yuga Labs hasn’t confirmed or denied rumors that it is selling the IP rights to CryptoPunks, the world’s most valuable NFT collection.

Anthony Pompliano Shares 3 Key Actions For Trump To Boost Bitcoin Growth

Anthony Pompliano, a prominent Bitcoin advocate and investor, has proposed three strategic measures for President-elect Donald Trump to accelerate Bitcoin adoption in the United States. In a video, Pompliano outlined actionable steps to position Trump as a leader in the digital currency revolution.

Anthony Pompliano Proposes Repealing SAB 12

In a recent video on X, Anthony Pompliano’s first recommendation was to repeal Staff Accounting Bulletin No. 121 (SAB 121). This regulation currently limits banks from holding digital assets, requiring them to classify these holdings as liabilities. Pompliano argues that removing this barrier would allow banks to hold Bitcoin on behalf of their customers. This would foster institutional demand for cryptocurrency.

According to Anthony Pompliano, enabling financial institutions to incorporate Bitcoin into their balance sheets could create a more robust ecosystem for the digital asset. This change could also provide U.S. banks with a competitive edge in the growing global cryptocurrency market.

It is important to note that Bitwise Chief Investment Officer also shared insights on trends in corporate BTC adoption under Trump’s pro-crypto policies. He emphasized MicroStrategy’s aggressive Bitcoin strategy, new FASB rules enabling firms to record price gains,

Creating a Strategic Bitcoin Reserve for National Growth

Another action proposed by Anthony Pompliano was to establish a national Bitcoin reserve. He highlighted that the U.S. government already possesses approximately 200,000 Bitcoin, which could serve as a foundation for building such a reserve.

Anthony Pompliano suggested that increasing the government’s Bitcoin holdings, rather than liquidating them, would be a prudent move. He emphasized that Bitcoin’s growing utility as a store of value and hedge against inflation could benefit the economy in the long term.

The Bitcoin advocate added,

“If Bitcoin is good for individuals or corporations, it’s going to be good for the country, too.”

The growing Bitcoin prices and adoption have led to major corporate moves and acceptance. In a recent report, Genius Group approved a $33M rights offering to expand its Bitcoin Treasury to $86M. The offering allows shareholders to purchase shares at $0.50, with CEO Roger Hamilton planning to increase his stake by 10.3%.

Tax Code Reforms Under Donald Trump

Pompliano also urged Donald Trump to introduce tax reforms that would change how Bitcoin is treated under existing laws. Currently, Bitcoin is classified as property, meaning transactions involving the cryptocurrency are subject to capital gains tax.

This classification creates complexities for consumers and businesses seeking to use Bitcoin for everyday transactions. Pompliano proposed adjustments to the tax code to eliminate these barriers.

Moreover, Anthony Pompliano concluded his recommendations stressing that these measures will propel the United States to the forefront of the digital currency revolution.

Meanwhile, other countries like El Salvador have already integrated Bitcoin into their national strategies. This has inspired jurisdictions like Bhutan’s Gelephu Mindfulness City (GMC). GMC plans to hold Bitcoin, Ethereum, and BNB in its strategic reserves, focusing on digital assets with large market capitalizations and liquidity.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

The market is still in profit despite Bitcoin’s price slump

Bitcoin’s pullback to $90,000 caused quite a stir in the market. Although its recovery to above $96,000 on Jan. 14 offered some relief, many on-chain indicators revealed underlying stress in market health.

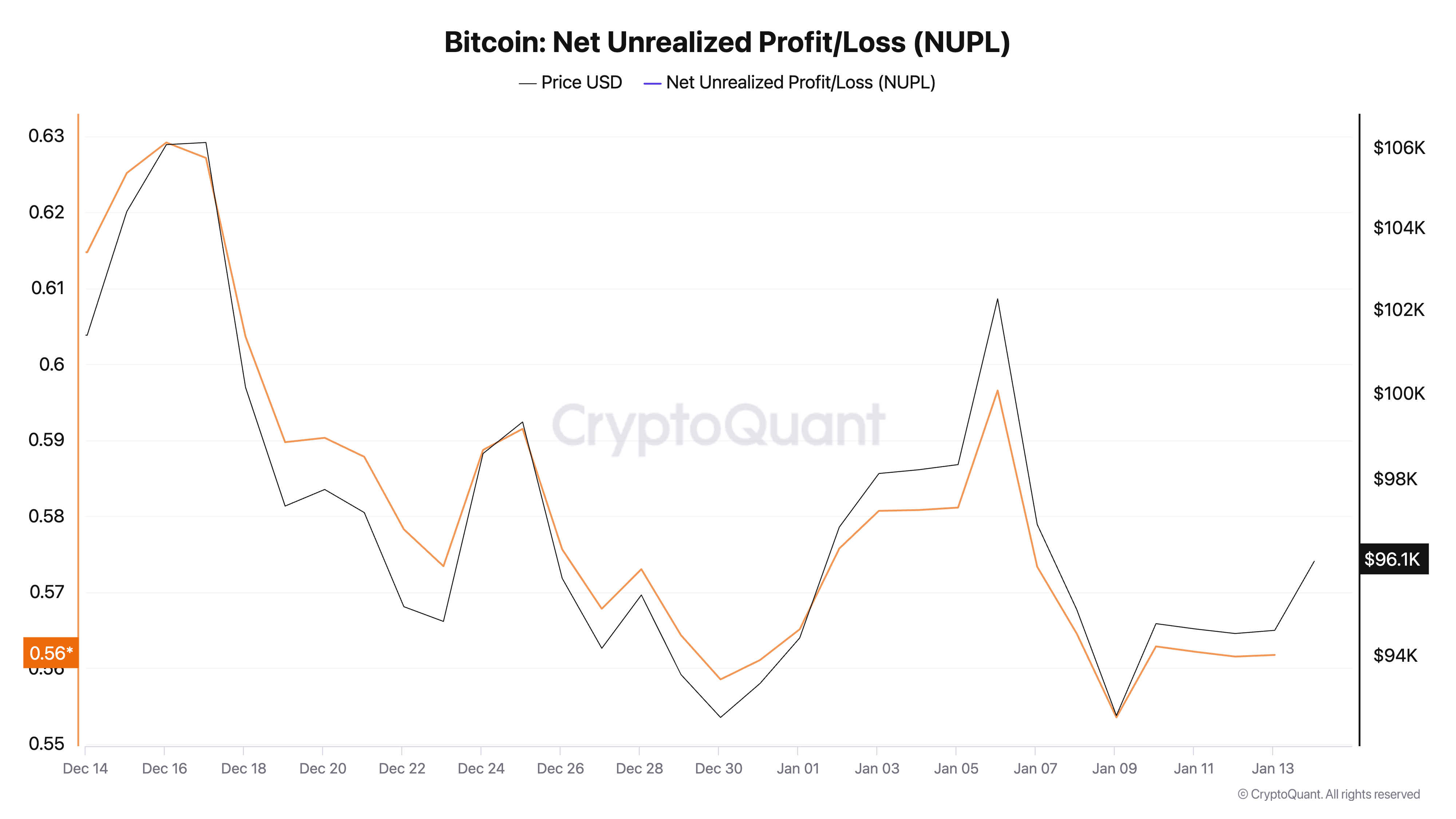

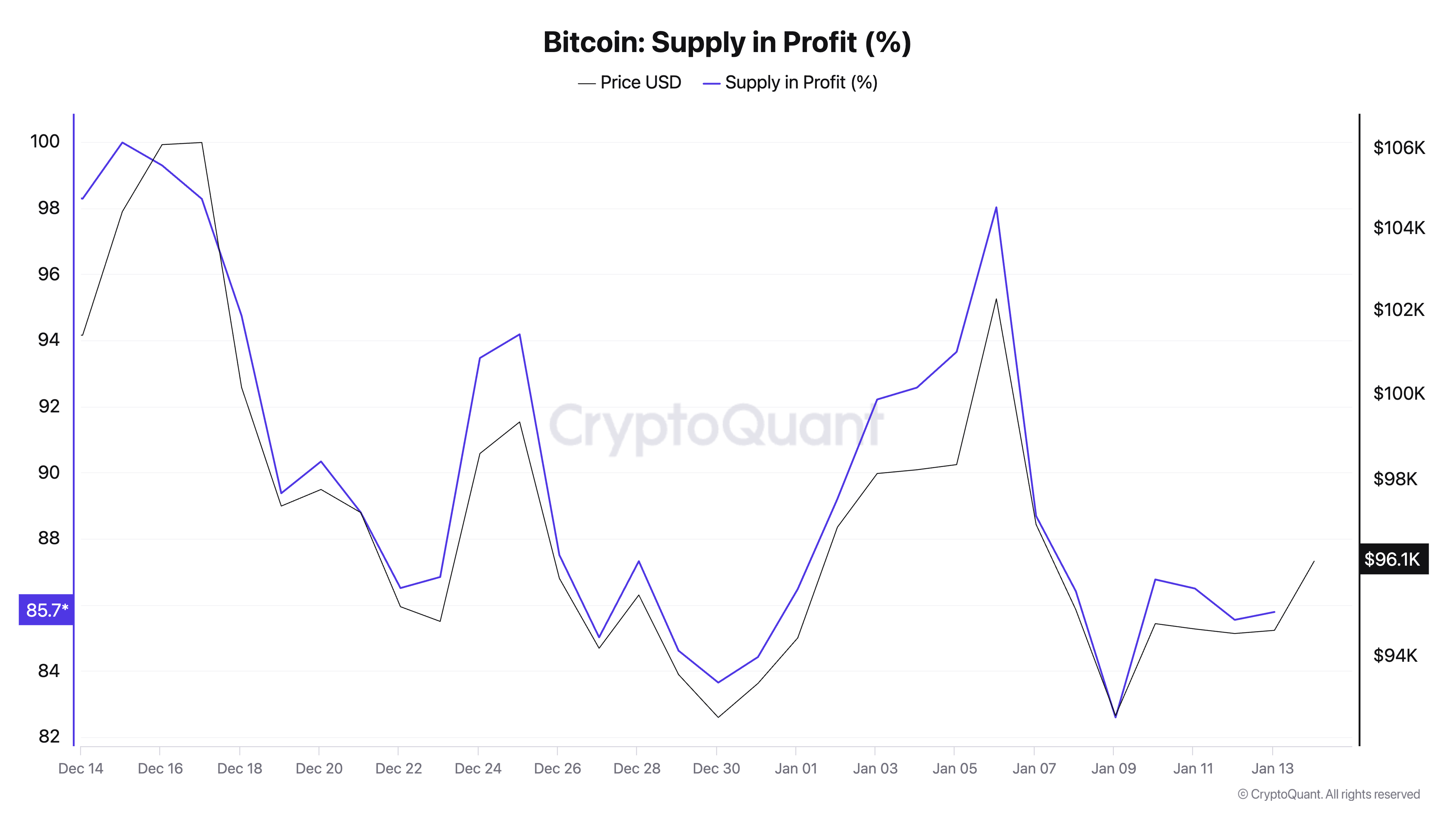

Key metrics like Net Unrealized Profit/Loss (NUPL) and the percentage of supply in profit showed significant declines over the past week, reflecting shifts in the market’s unrealized gains and losses.

NUPL, a metric calculated as the difference between unrealized profits and unrealized losses divided by the total market value, serves as a barometer for market sentiment. A positive NUPL indicates that the market is in a state of unrealized profit, suggesting optimism among holders.

Over the past week, NUPL dropped from 0.615 to 0.562, signaling a moderate reduction in aggregate unrealized gains. This decrease reflects a cooling of market exuberance, but the NUPL’s position firmly in positive territory suggests that significant unrealized profits still support the market structure. A drop of this magnitude (–0.053) indicates a softening in sentiment rather than a fundamental shift.

The percentage of Bitcoin’s supply in profit is calculated by comparing the acquisition cost of coins with current market prices. It dropped sharply from 98.52% to 85.78% over the past week, revealing that a substantial portion of Bitcoin’s supply moved from unrealized profit to unrealized loss due to price fluctuations.

On Jan. 13, 85.78% of Bitcoin’s supply was still in profit, indicating that most holders acquired their Bitcoin at prices below the current market price. This shows that despite the market being highly sensitive to price volatility, a large proportion of it still remains resilient.

These metrics are crucial in understanding Bitcoin’s cost-basis distribution and overall market health. NUPL and supply in profit collectively highlight the economic positioning of Bitcoin holders. While 14.2% of Bitcoin’s supply now has a cost basis above the current price, the data indicates robust underlying support for Bitcoin’s price to remain above $90,000. This further confirms that the market has not entered a prolonged distribution phase.

Supply in profit and NUPL measure the relationship between historical acquisition costs and current prices but do not account for actual trading activity or behavior. For instance, while a decline in unrealized profits might suggest increased selling pressure, these indicators cannot confirm whether holders are actively selling or simply holding through volatility.

These metrics offer a macro-level view of the market’s cost basis, acting as a “thermometer” for Bitcoin’s economic positioning. The data reinforces the view that most Bitcoin holders are still in profit, a factor that can provide stability in times of price turbulence.

While the sharp drop in unrealized profits might raise concerns about increased selling pressure, the resilience in the percentage of supply in profit suggests a strong base of holders who remain optimistic about Bitcoin.

The post The market is still in profit despite Bitcoin’s price slump appeared first on CryptoSlate.