Source link

Bitgo, Kraken Partner With FTX for Jan. 3 Payment Distribution – Bitcoin News

Bitcoin and Ether Lead Top Crypto Gainers; Can BTC and ETH Inspire XRP, Solana, Cardano, Shiba Inu?

Bitcoin and Ethereum have led top crypto asset gainers following the last price rebound. Most traders expect a positive run based on both assets, citing growing institutional demand and the decentralized finance (DeFi) ecosystem. At press time, the total crypto market cap stands at $3.7 trillion, a 2.97% surge in the last 24 hours.

BTC And ETH Dominate Inflows

In the last 24 hours, Bitcoin hit a new all-time high above $106K before a slight correction as bulls project higher gains. The asset is up 2.8% today, while weekly numbers soared 5% amid long-term whale acquisitions. On the institutional front, BTC products attracted $2 billion inflows in the last seven days, raising total assets under management (AUM) to $135 billion.

Bitcoin’s dominance is largely due to increasing institutional crypto investment. This year, fund flows have hit new highs, resulting in a similar price pattern for the asset. In Q1 2024, Bitcoin hit an all-time high above $73K and soared past $100k following the US Presidential elections.

Donald Trump’s anticipated crypto push fuels the recent BTC movement. Talks about a strategic Bitcoin reserve in the United States have led to whales accumulating more assets. Generally, a jump in Bitcoin price affects the wider market with inflows to altcoins and meme tokens. Fund rotation away from BTC to altcoins can be characterized as the start of the altcoin season.

Like Bitcoin, Ethereum leads top crypto gainers with a 2.5% daily inflow alongside rising institutional volumes. The leading altcoin maintains its drive in addition to bullish speculations above $5,000. ETH trades at $4,049 as bulls take its market cap to $487 billion.

Ethereum recorded its consecutive seventh week of institutional inflow, which took figures in the last seven days to $1 billion. Overall, the asset’s AUM stands at $20 billion.

Impact on The Wider Market

Most traders are projecting a wider fund flow to altcoins in the coming months. Although most of these assets are below water, analysts point to the previous cycle and the link between BTC and ETH on these assets. Crypto enthusiast @el_crypto_prof wrote on X.

“You’re facing the biggest Altcoin run in at least 4 years (probably more like 8, as everything reminds me of 2018). Every dip is meant to shake you out. Don’t forget that. Generational wealth is possible with alts in the next months imo.”

Top altcoins, XRP and Solana, sit slightly in the light green zone, with 5.2% and 1% gains, respectively.

Stanford Blockchain Club slams DOJ’s use of archaic laws in Tornado Cash case

The Stanford Blockchain Club has issued a scathing critique of the US Department of Justice’s (DOJ) prosecution of Tornado Cash developers Roman Storm and Roman Semenov, calling it an overreach of outdated federal money transmission laws.

In its report, titled “Tornado Cash and the Boundaries of Money Transmission,” the club challenged the DOJ’s use of 18 U.S.C. § 1960, a statute aimed at unlicensed money-transmitting businesses, to charge the developers of Tornado Cash, a decentralized Ethereum-based protocol.

The DOJ’s 2023 indictment labeled Tornado Cash an “unlicensed money transmitting business” for enabling users to anonymize crypto transactions.

The Stanford Blockchain Club argued that the statute, written before the advent of blockchain technology, fails to address the nuances of decentralized protocols like Tornado Cash, which operate through immutable smart contracts without intermediaries or custodians.

According to the report:

“The DOJ’s aggressive application of 18 U.S.C. § 1960 raises broader questions about the risks of stretching statutory language to cover novel technologies. This approach invites unelected officials and the judiciary to overstep their constitutional bounds, bypassing Congress’ authority to legislate.”

The report emphasized the constitutional implications of using executive enforcement to regulate emerging technologies. It warned that such actions circumvent the democratic process and risk stifling innovation by conflating legal use cases of privacy-preserving tools with illicit activity.

Stanford University, known for its leadership in both legal and technological innovation, has a history of engaging with complex regulatory challenges. The blockchain club’s report continues this tradition by delving into the tension between privacy rights and regulatory oversight in the digital finance space.

The Tornado Cash case highlights a growing debate about financial privacy and the risk of these new technologies being misused by bad actors.

Advocates, including the Stanford Blockchain Club, argue that protocols like Tornado Cash fulfill legitimate privacy needs by allowing individuals to protect their identities in transactions. Meanwhile, critics contend that such tools facilitate money laundering and other illegal activities.

The report’s release marks a significant contribution to ongoing discussions about how the US legal system can adapt to DeFi technologies. It remains to be seen whether the judiciary will consider such critiques as it continues to grapple with the complexities of blockchain regulation.

Mentioned in this article

Forte Unveils Open-Source Rules Engine to Support Safety and Economic Stability in Blockchain Development – Crypto-News.net

San Francisco, California, December 16th, 2024, Chainwire

Forte’s Open Source Rules Engine Empowers Web3 Developers with Dynamic On-Chain Compliance and Economic Solutions for Launching and Managing Digital Assets.

Forte has officially unveiled and launched the Forte Rules Engine, an open-source solution for developers to build safe, on-chain environments and manage digital asset economies for web3 apps. With the Rules Engine, developers can define and enforce rules, establish transaction guardrails, manage compliance obligations, and mitigate the risks of volatility and bad actors – all while supporting long-term digital asset utility and economic health.

Developers can now utilize the Forte Rules Engine by visiting: forte.io/developers

“The future of blockchain development is at a pivotal moment where the need to build strong foundations that foster safe, sustainable environments is paramount for blockchain projects and communities to thrive,” said Bela Pandya, CEO of Forte, “The Rules Engine was built to deliver these foundational technologies to developers that enable on-chain safeguards across a wide array of critical functions. From anti-dumping controls on airdrops to guardrails ensuring digital assets never interact with sanctioned wallets, and custom controls designed to mitigate volatility and market manipulation, the Rules Engine empowers developers to launch their projects confidently. This marks a new chapter for blockchain development, driven by compliance, economic stability, and a renewed sense of trust in blockchain development with much more on the horizon for the Forte Rules Engine.”

Fully compatible with all EVM chains and web3 wallets, the Rules Engine provides developers the on-chain technology they need to build a safe, sustainable economy that their communities trust. This innovative suite of solutions aims to support:

Safe Environments for Digital Assets

The Forte Rules Engine employs on-chain guardrails to implement protective layers and safeguards that help mitigate risk and manage digital asset markets. The technology streamlines compliance navigation by leveraging Forte’s ecosystem of regulated partners to facilitate Know Your Customer (KYC) and Wallet protocols as well as sanctions enforcement, fostering responsible practices and building trust among users and communities. Through enhanced features such as Zero Knowledge (ZK) capabilities, developers can ensure privacy, verify identities, and assure transaction integrity.

Economic Stability

Developers will have access to a growing set of features designed to help launch, grow and scale a sustainable economy that their community can trust. This includes both templated and bespoke rulesets which can be designed to mitigate market volatility and manipulation, enforce token utility requirements, and effectively manage trading volume.

The on-chain rulesets are designed for seamless integration and equipped with third-party integration options, ready to meet developer needs from day one. They offer the flexibility to adapt and evolve alongside the project, ensuring scalability and stability.

Developers interested in leveraging the Forte Rules Engine for their next project can start building here.

About Forte

Forte provides open-source, on-chain solutions that foster safe environments and support healthy and stable digital asset economies. Our trust and privacy-preservation solutions empower developers to manage compliance risk, promote economic stability, and leverage instant liquidity. Developers can deploy flexible and adaptable blockchain solutions that evolve with their dynamic needs – fully compatible with all EVM chains and web3 wallets. Forte and its ecosystem partners are currently working with acclaimed developers to redefine the future of blockchain innovation.

Contact

Sibel Sunar

47 communications on behalf of Forte

[email protected]

Ether.Fi pitches buybacks for ETHFI stakers

The proposal to buy back tokens with protocol revenues is intended as a new value accrual mechanism for tokenholders.

Bitpanda becomes first European firm to secure Dubai VARA in-principle approval – CoinJournal

- Bitpanda has secured in-principle approval from Dubai VARA.

- Dubai is emerging as a global crypto hub with a supportive regulatory environment.

- Bitpanda plans to establish a regional headquarters in Dubai to expand globally.

Bitpanda, a prominent European digital asset platform, has achieved a significant milestone by securing in-principle approval from the Dubai Virtual Asset Regulatory Authority (VARA).

This approval positions the Austrian company as the first European crypto firm to gain entry into Dubai’s burgeoning digital asset market.

Dubai emerging as a crypto hub

Dubai has emerged as a global cryptocurrency and blockchain innovation hub, attracting leading firms worldwide. With its progressive regulatory framework, the United Arab Emirates (UAE) offers a secure and innovation-friendly environment for crypto businesses and investors.

Bitpanda’s approval underlines its adherence to the region’s stringent regulatory requirements, reflecting the firm’s commitment to compliance and transparency.

Following the in-principle approval, Dubai will serve as Bitpanda’s gateway to global markets, and plans are already underway to establish a fully operational regional headquarters in the city.

According to Eric Demuth, co-founder and CEO of Bitpanda, Dubai’s status as a crypto-friendly city and its vibrant ecosystem make it an ideal launchpad for the firm’s international ambitions.

“In Europe, we have built a reputation as the most trusted and regulated digital asset platform. Now, we are scaling this proven model globally, with Dubai and the UAE serving as our strategic launchpad for international expansion. The opportunities are immense, and we are uniquely positioned to seize them,” Demuth said.

Bitpanda still requires additional approval for full authorization

Despite receiving in-principle approval, Bitpanda must fulfil additional regulatory requirements to achieve full authorization to operate in the UAE.

Nevertheless, the company’s entry into Dubai signifies its commitment to playing a pivotal role in the region’s crypto ecosystem, contributing to the city’s reputation as a global leader in digital asset innovation.

With plans to collaborate with other financial entities in the UAE, Bitpanda is poised to solidify its presence in one of the world’s most promising crypto markets.

MicroStrategy Acquires 15,350 BTC For $1.5 Billion, MSTR Stock Surges

MicroStrategy has announced another Bitcoin purchase, which they made for $1.5 billion. This comes just days after the software company’s inclusion into the Nasdaq-100, while the purchase marks their sixth in as many weeks. Meanwhile, the MSTR stock has surged on the back of this recent Bitcoin purchase.

MicroStrategy Acquires 15,350 BTC For $1.5B

MicroStrategy revealed in a press release that it has acquired 15,350 BTC for $1.5 billion at an average price of $100,386 per bitcoin and has achieved a BTC yield of 46.4% quarter-to-date (QTD) and 72.4% year-to-date (YTD).

The software company now holds 439,000 BTC, which it acquired for $27.1 billion at an average price of $61.725 per bitcoin. The company holds over 2% of Bitcoin’s total supply and is the public company with the largest bitcoin holdings.

MicroStrategy has shown no signs of slowing down despite already owning over 2% of the total Bitcoin supply. This recent purchase is their sixth in a six-week period, which began in November. Last week, the software company bought 21,550 BTC for $2.1 billion.

The “Bitcoin Standard” has undoubtedly favored MicroStrategy and its co-founder, Michael Saylor. Saylor pushed the company to adopt the Bitcoin Strategy in August 2020. Recently, Saylor highlighted the MSTR stock’s impressive performance this year, partly due to its BTC exposure.

MarketWatch data shows that the stock is up over 540% YTD. The MSTR stock is up over 4% and is currently trading at around $425. This recent surge is also because of the fact that MicroStrategy is set to join the Nasdaq-100, an achievement that can also be partly attributed to the company’s Bitcoin exposure, which has brought immense success.

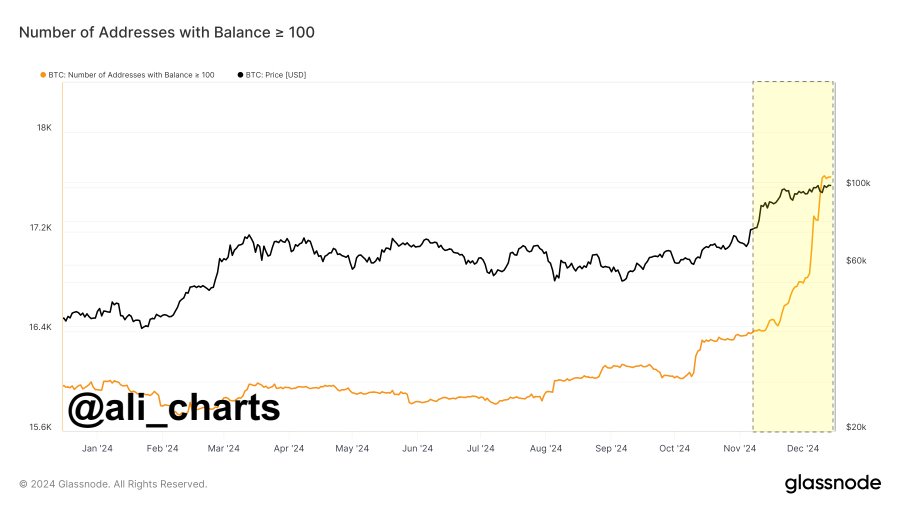

Number Of Bitcoin Whales Is On The Rise

The number of Bitcoin whales like MicroStrategy is on the rise. Crypto analyst Ali Martinez recently revealed that the number of BTC whales on the network has gone “parabolic” since Donald Trump won the US presidential elections.

The number of Bitcoin whales isn’t the only thing that has surged, as the Bitcoin price has also been on a bullish ride since Donald Trump emerged as the US president-elect. The Bitcoin price recently surged to a new all-time high (ATH) of $106,000 amid increased optimism that Donald Trump’s administration would create a Strategic Bitcoin Reserve.

MicroStrategy’s Michael Saylor is one of those who has openly supported the idea of a Strategic Bitcoin Reserve. The tech entrepreneur has even gone as far as advising the US to sell its gold reserves to buy more Bitcoin.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Ripple Sets RLUSD Stablecoin Launch Date, Making Token Accessible on XRP Ledger and Ethereum

Ripple, an enterprise-focused blockchain service closely related to the XRP Ledger (XRP), said it will start making its highly-anticipated U.S. dollar stablecoin accessible to users on Tuesday, Dec. 17 following the token’s regulatory approval.

RLUSD will be initially listed on several exchanges and crypto platforms including Uphold, MoonPay, Archax and CoinMENA, the company said in a press release, with further listings on Bitso, Bullish, Bitstamp, Mercado Bitcoin and Independent Reserve, Zero Hash and others in the coming weeks.

The company also announced two additions to its stablecoin advisory board: Raghuram Rajan, former governor of the Reserve Bank of India, and Kenneth Montgomery, former first vice president and COO of the Federal Reserve Bank of Boston. The pair join board members announced in October including Sheila Bair, former chair of FDIC, and Chris Larsen, co-founder and executive chairman and co-founder of Ripple.

The launch follows Ripple CEO Brad Garlinghouse’s announcement last week that RLUSD sealed “final approval” from the New York Department of Financial Services, paving the way for rolling out the stablecoin for the public from its test phase. RLUSD is fully backed by U.S. dollar deposits, U.S. government bonds and cash equivalents and aims to keep a steady price at $1.

With RLUSD, Ripple aims to compete for a piece in the rapidly growing stablecoin market, currently dominated by Tether’s $140 billion USDT and Circle’s $40 billion USDC tokens. Stablecoins are a key piece of infrastructure bridging digital asset markets and traditional finance, serving as liquidity for trading, vehicle for blockchain-based transactions and increasingly as a payment method across borders. Traditional financial institutions such as banks and payment companies including PayPal, Visa and Societe Generale have also entered the stablecoin space as regulators around the world put rules and guidelines in place for the asset class, bringing much-desired regulatory clarity.

“Early on, Ripple made a deliberate choice to launch our stablecoin under the NYDFS limited purpose trust company charter, widely regarded as the premier regulatory standard worldwide,” Ripple CEO Brad Garlinghouse said in a statement. “As the U.S. moves toward clearer regulations, we expect to see greater adoption of stablecoins like RLUSD, which offer real utility and are backed by years of trust and expertise in the industry.”

RLUSD will be initially available in the Americas, Asia-Pacific, UK and Middle East regions via its distribution and exchange partners, Jack McDonald, senior vice president of stablecoin at Ripple, said in an interview with CoinDesk. He was CEO of Standard Custody & Trust, a company acquired by Ripple earlier this year that holds a New York Trust license.

The token won’t be accessible in the E.U. in the beginning as Ripple does not hold the necessary license under the bloc’s MiCAR regulations, but the company is “actively exploring” ways to enter the bloc’s market, he added.

RLUSD volatility warning

RLUSD, which aims to hold a $1 price, may see an unusual price volatility due to early demand from traders and limited supply.

“There may be supply shortages in the very early days before the market stabilizes,” David Schwartz, chief technology officer at Ripple, warned in an X post. He said that some traders “are willing to pay” as much as $1,200 token price to buy a fraction of RLUSD.

“Please don’t FOMO into a stablecoin,” he added. “This is not an opportunity to get rich.”

Drake’s X Account Hacked to Promote Fraudulent Meme Coin

KeyTakeaways:

- Drake’s X account hacked to promote fraudulent “Anita” meme coin linked to Stake.

- Cybercriminals exploit high-profile figures to boost legitimacy of scam tokens.

- Drake’s crypto involvement raises questions amid ongoing controversies and allegations.

Drake’s official X account was hacked in a high-profile incident that saw the rapper’s platform used to promote a fraudulent meme coin called “Anita.” The hacker, who gained access to the account, posted a series of tweets falsely claiming that the token had been created in partnership with Stake, the gambling platform with which Drake has a longtime association.

The tweets, which included the project’s supposed contract address and a related character, were quickly deleted. Following the incident, the project’s X account was suspended.

Blockchain investigator ZachXBT uncovered the hack, pointing out suspicious activity on Drake’s account. The false posts touted the “Anita” meme coin as being endorsed by Drake and Stake, a crypto-friendly gambling platform that the artist has worked with since 2022.

Source: ZachXBT

The hacker’s actions were short-lived, as the posts were removed shortly after they appeared, and X’s moderation team quickly took down the related account.

This incident is part of a troubling trend in which hackers target high-profile individuals and their social media accounts to promote fraudulent projects. The cybercriminals behind these attacks typically use the legitimacy of well-known figures to deceive followers and boost the perceived credibility of the scams.

Drake’s involvement with the crypto market, particularly through his partnership with Stake, has been well documented. The rapper has previously shown support for digital assets, sharing posts related to Bitcoin and other crypto-related topics on his social media accounts.

This has led to speculation that his account’s hack could be linked to his endorsement of crypto-related projects, even though he has not publicly endorsed “Anita.”

Despite the connection between Drake and the crypto world, the rapper has also been involved in controversy recently. A 20-year-old influencer accused Drake and another individual, Top5, of failing to honor promises made regarding a crypto investment. The influencer claimed to have suffered a financial loss as a result, though these allegations are still unverified.

UK FCA Warns Against Retardio Solana for Unauthorised Financial Services, Urges Caution

The UK Financial Conduct Authority (FCA) has highlighted that Retardio Solana has been promoting and providing financial services or products without permission and has suggested users to avoid dealing with this firm and beware of scams. The regulator noted that firms like Retardio Solana may change their contact details over time and may also give details that belong to another business or individual, so the information looks genuine. FCA confirmed that users who deal with this firm will not have access to the Financial Ombudsman Service in case of any complaint. FCA has urged the users to deal with registered crypto firms.