Source link

Bitwise CEO Discusses ‘Non-Obvious’ Tokenization Revolution – Crypto News Bitcoin News

Dutch Regulator AFM Awards EU MiCA License to 4 Companies

Four digital assets companies have just secured Markets in Crypto Assets (MiCA) licenses in the Netherlands, letting them operate across the entire 27-nation European Union.

Crypto platform MoonPay, digital asset management company BitStaete, bitcoin lightning FinTech ZBD and prime brokerage and clearing company Hidden Road attained the much desired crypto asset service providers license from the Dutch Authority for the Financial Markets (AFM), a filing from Dec. 30 showed.

MiCA is a bespoke rulebook for crypto companies that requires firms to receive a Crypto Asset Service Provider (CASP) license from one member state which then enables them to operate across the entire European Union.

The European Union set a Dec. 30 deadline for its member states to implement MiCA, though not all countries have managed to.

“MiCA represents a pivotal moment for the European digital asset industry, and we’re proud to have worked collaboratively with the Dutch AFM to be among the first to embrace this new regulatory framework,” said Ivan Soto-Wright, CEO and co-founder of MoonPay, in a statement.

Fan engagement platform Socios.com secured authorization from the Malta Financial Services Authority (MFSA), it said in a statement on Monday. The approval is for a class 3 Virtual Financial Assets Act (VFAA) license that will enable it to operate as a regulated Virtual Financial Asset service provider.

Meanwhile, the U.K., which is closely following after the EU in its approach to crypto, added crypto trading firm GSR Markets to its crypto register at the end of 2024.

Pixelport Launches Testnet for Cross-Chain NFT Trading and Fractionalization – Crypto-News.net

Pixelport, an NFT-focused platform, has launched its incentivized testnet, enabling developers, creators, and early adopters to test cross-chain NFT trading and fractionalization capabilities. The launch, powered by Analog’s Generic Message Passing (GMP) protocol, aims to simplify the creation, management, and transfer of NFTs across multiple blockchains.

The platform’s testnet went live on December 30, 2024, providing tools and incentives for participants to explore its features. Pixelport integrates cross-chain compatibility, fractional ownership, and secure transfers to address liquidity challenges in the NFT market.

Key Features of Pixelport

Pixelport leverages Analog’s GMP protocol to enable seamless NFT interoperability. Developers can access a turnkey software development kit (SDK) and application programming interface (API) to create cross-chain NFT collections and fractionalize assets for increased liquidity. These features extend NFTs’ use cases beyond digital art, targeting sectors such as real estate, gaming, and decentralized governance.

According to Pixelport, the platform also supports bridging NFTs between blockchains, making assets more accessible and transferable.

Incentivized Quests and Rewards Program

The testnet launch includes an incentives program with tasks designed to encourage user engagement. Participants can earn Pixel Points (PP) by completing quests, including:

- Multi-Chain Collections: Deploy NFT collections across multiple blockchains like Ethereum and Binance. (Reward: 150 PP)

- Bridge NFTs Between Chains: Transfer NFTs between supported blockchains. (Reward: 100 PP)

- Deploy Additional Collections: Expand existing collections to other chains like Arbitrum. (Reward: 100 PP)

- Mint New NFTs: Create and mint NFTs on supported networks. (Reward: 100 PP)

Collaborative quests with partners such as Analog, Rarible, and Pudgy offer additional rewards, including exclusive incentives and early access features.

Market Context and Future Prospects

The NFT market is expected to reach $13.6 billion by 2027, driven by growing demand for interoperability and fractional ownership. Pixelport’s approach aligns with these trends, addressing fragmentation and improving liquidity.

Early adopters participating in the testnet could also qualify for a future Pixelport airdrop allocation and Analog Testnet Points (ATP). Staking Pixelport NFTs will provide ANLOG token rewards, enhancing long-term value for participants.

About Pixelport

Pixelport is a super app focused on enabling cross-chain NFT functionality, including minting, fractionalization, and transfers. The platform aims to simplify NFT trading and improve accessibility, security, and liquidity across multiple blockchains.

MiCA can attract more crypto investment despite overregulation concerns

European retail investors will likely feel the biggest effect of the MiCA regulations through more stringent data collection and the potential introduction of crypto taxation laws.

Digital Sovereignty Alliance Launches to Champion Ethical Crypto Policies in the U.S. Senate and House of Representatives – Press release Bitcoin News

Source link

Bitcoin miners to soar in 2025 amid AI hosting and BTC yield strategies – Clear Street

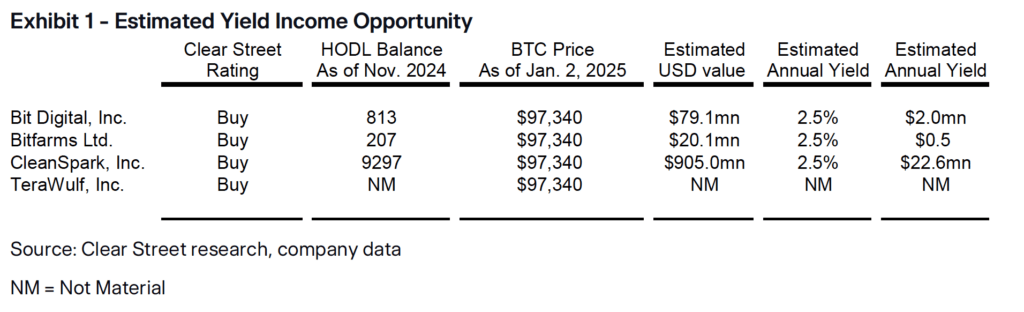

According to a recent Clear Street report, Bitcoin miners are pursuing yield strategies for their BTC holdings and diversifying into AI compute.

The report, titled ‘BTC Mining: 2025’s Key Themes Emerge,‘ outlines three themes for 2025: generating revenue on bitcoin reserves, leveraging existing infrastructure for HPC initiatives, and benefiting from a shift in US regulatory leadership.

Bitcoin yield and spot ETF upgrades

Clear Street’s authors indicate that several miner management teams are investigating ways to create income from stored BTC, with securities lending described as a potentially viable approach pending regulatory adjustments. The report states that a new SEC stance could permit in-kind creation of BTC exchange-traded fund shares, allowing miners to exchange bitcoin directly for ETF units and subsequently partner with prime brokers on share lending income. Low-to-mid single-digit yields are noted for general collateral securities, while higher rates may apply if ETF shares become harder to borrow.

Clear Street adds that legal changes would place BTC securities lending on par with broader lending practices, prompting sector participants to focus on operational details. Per the analysis, CleanSpark holds a notable HODL balance and could earn millions of dollars in annual interest once strategies scale. Bit Digital, Bitfarms, and TeraWulf are cited with varied holdings or approaches, including staking programs or not retaining Bitcoin at all, depending on corporate policy. Clear Street projects that such yield mechanisms could unlock additional revenue streams and help miners optimize large-scale operations that might otherwise be idle.

HPC compute and AI diversification

The report also highlights a growing pivot toward HPC compute, with miners repurposing data centers, power sources, and advanced equipment to serve AI-driven workloads. The authors see a path for companies to diversify earnings beyond mining. Bit Digital is said to be transitioning into a data center enterprise via acquisitions in Montreal, aiming to host HPC clients for stable fees and potential upside. TeraWulf is noted for a new HPC agreement that could expand to over 100 MW of capacity, targeting demand for complex AI research needs. Clear Street’s figures show that HPC services can generate appealing per-megawatt revenues, with margin ranges depending on data center configuration and contract size.

According to the report, political shifts may also bolster the industry’s outlook. President Trump’s administration is portrayed as friendlier to Bitcoin interests due to potential changes at the SEC and Department of Energy and more open views on BTC products. Trump’s nominee for SEC chair, Paul Atkins, has past involvement in digital asset initiatives, and the proposed Treasury Secretary, Scott Bessent, is seen as more receptive to crypto than previous leadership.

However, the research warns that cuts in federal spending or energy policy changes could introduce uncertainties, particularly if renewable energy credits are modified. Clear Street also notes the possibility that diminished government outlays might reduce inflationary pressures some investors see as beneficial for Bitcoin.

The analysis highlights several companies as top picks based on valuations, expansion potential, and current HPC roadmaps.

Clear Street recommendations for Bitcoin miners

Bit Digital (BTBT) is labeled a Buy due to its shift from an asset-light mining model toward HPC revenue, with management citing a pipeline of potential data center tenants. CleanSpark (CLSK) is presented as a favorite pure-play miner, supported by best-in-class energy strategies and a pipeline for growth through 2027. TeraWulf (WULF) has a larger multiple relative to others but aims to justify it with new HPC deals and improved mining metrics. Bitfarms (BITF), regarded as a BTC mining specialist, reportedly has stable energy contracts and is poised for a potential HPC foray in late 2025 or early 2026.

Per Clear Street, these projections rest on each firm’s capacity to scale data center operations, secure or renew power agreements, and navigate final regulatory steps for securities lending. The authors emphasize that clarity from the SEC on in-kind BTC ETF share creation will be pivotal for unlocking yield on HODL balances.

Their projections point to stronger revenue for participating miners as new practices mature and capital inflows expand from institutional partners seeking additional exposure to digital assets. Bitfarms, Bit Digital, CleanSpark, and TeraWulf remain in focus based on Clear Street’s current forecasts.

Mentioned in this article

Spirit Blockchain Capital Ventures into Dogecoin Yield Strategy Amid Growing Meme Coin Adoption – Crypto-News.net

Discover how Spirit Blockchain Capital is leveraging Dogecoin for yield generation, marking a bold move in digital asset strategy and treasury optimization.

Spirit Blockchain’s Strategic Move

Spirit Blockchain Capital Inc., a Canadian Securities Exchange (CSE)-listed company trading under the ticker SPIR, has announced a strategic initiative to generate returns on its dogecoin (DOGE) holdings. This announcement comes just over a month after Spirit acquired Dogecoin Portfolio Holdings Corp. in November 2024.

The initiative aims to optimize Spirit’s treasury by leveraging DOGE for yield generation, marking a significant step in the company’s approach to maximizing digital asset utility. As of December 1, 2024, Spirit increased its exposure to DOGE as part of its broader digital asset strategy.

Enhancing Treasury and Shareholder Value

According to Spirit Blockchain’s CEO, Lewis Bateman, the move is an effort to position the company as a leader in yield generation within the meme coin and broader digital asset sector.

By activating a yield-generation strategy with Dogecoin, we aim to unlock a previously untapped revenue stream while simultaneously positioning ourselves as a market leader, Bateman said.

The firm’s commitment to adapting and innovating in the rapidly evolving cryptocurrency market underscores its ambition to capitalize on emerging opportunities. This strategic approach is expected to benefit the company and its shareholders while setting a precedent for utilizing meme coins like DOGE in financial strategies.

Spirit Blockchain’s Vision

Spirit Blockchain provides a wide array of services, including capital funding, advisory and research expertise, and digital asset treasury management. With its recent acquisition of Dogecoin Portfolio Holdings Corp., Spirit has strengthened its presence in the meme coin space and expanded its digital asset offerings.

This latest initiative reflects Spirit’s broader vision of integrating meme coins into mainstream digital asset strategies. While the move involves inherent risks given DOGE’s price volatility, it could offer significant returns as the meme coin ecosystem matures.

Industry Implications and Risks

Spirit Blockchain’s strategy highlights the evolving role of meme coins in the digital asset sector. DOGE’s popularity has grown beyond its origins, attracting attention from institutions willing to explore its potential for revenue generation. However, the inherent volatility of meme coins raises questions about the long-term viability of such strategies.

Skeptics argue that relying on a meme coin for treasury yield could expose Spirit to significant risks. However, early adoption in uncharted territories often rewards pioneers. Spirit’s willingness to innovate could position the company ahead of competitors, particularly as the market for meme coins stabilizes.

A Call for Innovation in Digital Assets

Spirit Blockchain’s bold move serves as an example of how traditional institutions are experimenting with digital assets to unlock new revenue streams. This approach could inspire similar initiatives across the industry, especially as blockchain technology and digital currencies continue to evolve.

Stay informed about the latest developments in digital asset strategies. Follow Spirit Blockchain’s journey and explore how innovative approaches are shaping the future of cryptocurrency.

What to Expect From Bitcoin, PEPETO, and ETH in 2025

The cryptocurrency market continues to shape up as some tokens are rallying for the next bull run. With the crypto community already versed with assets like BTC and ETH, altcoins like PEPETO are springing up as they continue to grab investors’ attention with their price growth potential.

Although this doesn’t mean Bitcoin and Ethereum would take a huge dump next year, the market volatility and economic conditions only indicate some emerging projects like PEPETO would thrive better and un-seat names like PEPE and DOGE.

In this article, we will look at clear indications and signals about what to expect from Bitcoin, Pepeto, and Ethereum in the market and how investors can boost their portfolios with these assets.

Why Do Bitcoin, PEPETO, and Ethereum Stand Out From Other Altcoins in the Market?

Compared to other crypto assets and emerging tokens in the market, BTC, PEPETO, and ETH have been considered tokens that can turn pennies into life-changing returns. Here is what to expect from them.

PEPETO, the God of Frogs

PEPETO is an emerging meem-coin that builds upon loopholes ignored by major assets in the crypto world. Compared to other tokens, PEPETO offers a zero transaction fee on all its bridges, allowing assets to move seamlessly using its lock-and-mint mechanism.

For its token presale, PEPETO is allocated 30% of its total supply, ensuring enough liquidity and participation to jumpstart the project.

To further boost its long-term price trajectory, 2.5% will be reserved to maintain healthy liquidity across exchanges, ensuring smooth trading and stability More plans by the pepeto team can also be found below:

Likewise, holders of PEPETO can stake their tokens and earn rewards, incentivizing long-term participation and supporting the stability of the ecosystem. To enjoy these benefits and more, head on over to the Pepeto site to buy the token.

The Supremacy of Bitcoin

Bitcoin has been one of the dominating forces in the market, continuing to make holders and new investors massive gains when they bet on it.

After reaching an all-time high this year, crypto analysts are positive that its widespread institutional adoption, determined by macroeconomic trends and DeFi integrations, would be a major booster for the 2025 bull run.

Bitcoin halving this year is also a major contributor to its scarcity, as most whales, who are top holders, are holding onto what they’ve got and even buying more irrespective of market downturns, further resulting in an increase in price come 2025.

Smart Contracts Domination by Ethereum

Just like Bitcoin, Ethereum is a major player in various decentralized applications and smart contract blockchain projects.

With a market cap of over $400 billion, its recent network transition to Ethereum 2.0 has been creating a buzz among community cabals, who predict reduced energy consumption and increased scalability for 2025.

Although its high transaction fees and volatility might be a major deterrent for small-scale investors who can’t afford high gas fees as they make transactions.

PEPETO: A perfect alternative memecoin to invest in

For investors looking for the perfect altcoin to invest in, PEPETO offers a fresh and promising alternative, as Bitcoin and Ethereum are already proven crypto assets that dominate the crypto market.

PEPETO is also considering small-scale investors, offering them a chance to invest with any amount they’d like instead of the enormous price Bitcoin and Ethereum are selling at.

Whether you’re a seasoned crypto enthusiast or a newbie, the best time to invest in PEPETO was yesterday, as monitoring its token could yield significant rewards by 2025.

ABOUT PEPETO

Pepeto is a cutting-edge cryptocurrency project blending the playful spirit of memecoins with a powerful utility-driven ecosystem. It features a zero-fee exchange, a cross-chain bridge for seamless swaps, and staking rewards designed to support the next generation of tokens.

Media Links:

Contact Information:

Contact: TokenWire Team

Email: [email protected]

MEXC Embarks on a New Chapter: Redefining “Your Easiest Way to Crypto” – Press release Bitcoin News

Source link

Bitcoin Miner MARA Holdings Is Lending 7,377 BTC to Help Offset Costs

MARA Holdings (MARA), the largest bitcoin (BTC) miner by market capitalization, said it is lending 7,377 BTC to third parties to generate a return on its holdings and cover some operating costs.

In a production report released Friday, MARA did not identify the borrowers nor reveal other details regarding the program, which ties up about 16% of its bitcoin. Robert Samuels, the company’s vice president of investor relations, said in a post on X that it is earning a yield of less than 10%.

“There has been significant interest in MARA’s bitcoin lending program,” Samuels posted. “It focuses on short-term arrangements with well-established third parties. It generates a modest single-digit yield. It has been active throughout 2024. The long-term objective is to generate sufficient yield to offset operating expenses”.

The company produced 890 bitcoin last month, 2% fewer than in November, the production report shows. Still, it’s the second-biggest number of BTC since April’s reward halving.

“We mined 249 blocks, the second most blocks in a month on record,” Chairman and CEO Fred Thiel said in the report. “MARAPool achieved an impressive annual hash rate growth of 168% in 2024, exceeding bitcoin’s network growth rate of 49%”.

For all of 2024, MARA acquired 22,065 BTC at an average price of $87,205 and mined an additional 9,457 BTC taking its total held to 44,893 BTC. Bitcoin is currently trading just below $100,000. The company is the second-biggest publicly traded owner of bitcoin, trailing only MicroStrategy (MSTR).

MARA shares rose 2.60% in pre-market trading and have 14% since the start of the year.