Players can earn Notcoin tokens and a new in-game token in the story-driven game.

Source link

Arkham explained the process of tagging the wallet as likely BitGo in a Telegram message to CoinDesk. “The address was clustered with a large input cluster which we were able to identify as BitGo due to custody structure and wallet types used,” an Arkham analyst said. “We’ve also been able to identify the other fur exchange partners used for Mt. Gox distributions, so there’s also a process of elimination.”

Restaking yields are still mostly speculative, according to Mike Silagadze, who spoke at the Blockchain Futurist Conference.

Share this article

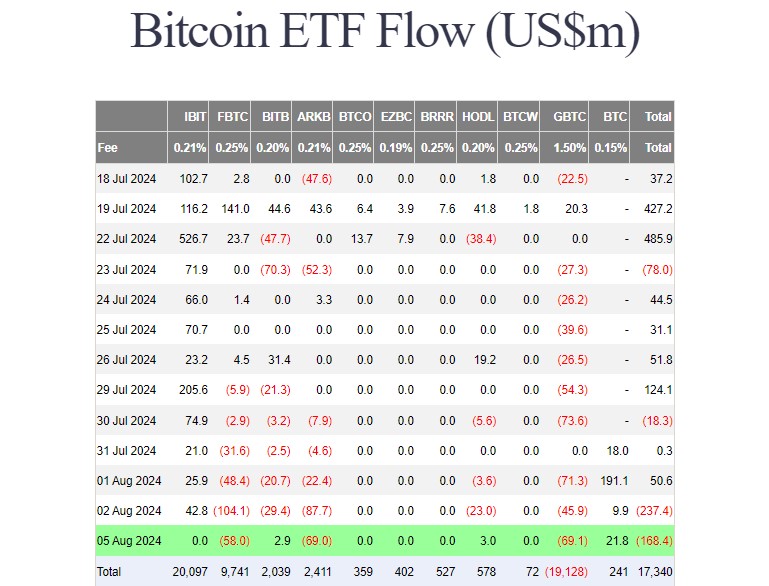

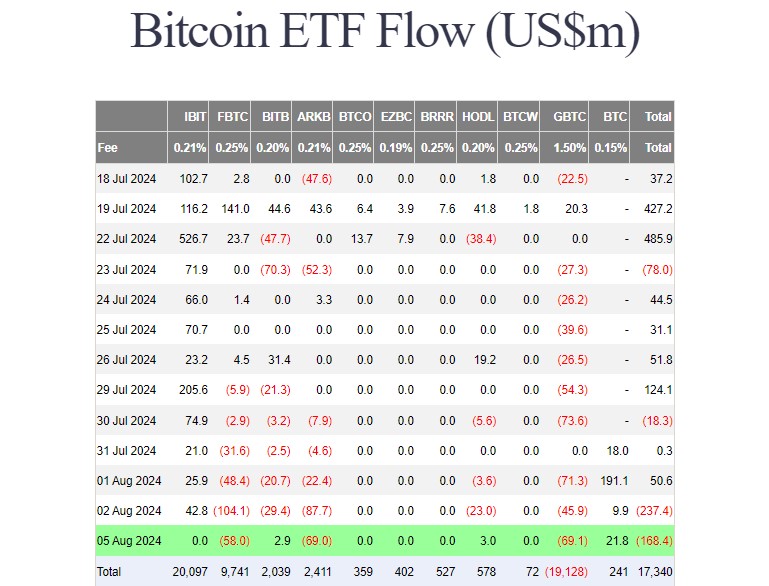

Investors pulled approximately $168 million from the group of nine US spot Bitcoin exchange-traded funds (ETFs) on Monday, bringing the total net outflows for two consecutive days to $405 million, according to data from Farside Investors. Meanwhile, spot Ethereum ETFs collectively logged nearly $49 million in net inflows.

Grayscale’s Bitcoin ETF (GBTC) and Fidelity’s Bitcoin fund (FBTC) dominated daily outflows as traders withdrew around $69 million from each fund.

In contrast, Grayscale’s Bitcoin Mini Trust (BTC), the low-cost version of GBTC, took in almost $29 million, becoming the ETF with the most daily outflows. Two ETFs that also posted gains today were Bitwise’s Bitcoin ETF (BITB) and Valkyrie’s Bitcoin fund (BRRR), attracting approximately $6 million.

Other Bitcoin funds, including BlackRock’s iShares Bitcoin Trust (IBIT), reported zero flows.

According to data from Coinglass, US Bitcoin and Ethereum ETFs recorded nearly $6 billion in trading volume on Monday. Spot Bitcoin ETFs accounted for over $5 billion of the total volume, with IBIT and FBTC being the dominants.

Spot Ether ETFs, led by Grayscale’s Ethereum ETF and BlackRock’s iShares Ethereum Trust (ETHA), contributed around $715 million to total trading volume.

Bloomberg ETF analyst Eric Balchunas called the high trading volume “crazy volume during a market rout is generally a pretty reliable measure of fear.” He added that deep liquidity on bad days is valued by traders and institutions, indicating long-term benefits for ETFs.

Bitcoin ETFs have traded about $2.5b so far, a lot for 10:45am, but not too crazy (full history below). If you bitcoin bull you actually DONT want to see crazy volume today as ETF volume on bad days is a pretty reliable measure of fear. On flip, deep liquidity on bad days is part… pic.twitter.com/TOQRjyriqp

— Eric Balchunas (@EricBalchunas) August 5, 2024

Farside’s data shows that BlackRock’s ETHA captured $47 million in net inflows on August 5, followed by VanEck’s and Fidelity’s Ethereum ETFs.

These two funds captured almost $33 million in inflows. Bitwise’s Ethereum fund and Grayscale’s Ethereum Mini Trust also reported gains on Monday.

The Grayscale Ethereum Trust (ETHE) suffered nearly $47 million in net outflows, the lowest since it was converted to an ETF. More than $2.1 billion was taken from the fund in ten trading days.

Investors still hold around 234 million ETHE shares. With the recent crypto market downturn, those shares are now valued at around $4.7 billion, as updated by Grayscale.

The crypto crash kicked off on August 4 following news of Jump Trading moving large amounts of Ether to exchanges. This led to a sharp price correction across crypto markets, with Bitcoin briefly dipping below $50,000 at the start of US trading hours on August 5. Ethereum followed suit, losing over 20% of its value in a day.

At the time of reporting, both Bitcoin and Ethereum prices have covered slightly. BTC is currently trading at around $54,000 while Ethereum is up 6% to over $2,400, CoinGecko’s data shows.

Share this article

Amid a week of strong volatility in the crypto market, $2.5 billion worth of Bitcoin options and Ether options will be expiring today amid a tight fight between the bulls and the bears. Both the assets – BTC and ETH – have been showing major strength gaining 7% and 10% respectively.

As per the data from Deribits, a total of 32,000 Bitcoin options contracts are set to expire today with a put call ratio of 0.71. The notional value of the expiry is $1.943 billion while the max pain point of $60,000.

The Yen rate hike last week induced severe volatility in the crypto market with the Bitcoin price dropping under $50,000 earlier on Monday. However, the Bank of Japan suggested a softer stand going ahead if the market instability escalates. This led to a strong recovery in the last four days, with BTC surging sharply by 20% currently trading at more than $61,000 levels.

Also, the implied volatility has decreased to a great extent but still remains higher than the pre-crash levels. The ongoing market volatility makes it challenging for IVs to decline rapidly over a short period.

The Grayscale Research report notes that if the US economy avoids recession and manages a “soft landing,” the token valuations can rebound with Bitcoin testing its all-time high levels by the end of the year. Besides, the report also noted that there is little tolerance for a deep economic recession and the Fed could pivot soon to rate cuts on the first sight of trouble.

Also Read: CBOE Resubmits Bitcoin ETF Options Trading Application, Q4 Approval Likely?

A total of 206,000 ETH options are set to expire today with a put-call ratio of 0.96, a notional value of $560 million, and a max pain point of $2,950. The put-call ratio close to 1 shows that it’s a tight fight between the bulls and the bears.

In the last 24 hours, the Ethereum price has witnessed a strong rebound jumping 10.70% and shooting at the way to $2,700. As per the technical charts, ETH can further extend a rally to $2,820.

#Ethereum forms a bull pennant on lower time frames, indicating a potential rise of over 4% towards $2,820! pic.twitter.com/EHp4XwBF3F

— Ali (@ali_charts) August 9, 2024

The Ethereum ETFs were showing major strength during the market collapse, however, have been seeing outflows as the market revived in the last two days.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Andjela Radmilac · 2 days ago

CryptoSlate’s latest market report dives deep into the VIX to explain its significance, historical context, recent trends, and implications for the crypto industry.

Crypto analyst Javon Marks has predicted that Ethereum (ETH) could enjoy a 75% breakout and rise to $4,723. The analyst also explained why this parabolic rally is possible for the second-largest crypto by market cap.

Marks mentioned in an X (formerly Twitter) post that Ethereum’s price is poised to rise to $4,723 as bull divergences continue to hold within a massive climb since breaking out. He added that the 75% move to this target and above can take place with the breakout and divergence holding.

From the chart he shared, Marks also suggested that Ethereum’s price could rise to $8348. However, the analyst didn’t provide a timeline for when ETH will reach this price target. Crypto analyst Altcoin Daily also recently predicted that Ethereum could rise above $8,000 as he put his peak price target for ETH in this bull run at $8,800. Crypto analyst Poseidon also believes that Ethereum’s price can rise as high as $8,000.

Meanwhile, crypto analyst DavidOnCrypto has provided a timeline for when Ethereum could reach $8,000, stating that it will happen in the next six months. He claimed that ETH’s move from its current price level to $8,000 would foreshadow the move that Bitcoin enjoyed as it rose from $25,000 to $70,000.

Ethereum investors will undoubtedly be wary of such price targets, considering how much the crypto token has underperformed compared to Bitcoin since the start of the year. However, crypto analysts like Roman have assured that Ethereum’s time will come when it will make that parabolic run in this market cycle.

The analyst explained that it wasn’t unusual for Ethereum’s price to lag while Bitcoin hit new highs. He alluded to 2020 when ETH was down 80% from its all-time high (ATH) while the flagship crypto broke its ATH. Roman predicted that Ethereum would make its run by year-end, as that is when he believes liquidity will begin to shift from Bitcoin to Ethereum and other altcoins.

Crypto analyst Crypto Kaleo recently stated that he is confident that Bitcoin’s dominance has hit cycle top. This represents a positive for Ethereum’s price as Crypto Kaleo noted that altcoins will begin to gain ground starting with the “king” ETH. He added that the real altcoin season begins when Bitcoin’s dominance drops beneath 50%.

Meanwhile, Grayscale’s Ethereum Trust (ETHE), which has recently contributed much of the selling pressure on Ethereum, recorded its first zero-flow day since converting to a Spot Ethereum ETF.

This is undoubtedly a positive for Ethereum, especially considering that Grayscale’s Bitcoin Trust (GBTC) recorded 78 consecutive outflow days before registering its first day without an outflow. On the other hand, ETHE achieved this feat on the fourteenth day of trading as a Spot Ethereum ETF.

Featured image created with Dall.E, chart from Tradingview.com

In case, you are looking for a cool and interesting way to earn a quick buck, Here’s a platform that pays you for filling out simple surveys. Toluna Group lets you take surveys for forming a database for market research.

[polls_shortcode postid=”52287″]

Toluna is a worldwide survey technology provider and claims to be the “ World’s Largest social voting community” which has more than nine million survey takers.

In this review, you will get a detailed insight into Toluna, Let’s look into this review article now:

| Name | Toluna |

| Owner | Frederic-Charles Petit |

| Founded Year | 2000 |

| Headquarters | Paris, France |

| Type | Online Surveys |

| Apps | iPhone & Android Devices |

| Support | Email, Phone |

| Website | www.toluna.com |

Toluna is a community survey platform that offers online surveys in return for rewards. This is a Paris( France) based company, managed by the Toluna Group and a well known market research company preferred by brands around the world. With more than 9 million survey takers, for the people who want to make money by taking surveys, Toluna is a preferred option.

The users that register on Toluna and take up these surveys are known as “Toluna Influencers”. These surveys completed are used by the major brands to help them figure out their business plan. It is one of the world’s most popular survey sites which has a very strong subscriber base and an effective portfolio of clients.

With 16+ offices globally, Toluna team aims to provide better products and quality to the consumers. They do it by surveying for the brands and thus it helps in dealing with customer satisfaction and to improve their business plan.

Toluna provides its membership to 49 countries. The number of surveys that are available depends on your location.

Step 1: You can fill up the registration form online and sign up for Toluna.

Step 2: After the Toluna login, you will be asked to verify your account by providing your personal details. Further, you are good to take the online surveys.

Toluna Influencers are paid in the form of points which can be redeemed further in the form of gift cards, vouchers, etc. There are two types of Toluna surveys available listed below:

You can update your personal information by logging into your account. Select “Account” in the top right corner and then click the Edit option. You can also view your account activity such as credits purchased, surveys launched, and the current status of your subscription.

In cases where you forget your password, you can do it by Clicking the Sign in button at the top right side. Then click the “forgot your password” option and follow the instructions further which you will be able to retrieve your password.

There are 8 ways to earn in Toluna which are as follows:

There are 3 ways to redeem the points in Toluna which are listed below:

You need to reach of minimum of 30,000 points which are listed below:

As per the Toluna reviews, it has been found that Toluna is a legitimate business. Despite its long wait times, it has a noted record of paying its clients and further issuing them good rewards.

It is a company that offers to pay on each survey you take. It has been very popular and has become one of the people’s number one choices regarding online surveys. They also have a base of around 13 million users and is on a rapid expansion

Toluna also has an A+ rating in the Better Business Bureau(BBB) with only around 31 customer complaints. Further, it has a 3.8 rating on the Trustpilot with more than 2,100 Toluna reviews.

There are a lot more positive reviews compared to the criticism. It has great customer service for which it accounts as one of the legit organizations that pay people in response to the online surveys.

It is to be acknowledged that Toluna is a legitimate business which pays its users based on the surveys they take.It is one of the top rated companies with a trusted community of 1+ million members which make it highly recommended.

It is an honest way to make full time income on the internet by taking surveys. It has no hidden costs and in turn you will learn how to build a flourishing business online in Toluna. It also allows you to choose surveys in categories which you are interested in.

Thus finally it is advisable that Toluna is worth giving a try. You can take it as a fun experience and further you will enjoy it a lot. If you are looking to earn income by taking up online surveys, then Toluna is definitely on the top lists which are trusted.

No, Signing up for Toluna is completely free. Sign up today and access its features free of cost

Toluna Influencers are compensated in points, which can be exchanged for a variety of items such as gift cards, competition entries, or plain old cash.

It is dependent on the targeting and the screening questions. The more of these questions you have, the longer your survey may take to complete.

You need to have at least 60000 points.

Go to rewards, convert your points into cash through, 60000points=$20.

Toluna is a safe and reliable platform. It is not a scam, and millions of people from all over the world have taken their surveys for over ten years. However, your experience with the site may vary from that of other survey takers.

( votes)

Source link