Phishing attacks were the most costly attack vector for the crypto industry in 2024, netting attackers over $1 billion across 296 incidents.

Phishing attacks were the most costly attack vector for the crypto industry in 2024, netting attackers over $1 billion across 296 incidents.

Source link

The bitcoin (BTC) price may have more than doubled last year, but investors who bought the largest cryptocurrency during 2024 saw, on average, only a fraction of that according to a measure known as the realized price.

The realized price is the average value of all bitcoin calculated at the price at which the tokens last moved on-chain. While that value is around $41,000 for BTC since its inception in 2009, for coins bought last year it was around $65,901 by Dec. 31. With the market price closing around $93,000, 2024’s buyers were, on average, looking at unrealized profit of around 40%.

Monitoring the realized price is important to understanding individual participants’ overall profit or loss and cost basis. It means bitcoin would have to slump some 31% for last year’s investors to return to break-even price levels. The U.S. spot-listed exchange-traded funds (ETFs) debuted on Jan. 11, close enough to the start of the year that this is a good approximation of their cost basis.

There’s another reason to monitor the level. When the bitcoin price dropped below the 2024 realized price, it has tended to mark a local bottom in bitcoin price. That occurred once in January, after the launch of the ETFs, and several times in the middle of the year. Monitoring the cost basis of the 2024 cohort would have been a profitable trading strategy.

As we enter 2025, the average cost basis is around $95,500, which puts the buyer at a slight profit as we start the year. As of press time, bitcoin is trading at over $96,000.

In addition, historically, the realized price offers a great support level for bitcoin in bear markets and rarely trades below it.

Victoria, Seychelles, January 3rd, 2025, Chainwire

Bitget, the leading cryptocurrency exchange and Web3 company, is excited to announce the launch of PHAUSDT futures trading with a maximum leverage of 75x, along with support for futures trading bots. Trading began on December 30, 2024, at 19:50 (UTC+8).

Users can access PHAUSDT futures trading via the official website or the Bitget APP.

PHAUSDT futures allow users to trade the underlying asset PHA, with USDT as the settlement asset. The tick size for trades is 0.00001, and trading offers a maximum leverage of 75x. Funding fees are settled every eight hours, and trading is available 24/7.

Bitget reserves the right to adjust trading parameters, such as tick size, maximum leverage, and maintenance margin rate, depending on market risk conditions.

Bitget offers a variety of futures trading options to suit diverse trading needs:

Bitget futures provide high leverage options, innovative trading tools, and advanced features such as futures trading bots, helping users enhance their trading strategies and maximize their potential.

About Bitget

Established in 2018, Bitget is the world’s leading cryptocurrency exchange and Web3 company. Serving over 45 million users in 150+ countries and regions, the Bitget exchange is committed to helping users trade smarter with its pioneering copy trading feature and other trading solutions, while offering real-time access to Bitcoin price, Ethereum price, and other cryptocurrency prices. Formerly known as BitKeep, Bitget Wallet is a world-class multi-chain crypto wallet that offers an array of comprehensive Web3 solutions and features including wallet functionality, token swap, NFT Marketplace, DApp browser, and more.

Bitget is at the forefront of driving crypto adoption through strategic partnerships, such as its role as the Official Crypto Partner of the World’s Top Football League, LALIGA, in EASTERN, SEA and LATAM markets, as well as a global partner of Turkish National athletes Buse Tosun Çavuşoğlu (Wrestling world champion), Samet Gümüş (Boxing gold medalist) and İlkin Aydın (Volleyball national team), to inspire the global community to embrace the future of cryptocurrency.

For more information, users can visit: Website | Twitter | Telegram | LinkedIn | Discord | Bitget Wallet

For media inquiries, please contact: [email protected]

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to their Terms of Use.

Public Relations

Media

Bitget

[email protected]

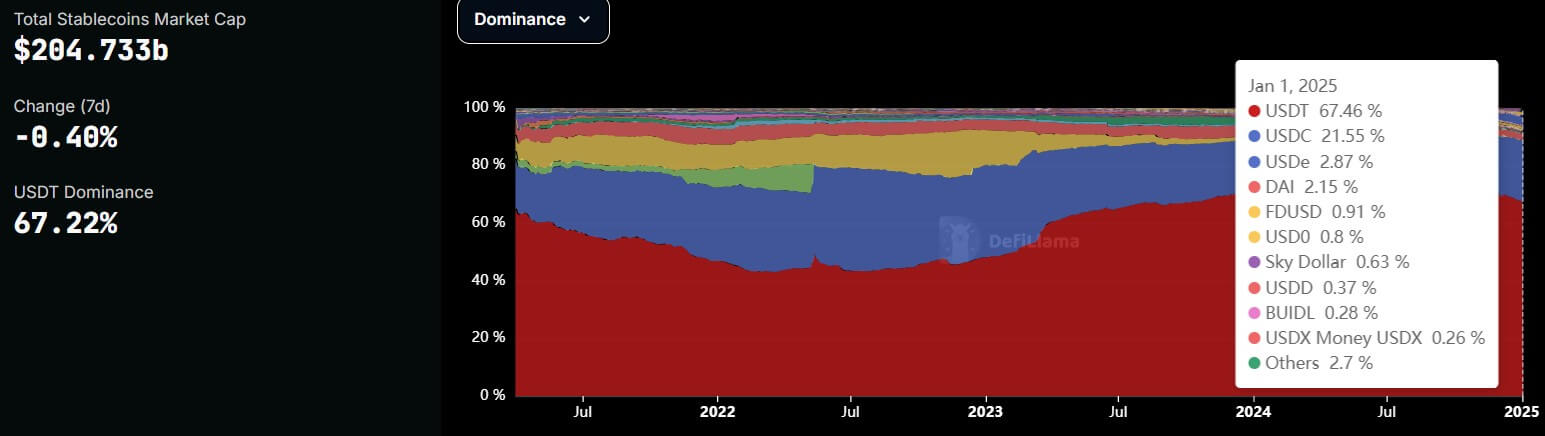

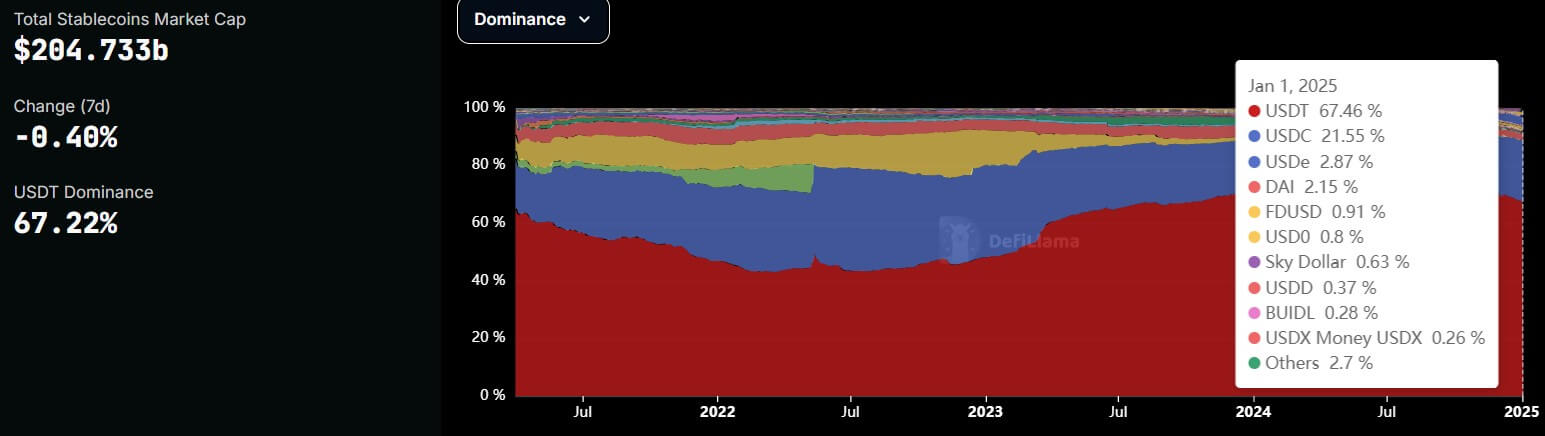

The crypto markets closed 2024 on a shaky note, with fears surrounding Tether (USDT) dominating social media. Many speculate that Tether’s compliance with Europe’s MiCA regulations could trigger a market crash. However, the narrative may be overblown according to Michael Van de Poppe.

Tether, often a target of skepticism, has faced allegations of being a “bubble” or engaging in opaque practices. Despite the criticism, Van de Poppe noted that Tether reported over $5 billion in net profits in the first half of 2024, highlighting its robust financial health. The company claims to be fully backed and over-collateralized, but critics point to its lack of transparency as a persistent issue.

MiCA (Markets in Crypto Assets Regulation) introduces strict rules for stablecoins operating in Europe, emphasizing investor protection and financial stability. While Tether has chosen not to comply with MiCA, it has invested in the euro-pegged stablecoin issuer Stably, which meets regulatory requirements. This move allows Tether to maintain its presence in the U.S. and MENA regions while avoiding European regulatory hurdles.

As exchanges in Europe adapt to MiCA, many have proactively delisted USDT in favor of USDC or euro pairs. While competitors like Circle’s USDC have gained market share, some experts argue that fears about USDT’s future are exaggerated. Analysts suggest that while this transition may cause temporary liquidity issues, a market crash is unlikely. Instead, the fear-driven selling could present buying opportunities for altcoins at discounted prices.

Tether’s CEO, Paolo Ardoino, urged supporters to ignore misinformation, labeling competitors’ claims as baseless. Tether has been preparing for MiCA, even halting its EURT stablecoin to comply with future regulations while investing in other EU operations.

Crypto lawyer Jonathan Galea clarified that not meeting MiCA compliance doesn’t make Tether illegal, but the rules could limit market liquidity if enforced too strictly. Importantly, Tether’s focus on Asia, where most of its trading occurs, means the European market’s impact is limited.

Van de Poppe’s on altcoin predictions for 2025 suggests that the current market negativity presents a unique opportunity to accumulate altcoins at cycle lows. He notes that Bitcoin’s correction and outflows from its ETFs are typical year-end portfolio rebalancing by asset managers, with inflows expected in January.

Ethereum, however, is holding strong against Bitcoin, showing signs of upward momentum, and yet it remains undervalued. Van de Poppe highlights Optimism and SEI as promising altcoins, with potential rebounds early in the year, and emphasizes that XRP’s correction is a natural retracement.

He dismisses the bearish sentiment around Tether as overblown, suggesting the market is primed for a reversal in January, offering a favorable entry point for long-term gains.

As Bitcoin price started the year on a positive note, a flurry of market enthusiasts are eyeing further rallies for the flagship crypto. Top experts even predicted a potential BTC surge to $108K in the coming days as a flurry of market developments hinting towards a potential market rally. So, let’s look at the key support levels that BTC should hold to continue its rally in the coming days.

Bitcoin price has recorded a robust rally this year, especially after Donald Trump’s election win in November. The optimism was further bolstered after Donald Trump pledged to make the US the crypto capital while hinting towards a potential creation of a BTC strategic reserve in the US.

Amid this, top market expert, Ali Martinez said that Bitcoin price is poised to hit $108K in the coming days, boosting market optimism. In a recent X post, he highlighted the technical charts of BTC, indicating a potential BTC price rally to $108K in the coming days.

Meanwhile, the expert noted that if BTC could soar past the $94.7K level, it could target the $97.5K level next. In addition, he also predicted that once the flagship crypto soars past these crucial supports, it could rally to $108K next hitting a new ATH.

However, he also warned that if Bitcoin price fails to maintain the $92,500 support, the bearish sentiment may continue to dominate. It also resonates with some recent warnings from experts. For instance, Peter Brandt has recently warned over a potential Bitcoin crash to $70K.

Bitcoin price noted a significant recovery on the last day of the year, signaling the growing confidence of investors. In addition, the Trump inauguration on January 20 has also fueled sentiment, given the Republican leader’s pro-Bitcoin stance recently.

Meanwhile, in a recent analysis, a prominent crypto market expert Jelle said that Bitcoin is poised to hit $150K in 2025, sparking market optimism. However, pro-XRP lawyer Bill Morgan countered the comments, saying that XRP and HBAR will outperform BTC and other top altcoins.

On the other hand, another top market expert Michael van de Poppe hinted that despite the recent correction concerns, BTC is likely to hit $104K ahead. This showcases the growing market confidence towards the flagship crypto. Also, a recent BTC price analysis hinted at a potential rally to between $150 and $300K in 2025.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

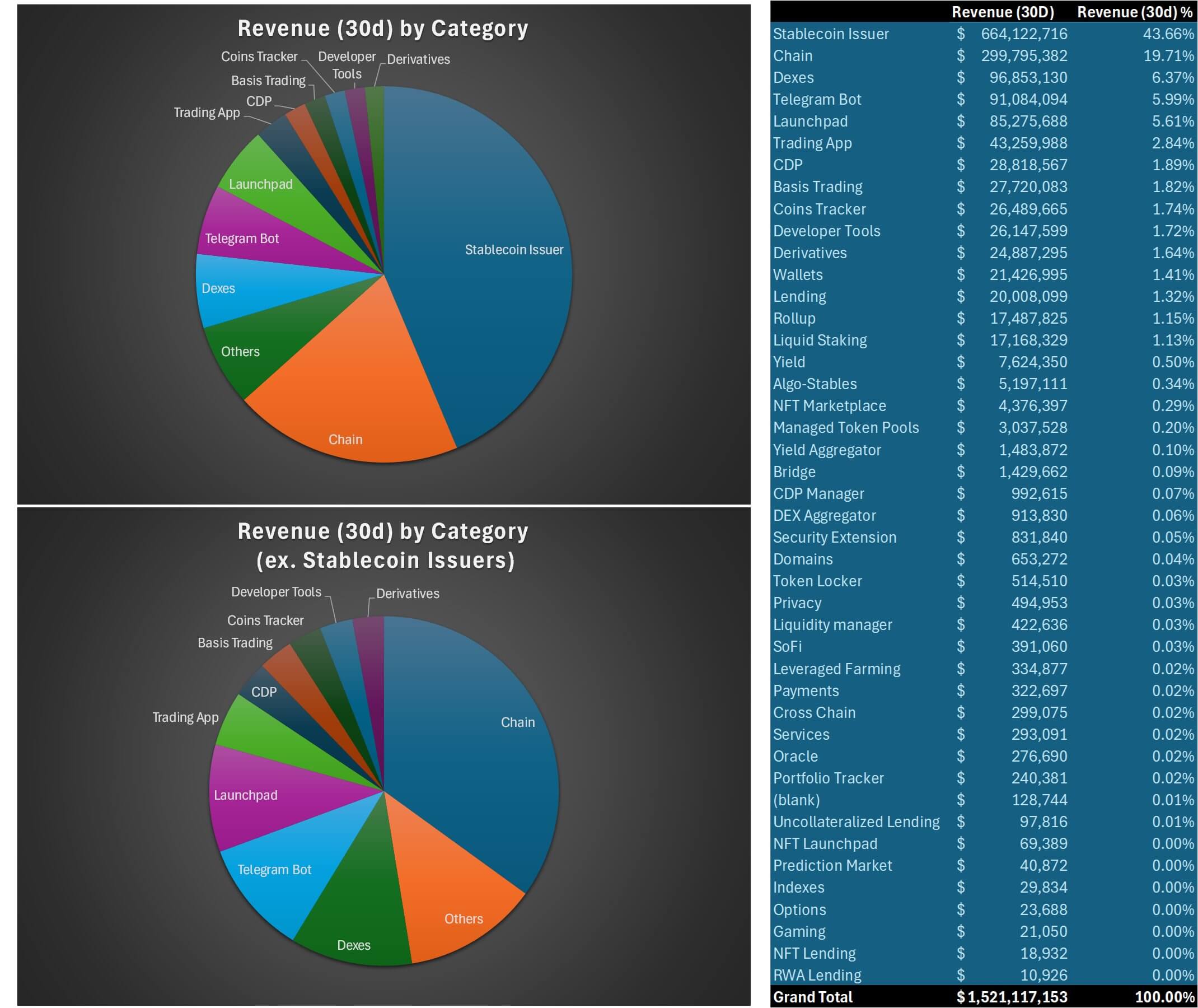

The crypto industry saw significant on-chain revenue in December, with stablecoin issuers taking the lion’s share, according to data from DeFiLlama.

These issuers collectively earned over $664 million, representing over 40% of the $1.5 billion total revenue generated by crypto protocols.

Tether, the USDT stablecoin issuer, emerged as the top contributor, pulling in $532.10 million. Circle, the USDC issuer, followed with $132.77 million.

Together, these two issuers dominate the stablecoin sector, accounting for nearly 90% of the market, which is valued at over $200 billion.

Stablecoins continue solidifying their role as one of the most practical crypto products. Their price stability shields users from the volatility typical in other digital assets, making them a preferred choice for traders and a gateway to the US dollar in emerging markets.

Market predictions suggest that the stablecoin market could grow to $400 billion by 2025, presenting substantial profit opportunities that have attracted new entrants like Ripple and BitGo.

Cryptocurrency broker FalconX has acquired derivatives startup Arbelos Markets to enhance its trading and risk management solutions. Notably, the deal aims to strengthen FalconX’s position in institutional crypto finance.

In a January 2 post on X, Raghu Yarlagadda, CEO at FalconX Network confirmed the latest acquisition and welcomed the Arbelos team aboard the FalconX platform. Then, the firm’s CEO highlighted FalconX’s aim of acquiring Arbelos Markets.

“By combining Arbelos’s world-class systematic trading capabilities with FalconX’s balance sheet, regulatory readiness, and broad client base, we’re now uniquely positioned to create greater value for our institutional clients and the ecosystem,” said Yarlagadda in the post.

For context, the acquisition expands FalconX’s derivatives offerings, catering to institutional investors seeking advanced trading tools. It also bolsters FalconX’s capabilities in liquidity management and risk control within the evolving digital asset market. Furthermore, this aligns with its long-term strategy to deliver sophisticated products for institutional clients.

Arbelos Markets specialized in crypto derivatives and structured financial products, which provided hedging tools for digital asset portfolios. FalconX plans to integrate these capabilities to meet the rising demand for regulated crypto investment options.

“This isn’t just about scaling FalconX—it’s about building the foundation for the next phase of crypto market growth. A healthy, transparent derivatives market is key to long-term institutional confidence,” said the FalconX CEO

So Arbelos’s expertise complements FalconX’s infrastructure, enabling optimized service delivery and tailored risk management solutions.

Meanwhile, the acquisition positions FalconX to capitalize on global trends favoring regulated derivatives markets. Analysts expect the combined platforms to attract hedge funds and asset managers seeking compliance-focused crypto trading strategies.

The deal highlights the growing institutional adoption of cryptocurrencies and derivatives amid regulatory developments. FalconX aims to set new standards in compliance and transparency through this integration.

Source link

Programmable blockchain Cardano’s ADA token jumped 12% in the past 24 hours to lead gains among crypto majors, with rangebound trading in bitcoin (BTC) influencing the broader market.

ADA crossed $1, a three-week high, as BTC, ether (ETH), Solana’s SOL and dogecoin (DOGE) added under 2%. The broad-based CoinDesk 20 (CD20), a liquid index tracking the largest tokens by market cap, rose 1.57%.

Traders expect bitcoin price-action to remain rangebound until late January, with gains expected from February onward as President-elect Donald Trump takes office, as a CoinDesk analysis previously noted.

ADA’s bump came on no immediate catalyst, but the protocol is set to see several fundamental developments in the coming months. These include a bitcoin-centric decentralized financial ecosystem and ongoing efforts to improve Cardano’s scalability, network performance and interoperability with other networks.

Price-chart analysis suggests further gains of as much as 30% for the token ahead.

“ADA’s three-day rise has lifted prices above a trendline characterizing the four-week pullback from early December highs,” CoinDesk analyst Omkar Godbole said. “The breakout and a renewed bullish crossover on the momentum indicator MACD suggest the potential for a re-test of the Dec. 3 high of $1.32.”

“The widely-tracked 14-day RSI is looking to cut through a descending trendline, validating the bullish price action,” Godbole added.

In technical analysis, MACD (Moving Average Convergence Divergence) indicates momentum using average prices over a period, with a bullish crossover meaning a potential price increase. RSI (Relative Strength Index) measures the speed and change of price movements; and cutting through a trendline suggests continued upward movement.