Source link

Ethereum Technical Analysis: ETH Faces Persistent Downtrend Despite Strong Market Activity – Markets and Prices Bitcoin News

Kamala Harris Pulls Well Ahead of Trump on Polymarket

“Yes” shares for Harris were trading at 52 cents on the crypto-based betting platform Monday during U.S. morning hours, meaning the market sees a 52% chance she will win the presidency. Each share pays out $1 in USDC, a stablecoin, or cryptocurrency that trades at par with the U.S. dollar, if the prediction comes true, and zero if not. Trump shares were changing hands at 45 cents.

Lido community votes to bring stETH to Binance BNB Chain

Lido Finance is the market leader in Ethereum staking, claiming 28.2% of net ETH deposits.

Breaking: Marathon Digital To Buy Bitcoin From $250M In Convertible Notes

Marathon Digital has announced plans to offer $250 million aggregate amount worth of convertible senior notes. The company intends to use the new raise to fund more Bitcoin (BTC) acquisition plans and general corporate purposes. This year, firms continue to add Bitcoin to their balance sheet for several reasons.

Marathon Digital To Offer $250M Convertible Notes

Marathon Digital disclosed plans to offer $250 million $250 million in senior convertible notes based on market conditions. The notes which will be offered to qualified institutional buyers will become due in 2031. This will fund the company’s Bitcoin acquisition plans as multiple firms continue to purchase the asset amid increased demand this year.

“MARA intends to use the net proceeds from the sale of the notes to acquire additional bitcoin and for general corporate purposes, which may include working capital, strategic acquisitions, expansion of existing assets, and repayment of debt and other outstanding obligations. The notes will be offered and sold to persons reasonably believed to be qualified institutional buyers under Rule 144A under the Securities Act.”

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

How different Bitcoin Fear & Greed indexes calculate market sentiment

As provided by several different platforms, the Fear and Greed (F&G) indexes for Bitcoin offer varied methodologies and insights into market sentiment. Each platform employs unique metrics to gauge investor sentiment, resulting in different scores and interpretations of the market’s mood.

Alternative.me is one of the most popular F&G indexes designed explicitly for Bitcoin. It considers factors such as volatility, market momentum/volume, social media sentiment, dominance, and trends. The index is updated daily and scores 0 to 100, indicating fear or greed in the market. The data sources include volatility (25%), market momentum/volume (25%), social media (15%), surveys (15%), and dominance (10%) of Bitcoin.

CoinStats also measures market sentiment based on similar factors like volatility, social media, and market momentum. However, it includes surveys as part of its analysis, contributing to the index’s result. This index is updated every 8 hours and considers volatility (25%), momentum/volume (25%), social media (15%), surveys (15%), Bitcoin dominance (10%), and Google Trends (10%).

CFGI.io offers a more comprehensive analysis by considering additional factors such as whale movements and order book analysis. It provides updates more frequently, every 15 minutes, and includes multiple temporalities for analysis. CFGI uses modules to analyze influential variables, including volume, volatility, dominance, whale movements, search engine data, and order book analysis. This multifactorial approach allows for a detailed understanding of market sentiment.

Binance also provides its own versions of the Fear and Greed Index, focusing on similar metrics to gauge investor sentiment. It calculates the index using various sources and provides historical data to track changes over time. Binance’s index is typically updated daily and considers factors similar to other indexes, such as volatility and market momentum.

As of the latest updates, Alternative.me’s index showed a score indicating “Extreme Fear” in the market, reflecting a bearish sentiment among investors. CoinStats also reported an “Extreme Fear” score, suggesting a more cautious market sentiment. CFGI.io’s index provides a dynamic view of market sentiment, with recent scores indicating a neutral sentiment. These variations highlight the differences in methodologies and the importance of considering multiple sources for a comprehensive view of market sentiment.

As of press time, Bitcoin has risen 2.2% over the past 90 minutes, while multiple indicators show the market in extreme fear. However, Bitcoin has also fallen around 3.4% over the past 24 hours.

Mentioned in this article

XRP surges after Ripple ‘victory,’ Trump Jr. crypto platform plans, and more: Hodler’s Digest, Aug. 4-10

XRP surged 26% after Ripple scores a ‘victory,’ Donald Trump Jr. reveals plans to launch crypto platform: Hodler’s Digest

XRP Bullish Options' Popularity Jump May Be Due to ETF Speculation, Observers Say

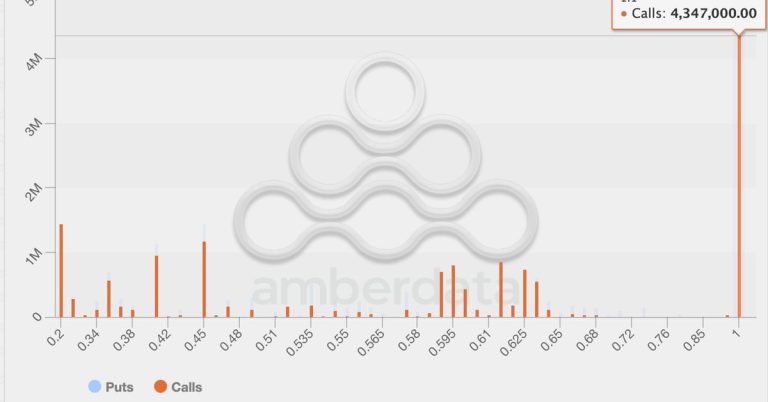

As of writing, XRP’s $1.10 call option, set to expire on Aug. 28, had an open interest of 4,347,000 contracts valued at $2.44 million, making it the most favored among all available XRP options on the exchange, according to data tracked by Amberdata. The amount is significant for an options market that is barely five months old.