White hat organization Security Alliance (SEAL) urged users to transfer crypto funds from LastPass if their private keys had been stored there since December 2022 or earlier.

White hat organization Security Alliance (SEAL) urged users to transfer crypto funds from LastPass if their private keys had been stored there since December 2022 or earlier.

Cryptocurrency prices today saw Bitcoin (BTC) making headlines again as it reached a new all-time high, touching $107,700. The global crypto market increased by 1%, reaching $3.72 trillion, while trading volume jumped 34% to $211 billion.

In the altcoin market, Bitget Token (BGB) surged 16%, reflecting strong investor interest, while Cronos (CRO) gained 7%, indicating steady demand. The Fear and Greed Index climbed to 81, signaling extreme greed as optimism continues to dominate the market.

Cryptocurrency prices today showcase BTC’s record-breaking momentum. Its new all-time high is driving bullish sentiment across the market. Increased trading activity and rising valuations reflect strong confidence among investors.

Cryptocurrency prices today saw Bitcoin (BTC) hitting a new all-time high of $107,700, fueling market optimism. Ethereum (ETH) and XRP recorded 2% gains, reflecting steady buying interest, while Solana (SOL) dropped 4% due to profit booking. The overall market remains positive, driven by rising trading volumes and BTC’s strong upward momentum.

Cryptocurrency prices today showed Bitcoin (BTC) trading at $106,256, marking a 2% increase in the last 24 hours. BTC recorded a 24-hour low of $103,320 and a high of $107,777, reflecting strong market activity. Its market cap stood at $2.11 trillion, while its trading volume reached $83 billion. Bitcoin’s dominance in the market remained steady at 56.46%.

As per SoSo Value, BTC ETFs witnessed significant inflows of $218 million on Monday. Fidelity contributed $116 million to Bitcoin ETFs, followed by Ark and 21Shares with $47 million, and Bitwise with $30 million. Meanwhile, BlackRock’s ETF data is still awaited, keeping investors eager for updates.

In other news, Michael Saylor proposed a framework for the U.S. to address its $36 trillion debt with Bitcoin. His innovative suggestion highlights the growing potential of Bitcoin in reshaping global financial strategies.

Cryptocurrency prices today highlighted Ethereum (ETH) price trading at $4,020, reflecting a 2% gain in the last 24 hours. ETH recorded a 24-hour low of $3,883 and a high of $4,108, showcasing steady upward movement. Its market cap stood at $484 billion, supported by a trading volume of $43 billion.

Ethereum ETFs saw an inflow of $20 million, indicating continued investor interest. Bitwise accounted for $8 million of the inflow, while Fidelity purchased $4 million of ETH ETFs. BlackRock’s ETF data is still pending, leaving the market awaiting further updates.

XRP price was trading at $2.48, reflecting a 2% increase in the last 24 hours. The cryptocurrency recorded a 24-hour low of $2.344 and a high of $2.568, indicating a steady upward trajectory. With a market cap of $142 billion and a trading volume of $12 billion, XRP has solidified its position as the third-largest cryptocurrency by market cap, holding a 3.81% dominance.

Analysts predict that XRP could surge to $7 following the launch of the RLUSD stablecoin. This development is anticipated to enhance XRP’s adoption and significantly impact its market trajectory.

Solana (SOL) price was trading at $214, experiencing a 4% drop in the last 24 hours. The cryptocurrency saw a low of $211 and a high of $223 during the same period, reflecting some volatility. With a market cap of $102 billion and trading volume of $5 billion, SOL is currently the 6th largest cryptocurrency by market cap.

In other news, Messari’s 2025 Crypto Theses Report suggests that Solana could experience explosive growth in 2025. This potential surge is expected to come from increasing adoption and the growing influence of the Solana ecosystem in the broader cryptocurrency market.

Top meme coins are showing bearish momentum today, with Dogecoin (DOGE) down by 1%, trading at $0.40. Shiba Inu (SHIB) also saw a 2% decline, trading at $0.00002706, reflecting the overall weakness in the meme coin market.

Other notable meme coins such as PEPE, WIF, and BONK were also down by 2% to 3% at the time of writing. The trend suggests a temporary dip in investor sentiment towards meme-based cryptocurrencies.

Bitget Token (BGB) emerged as the top gainer today, with a 16% increase in price over the last 24 hours. It was trading at $3.65, with a 24-hour low of $3.091 and a high of $3.66, reflecting strong upward momentum.

This significant price increase is attributed to Bitget, being granted a license to operate as a Bitcoin Service Provider by El Salvador’s Central Bank. This regulatory approval has fueled investor optimism, driving the surge in BGB’s price.

Cronos (CRO) became the 2nd top gainer today, with a 7% increase in the last 24 hours. It was trading at $0.188, with a 24-hour low of $0.17 and a high of $0.19, reflecting solid upward movement.

The cryptocurrency prices today show that CRO has a market cap of $5 billion and a trading volume of $131 million. Its strong performance highlights growing investor confidence and interest in the token.

Virtual Protocol (VIRTUAL) was trading at $2.86, showing a 6% increase in the last 24 hours. The cryptocurrency recorded a 24-hour low of $2.70 and a high of $3.28, reflecting strong upward momentum in its price movement.

Helium (HNT) was trading at $8.48, showing an 11% drop in price, making it the worst performer for today. Its 24-hour low and high were $8.40 and $10.10, reflecting significant volatility in its price movement.

Cryptocurrency prices today highlight the challenges Helium is facing, with the market sentiment turning bearish. Investors are keeping an eye on the cryptocurrency as it navigates this downward trend.

GALA price was trading at $0.045, experiencing a 10% drop in price over the last 24 hours. The cryptocurrency recorded a 24-hour low of $0.04483 and a high of $0.0502, indicating notable price fluctuations.

With a market cap of $1.67 billion and a trading volume of $344 million, GALA is still actively traded despite the recent price decline. Cryptocurrency prices today reflect the challenges GALA is facing in a bearish market.

Raydium (RAY) was trading at $4.89, showing a 9% drop in price over the last 24 hours. Its 24-hour low and high were $4.87 and $5.40, reflecting significant price fluctuations. Despite this decline, RAY continues to attract attention in the market, with investors closely watching its movement during this bearish period.

In addition, the hourly chart shows positive momentum, with Bitcoin (BTC) up by 0.50% in the last hour. Major altcoins like Ethereum (ETH), XRP, and Binance Coin (BNB) have also seen gains in the past hour, suggesting a brief market recovery. Cryptocurrency prices today indicate a mixed trend across different assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Although Ethereum (ETH) is becoming rather popular among institutions and confirms its rank among the top altcoins, there is increasing chatter about other altcoins that could surpass it. Could Cardano (ADA) and IntelMarkets (INTL) be the actual stars of 2025 since Ethereum (ETH) seems to have been witnessing strong bearish pressure lately?

Read on to find out why despite Ethereum’s (ETH) future seeming bright, Cardano (ADA) and IntelMarkets might outperform it next year.

IntelMarkets is a safe haven for strategic hedging, therefore controlling market volatility, in addition to being a strong platform for speculative trading. Using perpetual futures contracts, traders can guard their portfolios against losses by opening positions that balance possible drops in their holdings, therefore countering price downturns.

By shorting BTC futures, for example, a Bitcoin (BTC) holder can protect their portfolio against a market collapse. Supported by over $500,000 in development grants, IntelMarkets will be further enhanced by the forthcoming Rodeum blockchain infrastructure, which powers decentralized apps and supports the INTL ecosystem.

IntelMarkets guarantees traders may optimize profitability while avoiding risk in the fast-moving crypto market utilizing automated trading robots and sophisticated risk management tools. As IntelMarkets keeps innovating, it’s introducing a quantum-proof crypto custody solution with the Quantum X Wallet, providing industry-leading security for hassle-free asset management.

From big cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) to developing altcoins and niche tokens, IntelMarkets provides a wide spectrum of asset pairs that let traders vary their strategies and maximize success. Now is an opportunity to accumulate one of the top crypto coins positioned for exponential gains as the INTL utility token is now on sale at just $0.073273 in its eighth presale stage.

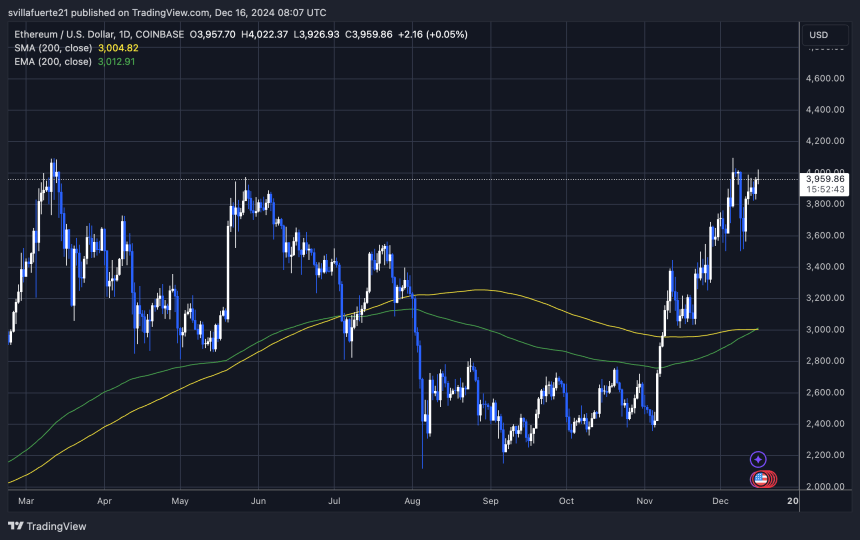

With the Ethereum price rising from $3,700 to almost $4,100 before declining down to the $3,700 zone as bearish pressure set in, also it has seen noteworthy volatility over the past week. The Ethereum price has shown resilience by keeping support higher than the $3,840 level despite these swings.

Maintaining an overall optimistic trend on the annual Ethereum price chart, the price structure of the altcoin shows higher highs and higher lows. Ethereum (ETH) is among the top altcoins to keep an eye on for possible significant recoveries as the recent pullbacks could be temporary and the altcoin is probably going to resume a significant bullish trend.

Though Ethereum’s (ETH) all-time high (ATH) of $4,891 was achieved in 2021, experts remain hopeful that the altcoin could hit this mark before the year ends. Buy signals from the MACD and Moving Averages on the Ethereum price chart together with positive sentiment help to strengthen the belief that is headed for more price appreciation.

Among the top crypto coins that are yet to hit a new ATH this year, Ethereum’s (ETH) continuous consolidation and strong technical signals point to a breakout to new highs perhaps approaching.

After failing to keep its position above the $1.25 to $1.12 level, the Cardano price has seen some notable volatility over the previous week. As a result, the Cardano price dropped more than 6%. Although Cardano (ADA) dropped below the crucial $1 barrier, it gained support at the $0.92 level where positive momentum swiftly recovered.

With this price action, the Cardano price chart shows that the altcoin has entered a phase of consolidation around the $1 mark; inventors are closely watching its subsequent activity. Cardano (ADA) has had a good month despite recent losses; its price rose noticeably, reaching $1.30 before running across opposition.

Though Cardano’s (ADA) long-term prospects remain bright despite recent declines, analysts think that the upward momentum of the altcoin will shortly start again, pushing the price above the $1.30 resistance level and straight back toward its all-time high (ATH) of $3.10.

Cardano (ADA) is still regarded as one of the top altcoins to hold given buy signals from important technical indicators including the MACD and Moving Averages on the Cardano price chart.

IntelMarkets (INTL) is taking the most space in investors’ portfolios while Ethereum (ETH) is attracting institutional interest and Cardano (ADA) is battling with consolidation. It is positioned to lead the 2025 rally with modern trading tools, unparalleled security, and an innovative platform that makes profit generation easier for traders.

Buy Presale

Website

Telegram

Source link

Este artículo también está disponible en español.

Ethereum is on the verge of reclaiming the $4,000 level as it inches closer to its all-time highs. The second-largest cryptocurrency by market cap has faced skepticism throughout this cycle, with some analysts predicting it would underperform compared to its previous bull runs. However, Ethereum has surprised doubters, steadily climbing in recent weeks despite market uncertainty.

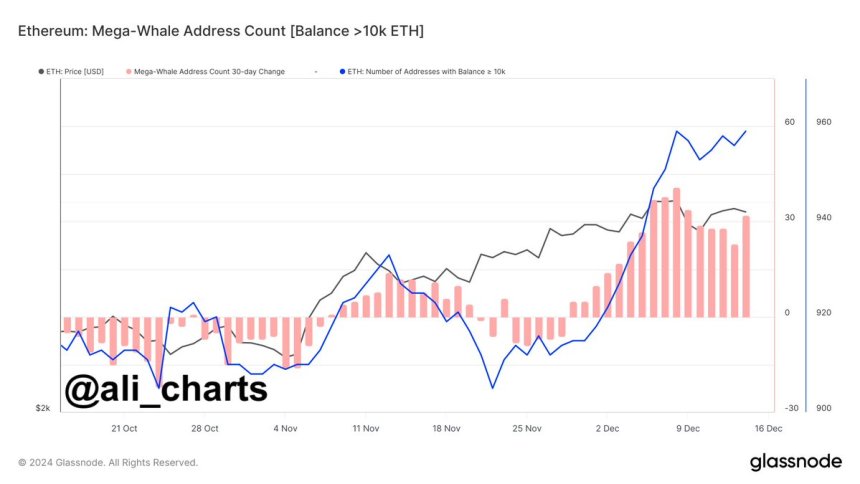

Key on-chain metrics from Glassnode reveal an important trend that could fuel further price gains: Ethereum whales have been accumulating aggressively since late November. This signals growing confidence among major holders, who are positioning themselves for potential upside. Historically, whale accumulation has often preceded significant price moves, hinting at the possibility of a breakout in the near term.

While the market remains divided on Ethereum’s trajectory, its ability to sustain upward momentum near the $4,000 mark will likely define its performance in the weeks ahead. Breaking above this critical resistance could open the door to new highs and further solidify ETH’s role as a leader in the ongoing bull cycle.

Ethereum has experienced a steady, albeit modest, rally since November 5, but it seems the real fireworks for ETH are yet to ignite. As Bitcoin soars into price discovery and several altcoins outperform expectations, Ethereum investors are searching for clear signals of an impending bull run for the second-largest cryptocurrency.

Key on-chain data shared by top analyst Ali Martinez on X provides intriguing insights into Ethereum’s current state. Martinez highlights that Ethereum whales—entities holding significant amounts of ETH—have been accumulating aggressively since the price broke above the $3,330 level.

This accumulation trend suggests that smart money is positioning itself for what could be a massive upward move in the months ahead. Historically, whale accumulation has often been a precursor to strong price rallies, as these large investors tend to anticipate major market shifts before retail traders.

However, the narrative isn’t entirely bullish. While whale accumulation may signal confidence, it also raises concerns about a potential bull trap. These large holders could quickly pivot, offloading their ETH for other assets if market conditions shift or if Bitcoin’s dominance suppresses altcoin growth. Such a move could catch smaller investors off guard, leading to sharp corrections.

For Ethereum, holding above critical levels like $3,800 while breaking key resistances could be the catalyst needed to spark a true bull run. Until then, ETH remains a watchlist favorite, balancing potential and uncertainty.

Ethereum (ETH) is trading at $3,950, struggling to break above the crucial $4,000 resistance level for several days. Despite this, the price remains resilient, signaling strong market support. Clearing this level is essential to confirm the continuation of the uptrend, as $4,000 represents a psychological barrier and a key resistance zone for the asset.

If Ethereum fails to breach the $4,000 mark, a retrace toward lower demand zones around $3,500 could be expected. This level has served as strong support in recent weeks, providing a cushion during periods of increased selling pressure. A pullback to this area could allow for renewed buying momentum, setting the stage for another attempt to break higher.

However, recent market dynamics suggest Ethereum may be poised for a significant move upward. Bitcoin’s surge into price discovery and growing optimism around altcoins have created a bullish environment. With whales continuing to accumulate ETH, as highlighted by on-chain data, market participants are increasingly confident in Ethereum’s ability to retest and surpass its all-time highs.

Featured image from Dall-E, chart from TradingView

Bitcoin reaching an all-time high of $107,000 reflects the strong bullish sentiment in the market in the past two months.

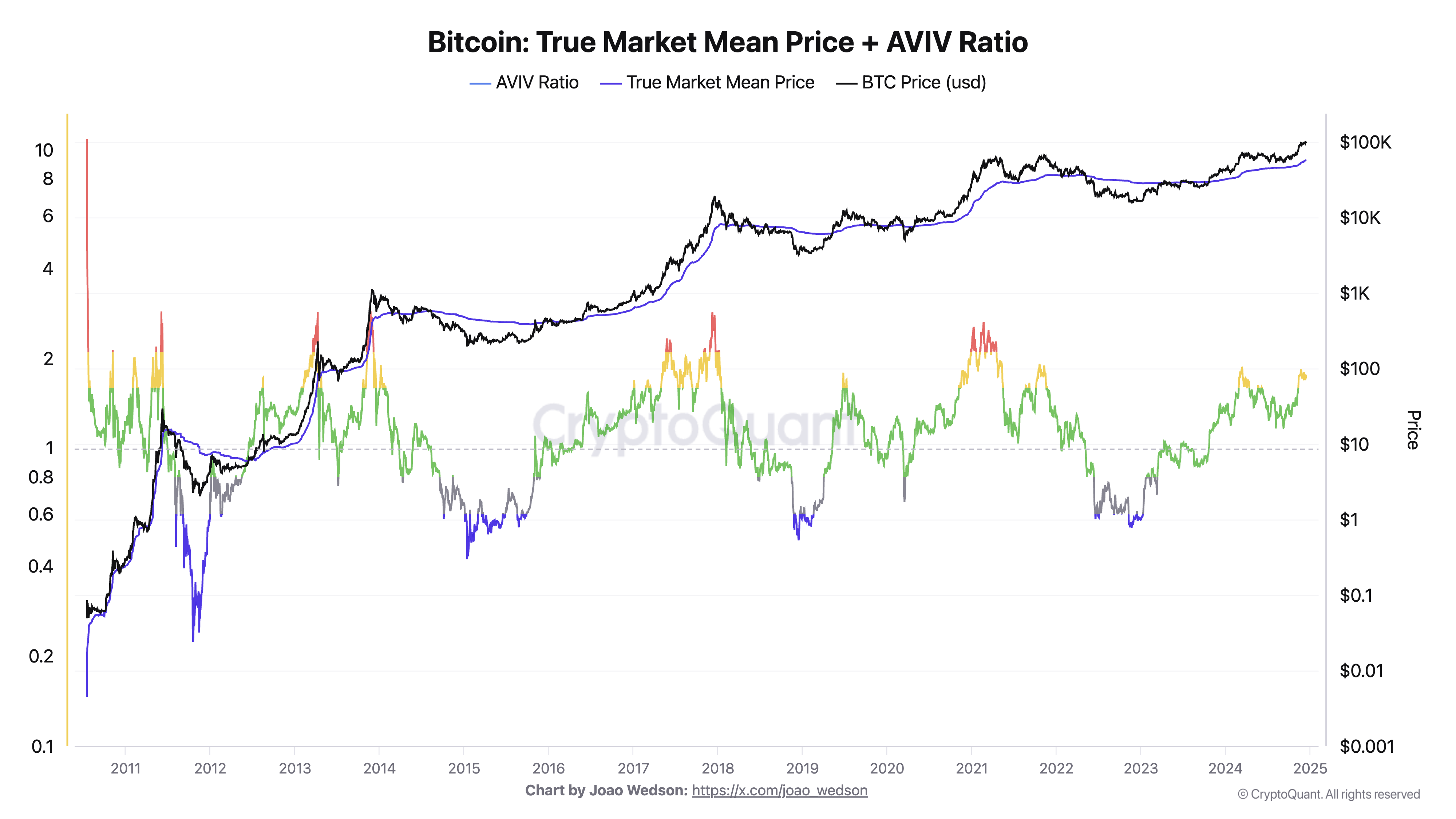

To understand what caused the persistent upward momentum this year, we can turn to the true market mean price (TMMP) and AVIV ratio. These on-chain indicators clarify investor behavior and provide insight into cost-basis trends.

The true market mean price (TMMP) is the average acquisition cost for the market, calculated by dividing the investor cap by the active supply. It excludes miners’ profit realizations to isolate investor-driven acquisition trends and measure Bitcoin’s cost basis across the secondary market. The AVIV ratio is often analyzed alongside TMMP, representing the ratio between active market valuation and realized valuation. It measures how far current market prices have diverged from the realized cost basis, showing potential overbought or oversold conditions. AVIV ratio is often used to identify profit-taking opportunities or risks during price volatility.

While TMMP has always been in a steady upward trend, changes in the pace of its increase can help clarify market behavior. The true market mean price has gradually risen throughout the year following Bitcoin’s price increase. The correlation between price increase and TMMP means that higher prices were supported by sustained market interest. As the year progressed, the gap between Bitcoin’s price and TMMP increased significantly, showing substantial unrealized profits for investors. This widening has historically been observed during mature bull markets, often preceding periods of increased volatility or corrections.

The AVIV ratio stood at moderate levels at the start of 2024, consistent with a market in an accumulation phase. By mid-year, as Bitcoin’s price advanced, the ratio climbed higher, reflecting growing investor profits and a strengthening market. In December, the ratio reached levels historically associated with overheated market conditions, similar to patterns seen in 2013, 2017, and 2021. Such spikes in the ratio occur when Bitcoin’s market price significantly exceeds realized valuation, signaling that the market may be approaching a local peak.

Data from CryptoQuant shows an interesting pattern — 2024 has seen relative stability in the AVIV ratio and TMMP compared to previous years. This suggests that the market is maturing and becoming more efficient, with fewer extreme swings in acquisition costs. Historically, significant fluctuations in the AVIV ratio and TMMP have often followed sharp price movements that preceded bear markets. However, the reduced volatility in the AVIV ratio and TMMP throughout 2024 indicates that investor behavior is becoming more consistent, supporting a more resilient market structure.

While the TMMP’s rise signals long-term investor confidence, the AVIV ratio’s elevated level highlights the short-term risks of a correction. Historically, periods where the AVIV ratio exceeds 2 have been followed by price retracements, as profit-taking pressures weigh on the market. December 2024 mirrors these historical trends, with rising AVIV levels and a significant deviation from TMMP indicating a potential cooling phase ahead. However, relentless institutional interest and the growing derivatives market suggest this cooling phase is unlikely to be long-lived or particularly aggressive.

Investor behavior in 2024 supports this analysis. The consistent increase in TMMP suggests that investors have been accumulating Bitcoin at higher prices, raising the overall market cost basis. At the same time, the AVIV ratio’s late-year spike points to profit-taking activity as the market surged to new highs. This combination of accumulation and realized profits reflects a healthy bull market structure but raises caution for a potential short-term correction.

The post AVIV ratio spikes as Bitcoin reaches new ATH appeared first on CryptoSlate.

Ripple’s upcoming RLUSD stablecoin is attracting bids upto 836 XRP ($2068) on onchain marketplaces ahead of its Tuesday release, a sign of frenzy among enthusiasts who may want to be the first to hold the token.

These bids range from 500 XRP ($1237) to as much as 836 XRP ($2068) as of Asian morning hours on Tuesday, CoinDesk viewed on the Xaman application. Each XRP exchanges hands for just under $2.5, data shows.

“There actually is someone willing to pay $1,200/RLUSD for a tiny fraction of one RLUSD.,” Ripple Labs CTO David Schwartz said in a Monday post. “Tools will show you the highest price anyone is willing to pay, even if it’s just for a tiny bit. Maybe someone wants the “honor” of buying the first bit of RLUSD on the DEX.”

“But rest assured, the price will come back to very close to $1 as soon as supply stabilizes. If it doesn’t, something is very seriously wrong,” Schwartz added.

Speculators often engage in high-priced transactions for small quantities of a new token or NFT to gain early access or to capitalize on the novelty of holding the first batch.

As such, RLUSD might not have enough liquidity to maintain its peg effectively in the first few hours after it goes live, meaning there may be some price discrepancies from the intended $1 peg. However, each token will be redeemed for only a dollar, and it is unlikely to remain depegged for an extended period.

RLUSD will go live on the XRP Ledger (XRP) on Tuesday, as CoinDesk reported, with initial listings on several exchanges and crypto platforms, including Uphold, MoonPay, Archax, and CoinMENA.

MicroStrategy joins the Nasdaq-100 after a 547% stock surge, driven by its bold Bitcoin strategy and entry into the Invesco QQQ Trust ETF, boosting investor interest.

MicroStrategy (MSTR), the world’s largest corporate Bitcoin holder, will officially join the Nasdaq-100 index on December 23, 2024, after achieving an extraordinary 547% stock surge this year. The inclusion also secures its position in the Invesco QQQ Trust ETF (QQQ), a move expected to generate substantial passive investment flows into its stock.

MicroStrategy’s stock, which climbed over 3% in premarket trading, reflects intensified investor interest driven by its aggressive Bitcoin acquisition strategy. The company currently holds 439,000 BTC, acquired at an average price of $61,725 per Bitcoin, amounting to 2% of Bitcoin’s total supply and valued at approximately $44 billion.

The announcement follows a recent disclosure by MicroStrategy’s founder and chairman, Michael Saylor, who revealed on social platform X that the company had purchased an additional 15,350 BTC for $1.5 billion, averaging $100,386 per Bitcoin.

MicroStrategy’s addition to the Nasdaq-100 translates into increased market visibility, improved stock liquidity, and fresh capital inflows from index-tracking funds like the QQQ ETF, which automatically invest in Nasdaq-100 constituents. Financial analysts argue that this milestone strengthens MicroStrategy’s Bitcoin accumulation strategy by creating a “Bitcoin-buying flywheel,” where higher stock demand fuels the company’s ability to expand its crypto holdings.

Analysts note that MicroStrategy’s Bitcoin acquisition strategy is unprecedented, reinforcing its status as the largest corporate Bitcoin holder.

As MicroStrategy joins other prominent tech companies like Palantir Technologies and Axon Enterprise, its inclusion highlights the ongoing convergence of traditional finance and cryptocurrency investment strategies. Analysts predict heightened stock activity, as MicroStrategy becomes a cornerstone asset for both tech-oriented and crypto-focused investors.

With institutional adoption of Bitcoin on the rise and MicroStrategy’s influence growing, its inclusion in the Nasdaq-100 marks a pivotal moment for the broader cryptocurrency landscape.

Discover how Bitcoin-focused companies like MicroStrategy are shaping the future of institutional investments, Check out their blog for more information and Follow us on X to keep up with the latest news in the Cryptocurrency & Blockchain Industry.

Lido staking requests on Polygon are no longer available but users can still withdraw their staked MATIC through the Lido interface on Polygon up until June 16, 2025.

Source link