Ethereum and DeFi will “both surge in the coming months” according to analyst Michaël van de Poppe: X Hall of Flame

Ethereum and DeFi will “both surge in the coming months” according to analyst Michaël van de Poppe: X Hall of Flame

Coinbase has announced the expansion of its services to Hawaii, granting residents access to a broad range of digital asset management options.

This comes on the heels of significant regulatory changes by Hawaii’s Department of Commerce and Consumer Affairs Division of Financial Institutions (DFI), which have opened new avenues for cryptocurrency businesses in the state.

For years, Hawaii’s stringent regulations have made it difficult for crypto exchanges to operate within its borders.

A particularly challenging requirement was the mandate for exchanges to maintain cash reserves equal to the value of digital assets held by customers, effectively deterring many businesses from entering the Hawaiian market.

However, recent adjustments, as part of the Hawaii Digital Currency Innovation Lab pilot program, have relaxed these restrictions, allowing companies like Coinbase to establish a foothold in the state.

With this regulatory easing, Hawaiian residents can now use Coinbase’s platform and mobile app to engage in the buying, selling, and management of cryptocurrencies.

In addition to these services, users can participate in crypto staking, earning up to 12% annual percentage yield (APY) on select digital assets.

This marks a significant shift for Hawaii, where the interest in cryptocurrencies has been growing, yet opportunities were previously limited due to the state’s tough regulations.

For Coinbase, its entry into Hawaii not only expands its user base but also highlights the state’s commitment to fostering innovation in the digital currency space even as the exchange battles with the US SEC concerning the disclosure of documents related to the application of securities laws to digital assets.

Share this article

Grayscale Investments, the leading asset manager, has expanded its portfolio with two new funds, the Grayscale Bittensor Trust and the Grayscale Sui Trust, said the company in a Wednesday press release. Bittensor Trust invests in TAO, a token for AI development, while Sui Trust focuses on SUI, a token for a high-performance blockchain.

“We are excited to add Bittensor and Sui to our product suite, and believe Bittensor is at the center of the growth of decentralized AI, while Sui is redefining the smart contract blockchain,” said Rayhaneh Sharif-Askary, Head of Product and Research at Grayscale.

The new trusts operate similarly to Grayscale’s existing single-asset investment trusts. Grayscale also offers trusts tied to various crypto assets like Solana, Stellar, Chainlink, and Litecoin. The firm just launched new funds that invest in Near and Stacks in May.

With these new offerings, Grayscale aims to meet growing investor demand for diversified crypto exposure. The trusts are among the first investment products focused solely on TAO and SUI.

“With the launch of Grayscale Bittensor Trust and Grayscale Sui Trust, we continue to provide investors with familiar products that enable access to tokens at the cutting edge of the crypto ecosystem’s continued evolution,” Sharif-Askary added.

At press time, Grayscale Bittensor Trust shares are trading at $5.15, and Grayscale Sui Trust shares are trading at $8.97. Both trusts are open to subscription by accredited investors and charge a 2% management fee.

Share this article

Celsius Network Ltd. has filed a lawsuit against Tether and its affiliated entities. The lawsuit alleges that the USDT issued conducted “fraudulent” and “preferential” transfers of Bitcoin (BTC) amounting to over $3.5 billion today. The complaint, lodged in federal bankruptcy court, seeks to reclaim the collapsed estate’s lost Bitcoin due to the USDT issuer’s actions during a critical period leading up to the firm’s bankruptcy. Despite the lawsuit, Tether CEO Paolo Ardoino has refuted the fraud claims and noted the fight will be underway calling it a “shake down.”

Celsius Network, a prominent crypto lender, entered into a loan agreement with Tether Ltd. in 2020. This arrangement allowed the lender to borrow stablecoins, specifically USDT and Euro Tether (EURT), at low-interest rates. In return, the crypto lender posted substantial collateral, including Bitcoin, to secure these loans.

At its peak, the firm had borrowed nearly $2 billion in USDT, backed by tens of thousands of BTC. The lawsuit focuses on actions taken by the USDT issuer during the ninety-day period before the crypto lender filed for bankruptcy on July 13, 2022.

According to the complaint, the USDT issuer demanded and received significant amounts of new collateral from the crypto lender. This totaled 15,658.21 Bitcoin, and further secured new borrowings with an additional 2,228.01 BTC. These actions, characterized as “Preferential Top-Up Transfers” and “Preferential Cross-Collateralization Transfers,” are claimed to have unfairly improved the stablecoin company’s position at the expense of other creditors.

On June 13, 2022, the stablecoin firm issued a final demand for additional collateral. The crypto lender, in accordance with their agreement, had 10 hours to respond. However, stablecoin issuer proceeded to apply the entirety of Celsius Network’s collateral, i.e., 39,542.42 BTC immediately, without granting the contractually stipulated time.

This action, referred to as the “Preferential Application Transfer,” allegedly allowed Tether to cover its exposure. However, the bankrupt crypto lender was “robbed” of its remaining BTC at a low market value.

Moreover, the lawsuit argues that the stablecoin firm’s breach of the contract’s 10-hour waiting period resulted in a “fire sale” of the now-bankrupt estate’s Bitcoin, with all 39,542.42 BTC applied against Celsius Network’s outstanding debt. Tether’s valuation of BTC at $816.82 million is significantly less than its current worth of more than $2 billion.

This caused substantial financial damage to the crypto lender. The court filing dated August 9 states that the stablecoin firm sold this Bitcoin at an average price of $20,656.88 each, notably below the market closing BTC price of $22,487.39 on that date.

The lawsuit also contends that the USDT issuer’s liquidation of Celsius’ Bitcoin was commercially unreasonable. In addition, the complaint highlights that established market practices dictate that such a large block of BTC should be sold over a longer period to minimize price impact and secure better pricing.

Hence, the stablecoin organization’s actions allegedly violated these practices by selling the BTC hastily and at prices lower than the actual market rates. Furthermore, the premature liquidation barred Celsius Network from withstanding the market crash. It also eliminated the chance for the automatic stay of bankruptcy to intervene.

Hence, the lawsuit seek “recover” the preferential and fraudulent transfers of Bitcoin. In addition, the crypto lender wants to claim damages for the alleged breach of contract. Thus, the bankrupt estate is demanding that the court order Tether to return the value of the BTC or its equivalent amount in damages.

Tether and its CEO Paulo Ardoino responded to the lawsuit via a public statement. In a post on X, the stablecoin issuer affirmed its commitment defend itself against Celsius Network’s lawsuit. Ardoino refuted the crypto lender’s claims by stating:

“In June 2022, when Bitcoin’s price declined, Celsius instructed Tether to sell the Bitcoin that Tether held as collateral. Tether was able to liquidate those Bitcoin and return the excess to Celsius (and disclosed transparently the action at that time.”

Consequently, Ardoino claimed that the lawsuit by Celsius Network was “baseless” and noted the firm was willing to seek a court redress. Meanwhile, the crypto lender is adamant on recovering 57,398.64 BTC worth over $3.5 billion from the stablecoin issuer.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Crypto interests are planning to go after Sen. Sherrod Brown (D-Ohio) in their biggest-ever single campaign, setting aside $12 million to support the Republican candidate seeking to snatch the Senate seat from the current chairman of the Senate Banking Committee, who has been highly critical of the digital assets sector and reluctant to embrace crypto legislation.

Bitcoin (BTC), the world’s biggest cryptocurrency by market capitalization looks bearish and may crash once again. Today, on August 13, 2024, a prominent trader made a post on X (previously Twitter) that Bitcoin Whales have offloaded a significant Bitcoin as its price fell below $60,000.

According to the post on X, these whales have offloaded a significant over 10,000 BTC worth approximately $600 million to the exchanges, including both centralized (CEXs) and decentralized (DEXs), in the past week. This post on X has gained massive attention as it has the potential to impact the BTC price.

After a 15% price rally in BTC, it has been continuously falling and has experienced a decline of over 4% in the last three days. The potential reason behind this significant BTC dump is the recent market crash on August 5, 2024, and the investors’ interest in BTC as its price continues to drop.

According to expert technical analysis, Bitcoin (BTC) looks bearish as it is moving below the 200 Exponential Moving Average (EMA) on a daily time frame. In addition to the 200 EMA, a strong bearish candle below the resistance level of $60,000 further strengthens the bearish outlook for BTC.

If the sentiment remains unchanged, there is a high possibility that it could crash another 12% to the $52,700 level in the coming days. However, for an upside rally, BTC needs to give a strong daily candle-closing above the $62,000 level.

At press time, BTC is trading near $59,120 and has experienced a price decline of over 1.7% in the last 24 hours. Meanwhile, its trading volume has decreased by 22% during the same period, indicating lower participation from traders and investors.

Additionally, BTC’s open interest has also fallen and in the last 24 hours, it has dropped by 1.5%, according to data from the on-chain analytic firm CoinGlass.

Source link

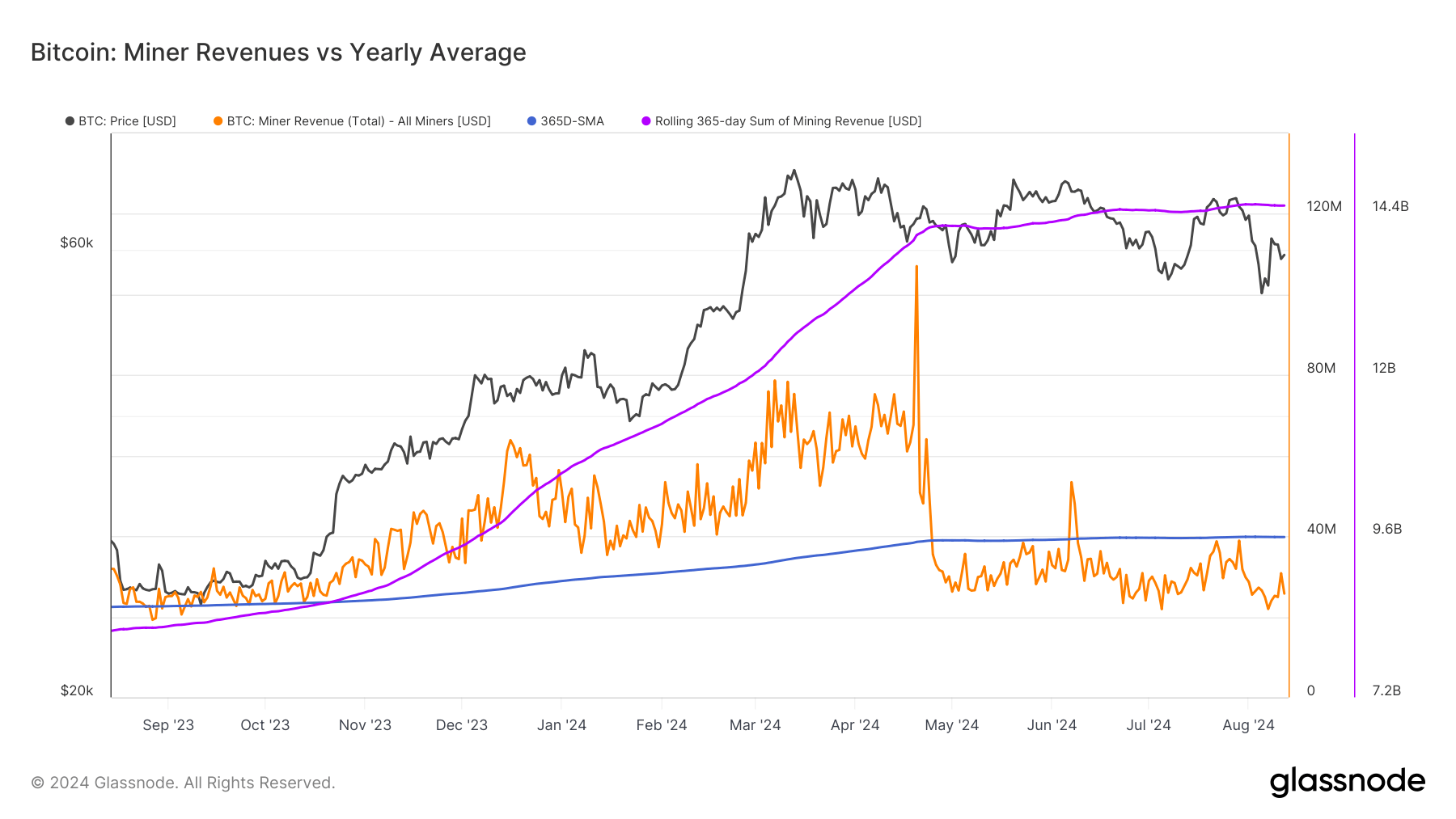

Miner revenues serve as a barometer for the overall state of the Bitcoin ecosystem, reflecting the delicate balance between mining costs, Bitcoin price, and network difficulty. Since Apr. 24, miner revenue has consistently been below its 365-day simple moving average (SMA), with only two brief exceptions in early June.

This prolonged period of below-average revenue culminated on Aug. 7, when miner revenue plummeted to its lowest level since September 2023. While this sustained downturn can be attributed to several factors, last week’s drop resulted from a significant drop in Bitcoin’s price.

Bitcoin saw significant volatility in August, dropping from $65,360 at the beginning of the month to below $50,000 on Aug. 5 before partially recovering to $54,000 within 24 hours. Significant price fluctuations like this directly impact miner revenue, as the USD value of each mined Bitcoin decreases with the price.

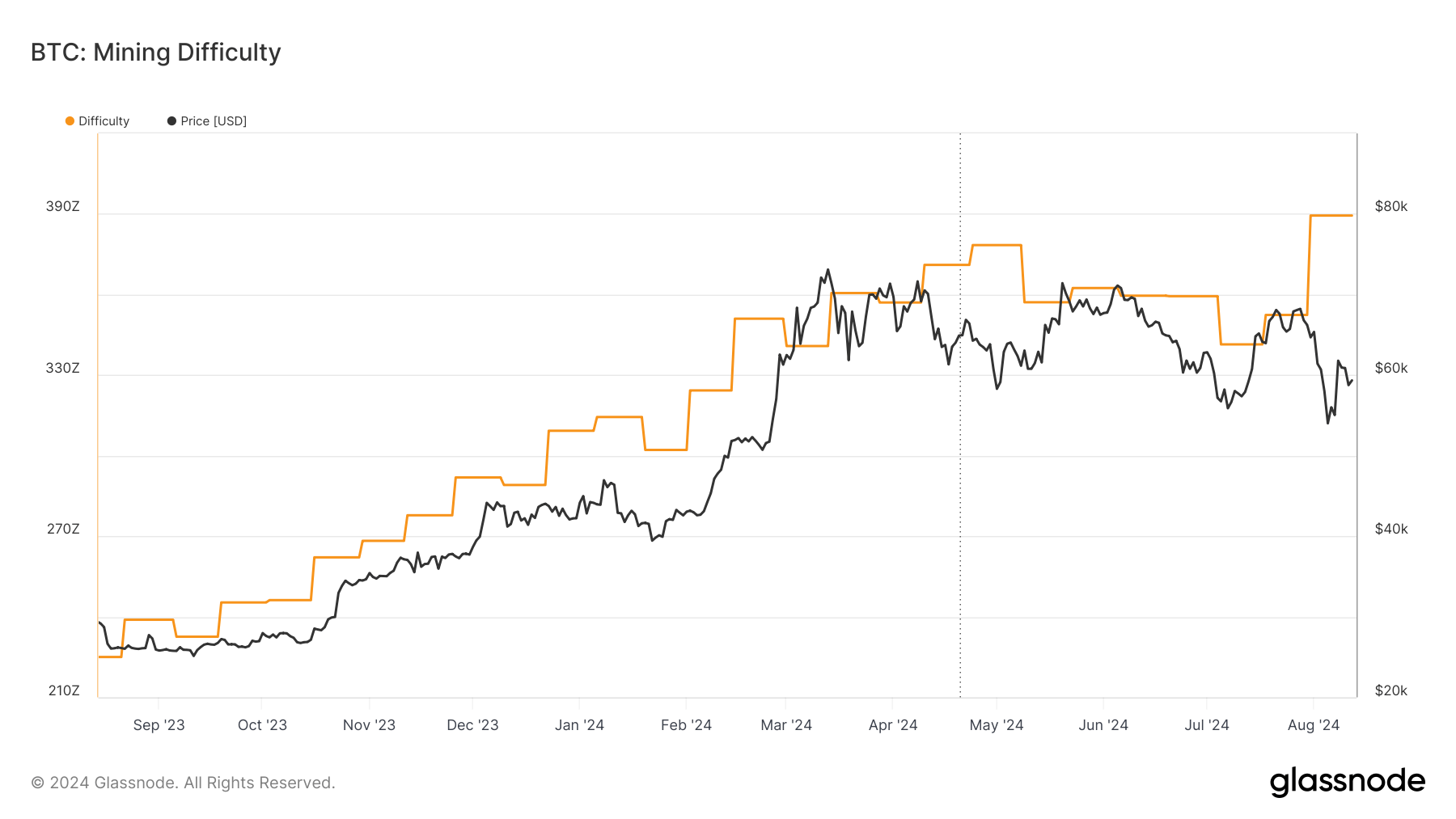

Bitcoin mining difficulty has also been increasing this month, requiring more computational power to mine each Bitcoin and further squeezing profit margins.

This short-term volatility is part of a long-term trend that began with Bitcoin’s halving in April. The halving reduced the block reward from 6.25 BTC to 3.125 BTC, halving the number of new Bitcoins entering circulation. This structural change has impacted miner revenues and profitability, forcing the industry to adapt to a new economic reality while juggling short-term volatility.

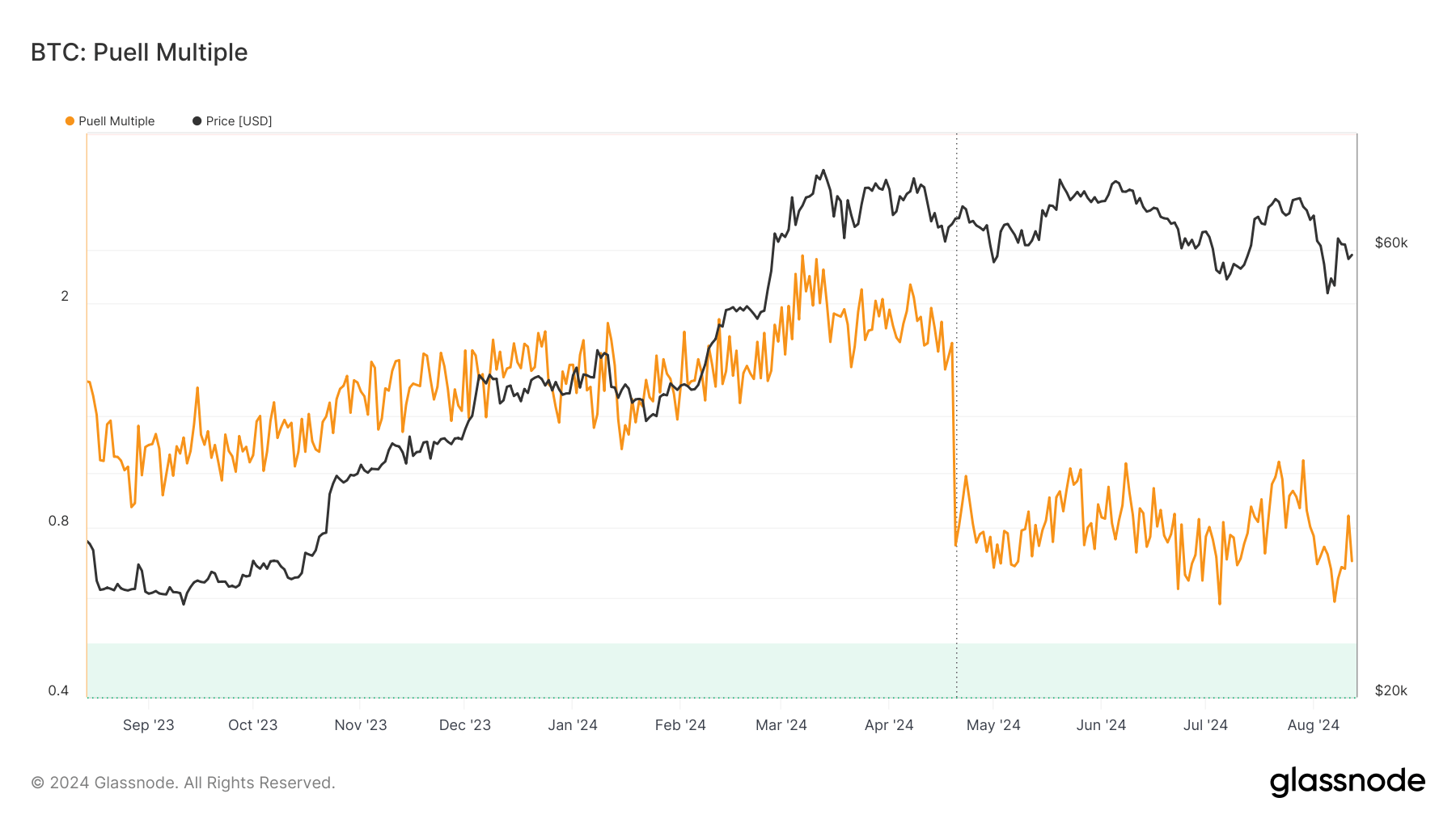

To better understand the implications of these changes, we can turn to the Puell Multiple, a valuable metric for assessing miner profitability and market conditions. The Puell Multiple is calculated by dividing the daily issuance value of bitcoins (in USD) by the 365-day moving average of daily issuance value. This metric helps identify periods of miner stress and potential market turning points.

On Aug. 5, the Puell Multiple dropped to 0.5910, its lowest level since Jan. 3, 2023. This sharp decline from 1.0525 on Jul. 29 indicates that the daily issuance value fell significantly below the yearly average. An even more dramatic drop occurred immediately after the halving, with the multiple plummeting from 1.6999 on Apr. 19 to 0.7441 on Apr. 20.

Historically, a Puell Multiple below 0.5 has signaled market bottoms and presented attractive buying opportunities for investors. The current value of 0.7, while not yet below this threshold, suggests that miners are under considerable pressure and that the market might have approached a bottom. However, it’s crucial to note that the recent halving event has fundamentally altered the issuance, potentially affecting how we interpret the Puell Multiple in the near term.

The combination of below-average revenue and a low Puell Multiple shows significant stress in the Bitcoin mining industry. Miners are currently earning less USD per Bitcoin mined, pushing less efficient operations towards the brink of unprofitability. The reduced rewards post-halving have intensified competition among miners for the available Bitcoin, leading to increased hash rates and mining difficulty.

If these conditions persist, the market may see another capitulation event, where miners are forced to sell a large part of their reserves or shut down operations altogether. This scenario could increase market volatility as miners liquidate holdings to cover operational costs. However, it may also drive efficiency improvements across the industry as miners seek cheaper energy sources and upgrade to more efficient hardware.

From a market perspective, the current state of miner revenues and the Puell Multiple carries several implications. as noted, periods of miner stress and low Puell Multiples have often signaled a good buying opportunity for long-term investors. Additionally, miners operating at or near breakeven levels may be less inclined to sell their Bitcoin holdings, potentially reducing overall market supply and supporting prices.

The stress on the mining ecosystem could lead to a more efficient and resilient industry in the long term, a trend we’ve already begun seeing among large, public miners. As less efficient operations are forced out of the market, those that remain will likely be better equipped to weather future market fluctuations.

The post Puell Multiple drops as miner revenues hit 10-month low appeared first on CryptoSlate.

Six months after big brother Bitcoin debuted on Wall Street, it was time for the second-largest cryptocurrency by market cap, Ethereum, to enter the spotlight.

Nine U.S.-listed spot Ether exchange-traded funds (ETFs) have only been trading for one day, but data reveals they’re off to a “solid” start — with over $1 billion flooding into the much-awaited investment products.

Data compiled by Bloomberg shows that on their first day of trading, the newly launched United States spot Ether exchange-traded funds generated nearly $1.1 billion in cumulative trading volume.

According to SoSoValue, of this $1.1 billion, the funds posted a net inflow of $106.6 million. Despite massive outflows from Grayscale’s newly converted Ethereum Trust (ETHE), which hit $484 million, the combined total inflows from the other eight funds have pushed the overall performance into positive territory.

BlackRock’s iShares Ethereum Trust ETF (ETHA) led the pack with $267 million in inflows, followed closely by the Bitwise Ethereum ETF (ETHW), which clocked in $204 million in net inflows.

ETH ETFs started trading on American stock exchanges on July 23 after the Securities and Exchange Commission (SEC) gave the funds the final blessing on July 22.

With the overall trading volume topping $1.08 billion, the ETFs registered approximately 23% of the volume that the spot Bitcoin ETFs saw on their debut day on January 11.

At the time, investors traded over $4.6 billion worth of shares of the extremely popular BTC-based funds on their first day, making it one of the most successful ETF launches in U.S. history. Many analysts had suggested that the Ether products mark another big win for the crypto industry’s efforts to thrust digital assets into the mainstream, although the volume and inflow for the ETH ETFs would not match Bitcoin’s because of the lack of a staking mechanism.

Nonetheless, yesterday was a successful launch for the newborn Ethereum funds. “Very solid first day,” Bloomberg’s ETF analyst James Seyffart noted.

However, the price of the industry’s second-most valuable digital coin fell slightly despite the rather successful debut. CoinGecko shows that ETH is changing hands for $3,464 per coin, down 1.4% in the last 24 hours as investors adopt a wait-and-see approach.

The decentralized finance (DeFi) sector is witnessing a resurgence, marked by growth in key metrics such as active loans and total value locked (TVL) from their 2023 lows.

DeFi lending, an important component that enables investors to lend their crypto holdings in exchange for interest, is an indicator of DeFi participation and overall market health.

In a recent post on X, crypto market analytics platform Token Terminal reported a notable rise in active loans within the DeFi sector, now reaching approximately $13.3 billion, levels that were last seen in early 2022. The post added that the increase in lending activity suggests a potential rise in leverage within the sector, a trend often associated with the onset of a bull market.

DeFi waking up again ✍️ pic.twitter.com/xrkQqCxGHE

— Token Terminal (@tokenterminal) July 31, 2024

During the 2021 crypto bull market, active loans in DeFi soared to a peak of $22.2 billion, mirroring the heights reached by Bitcoin and Ethereum, which approached $69,000 and $4,800, respectively. However, this number declined to around $10 billion by March 2022, eventually bottoming out at $3.1 billion in January 2023.

The total value locked (TVL) in DeFi also experienced a decline last year, plummeting 80% from a November 2021 peak of $180 billion to approximately $37 billion by October 2023. However, according to DefiLlama, the sector has also experienced a resurgence, with TVL increasing by around 160% to roughly $96.5 billion. Notably, DeFi TVL doubled in the first half of 2024, reaching a high of $109 billion in June.

Currently leading in locked value is the liquid staking protocol Lido, with a TVL of $38.7 billion. Following closely is the staking ecosystem EigenLayer and the Aave protocol, each holding over $11 billion in locked assets.

Taiki Maeda, the founder of Humble Farmer Academy, has predicted that we might be entering a “DeFi renaissance” after more than four years of underperformance.

He noted that many “DeFi OGs” are now in the category of “high float, low fully diluted valuation (FDV)” coins with strong catalysts on the horizon.

I believe we are approaching a period of DeFi renaissance after 4+ years of extreme underperformance.

A lot of these DeFi OGs are now in the category of “high float, low FDV” coins with strong catalysts on the way.

Here’s why I believe $AAVE @aave is poised to outperform pic.twitter.com/gaTZpKOfdg

— Taiki Maeda (@TaikiMaeda2) July 29, 2024

Maeda gave the DeFi lending platform Aave as an example, which he believes is “poised to outperform” due to the increasing supply of its native stablecoin GHO and the Aave DAO’s initiatives to lower costs and introduce new revenue streams.

Meanwhile, despite the recent positive trends, CoinGecko data shows that DeFi assets hold a market capitalization share of just 3.4%. Native tokens for prominent DeFi platforms such as Aave, Curve Finance (CRV), and Uniswap are also still down more than 80% from their all-time highs.

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!