An asset manager weighs in on Trump’s Bitcoin push, spot Ether ETFs record $107 million on debut day: Hodler’s Digest

An asset manager weighs in on Trump’s Bitcoin push, spot Ether ETFs record $107 million on debut day: Hodler’s Digest

Coinbase has set its feet back in Hawaii after a seven year break. The crypto exchange credits its return to new regulations in the state. This comeback will allow Hawaiian residents to use Coinbase’s full range of crypto services again.

In 2017, Coinbase left Hawaii because of strict financial rules set by the state’s Division of Financial Institutions (DFI). Back then, cryptocurrency companies needed a money transmitter license and had to keep cash reserves equal to the value of all cryptocurrencies held for customers. These rules made it hard for Coinbase and other companies to operate, leading to their exit from the state.

In June 2024, Hawaii’s Department of Commerce and Consumer Affairs (DCCA) announced that cryptocurrency businesses no longer need a money transmitter license to operate in the state. This shift in policies have provided crypto companies like Coinbase a chance to re-enter the Hawaiian market. With Coinbase’s comeback, the crypto community of Hawai can now enjoy a large variety of crypto services offered by the crypto exchange. These services include trading, staking and access to over 500 crypto trading pairs with advanced features. In his X post, Paul Grewal, the Chief Legal Officer of Coinbase, shared a blog post with this update.

Hawaii’s new rules show a big shift in the state’s approach to cryptocurrency. For years, strict regulations held back the growth of the crypto industry in Hawaii. The removal of strict regulations for crypto in Hawai shows that the state is now more open for digital technology.

Coinbase’s return is a big win for both the company as well as Hawaii’s residents. This lets the state people be more involved in the global crypto economy. This shift in regulations looks like influenced from the crypto trend in U.S. politics.

As Hawaii continues to update its approach to cryptocurrency, the state is likely to play a bigger role in the global crypto ecosystem. This offers residents new opportunities to engage with this fast growing industry. The comeback of Coinbase to Hawaii is a positive sign for the exchange as well whole crypto community amisds SEC always bringing new issues to light.

Poodlana is one of the new dog-themed tokens to surge ahead of a crucial inflation report on Wednesday.

The potential for the CPI data to swing the U.S Federal Reserve into action for a rate cut in coming months has the markets in a positive mood. Bitcoin’s surge to above $61,000 has buoyed the broader market, while traders eyeing the bull market are flocking to potentially biggest presale gem of the year – Poodlana (POODL).

Despite the news that BitGo moved $2 billion worth BTC from Mt. Gox on Tuesday, the benchmark cryptocurrency has remained near the psychologically important price level of $60k. The surge to $61k comes as investors target further indications that the Fed will cut rates.

Experts have largely shared this view, which has traders in position for a potential rally.

According to QCP Capital, investors are likely to pay closer attention to inflation numbers, with this adding to the overall Fed sentiment.

“This week’s inflation data will be key for the markets,” Sylvia Jablonski, chief executive officer of Defiance ETFs told CNBC’s Squawk Box. “If the market gets the sense that rates are going to be cut, we can end up with a positive year, but probably some volatility for the next month or two.”

As noted, cryptocurrencies have climbed in the past 24 hours as Bitcoin edged above $61k and Ethereum broke above $2.6k. Crypto analysts suggest the top cryptocurrencies could be on the path to greater gains, and the recent dip might have provided a crucial buying opportunity.

Solana meme coin’s market has increased 5.4% to over $6.62 billion. While a fraction of the $2.2 trillion global market cap, these assets have the potential to explode.

Poodlana, which launched its 30-day presale in July, is less than three days away from listing on DEX and potentially one of the top tier crypto exchanges.

The project that combines meme traction in Asia and fashion debuted in presale at the price of $0.02. In just over 27 days, POODL has gone viral with price now at $0.0539 and total amount raised in presale surpassing $7 million.

At the end of stage 10, Poodlana will list on Raydium and possibly one of the major exchanges with the listing price at $0.06.

If cryptocurrencies rally further, Poodlana could mirror top Solana meme coins Bonk, dogwifhat and Popcat that went parabolic after launch. POODL will go live on DEX on Aug. 16 and the next two days or so may be the best time to buy Poodlana.

To find out what sets Poodlana apart, visit the official website.

Source link

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

The ZKX Protocol, a Crypto.com-backed decentralized exchange, has shut down due to economic challenges.

Following the announcement, the ZKX token plunged by over 50% in the last 24 hours.

On July 30, co-founder Eduard Jubany Tur announced the discontinuation of the ZKX protocol. He expressed regret, stating that despite their best efforts, they were unable to find an economically viable path for the protocol.

According to data from CoinGecko, the ZKX token is currently trading at $0.01253, marking a 52.5% drop in value over the past 24 hours.

Effective immediately, all markets on the ZKX Protocol have been delisted, positions closed, and funds returned to each user’s trading account. Users can transfer these funds to their main self-custodial accounts, which are wallets on the Starknet blockchain.

Withdrawals can be made through the Starkway bridge back to Layer 1 at any time. The protocol will also enter a sunset period lasting until the end of August, during which Tur encouraged users to withdraw their funds and claim any pending STRK rewards. ZKX vesting and distribution will continue post-sunset, starting September 1.

Founded in 2021, ZKX aimed to create a scalable decentralized exchange for perpetual trading. The project received backing from notable investors, including StarkWare, Amber Group, Huobi, Crypto.com, and individual investors such as Sandeep Nailwal, Co-Founder of Polygon, and Ashwin Ramachandran, General Partner at DragonFly Capital.

Tur’s statement outlined various reasons for the decision to stop operations. The platform suffered from minimal user engagement, with only a handful of individuals mining STRK and ZKX rewards.

This lack of participation led to a drastic decrease in trading volumes, making it challenging for the protocol to generate sufficient revenue to cover its operational costs. Despite the efforts of market-makers, the financial burden of maintaining the platform’s infrastructure, including cloud server expenses, salaries, and other essential costs, far exceeded its income.

“We thoroughly evaluated the possibility of expanding cross-chain but we realized a significant portion of the entire codebase would have to be rewritten, tested, and re-audited in Solidity, and that would carry a significant cost. Given these challenges and the substantial investment required, we have made the difficult decision to wind down the platform.”

The announcement also mentions broader issues within the DeFi sector. The market’s undervaluation of tokens like ZKX and a general lack of demand have worsened the protocol’s financial difficulties.

Major token holders exercising their rights to cash out have further driven down the token’s value. The ongoing exhaustion of the DeFi model over the past five years has also contributed to the sector’s overall decline.

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Share this article

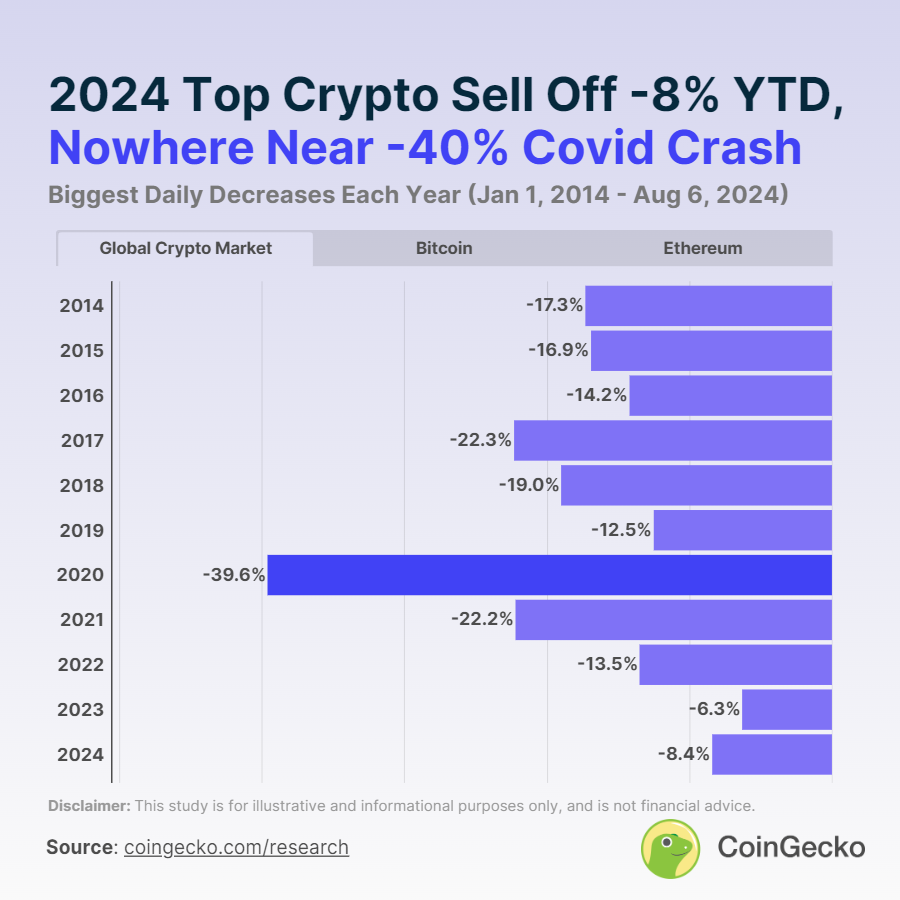

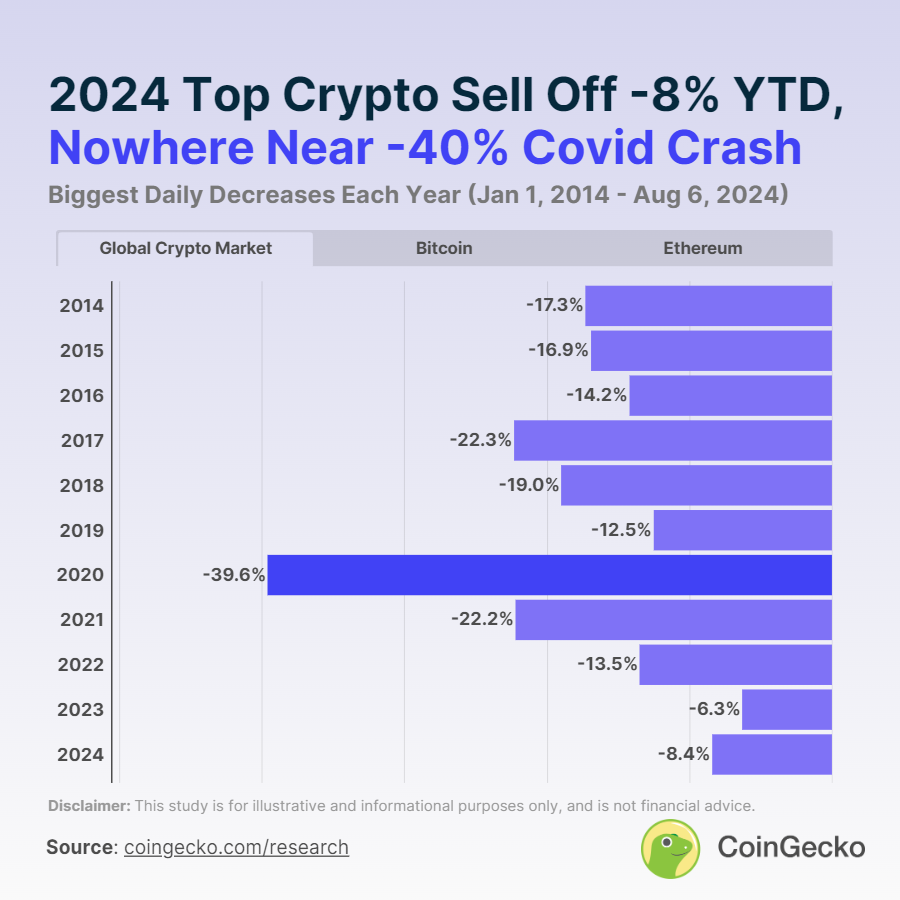

Despite Bitcoin’s (BTC) recent dip of 29% in two weeks, the crypto market has shown resilience in 2024, with no significant corrections compared to historical downturns. According to a CoinGecko report, the largest sell-off this year was a relatively mild -8.4% on March 20, 2024.

In contrast, the most severe crypto market correction in the past decade occurred during the Covid-19 crash on March 13, 2020. Total crypto market capitalization plummeted -39.6% day-over-day, from $223.74 billion to $135.14 billion, highlighted the report.

Bitcoin experienced its biggest price correction of -35.2% on the same day, while Ethereum saw its second-largest drop at -43.1%.

The crypto market has not recorded a single day of correction since the FTX collapse in November 2022. Over the past ten years, the longest crypto corrections have lasted at most two consecutive days, occurring only three times.

From 2014 to date, the global crypto market has experienced 62 days of market correction, representing just 1.6% of the time during this period, with the average crypto market correction being 13%.

Notably, 2023 saw zero days of correction for the overall crypto market, Bitcoin, and Ethereum. While the global crypto market and Bitcoin have avoided corrections in 2024 so far, Ethereum has experienced two days of price correction this year: -10.1% on March 20 and -10% on August 6, 2024.

Share this article

US Federal Reserve Bank of Boston President Susan Collins on Friday said it is appropriate now for the US Federal Reserve to start interest rate cuts. Moreover, the consumer price inflation (CPI) inflation data remains the last hurdle before the much-awaited Fed rate cuts.

Boston Fed President Susan Collins, in an interview with the Providence Journal, said the US Federal Reserve could begin easing interest rates provided that CPI inflation release cool further amid a strong labor market. The latest weekly jobless claims fell more than expected, driving a rebound in the market.

“If the data continue the way that I expect, I do believe that it will be appropriate soon to begin adjusting policy and easing how restrictive the policy is,” Collins said. “My outlook is for continued gradual reduction back to our 2% target amid a healthy labor market.”

She refused to provide more detail on the timing and extent of the Fed rate cuts, but confirmed lower interest rates in the next few years. “We’ll have more data before our September meeting, and I don’t want to get out ahead of that,” said Susan Collins.

The U.S. Bureau of Labor Statistics will release the CPI data on Wednesday, August 14. The annual CPI inflation rate in the US fell for a third straight month to a low of 3% last month. Economists estimates annual CPI inflation for July to come at 2.9%.

Recently, JPMorgan predicted Fed rate cuts by half a percentage point in September. The Wallet Street giant recently raised the odds of a US recession to 35% by the end of the year, up from 25% as of the start of last month. Notably, CME FedWatch tool shows a 54.5% chance of a 50 bps rate cut in September.

Crypto research firm Matrixport in a recent post on X said Bitcoin is oversold. The firm expects a relief rally in Bitcoin after the upcoming inflation data including PPI on Tuesday and CPI on Wednesday.

Bitcoin traders can respond positively if the CPI data comes in lower than 3%. Matrixport claimed it warned its clients that trading volumes and liquidity have remained low historically in August. It adds that the trading ecosystem will remain challenging in the coming weeks. However, the odds of Fed rate cuts will see a significant boost.

BTC price trades above $60,000 on the options expiry day, which is in line with the max paint point. The price jumped more than 6% in the past 24 hours, with a 24-hour high of $62,673. Furthermore, the trading volume remains low today.

Also Read: 32,000 Bitcoin Options Set to Expire Amid Strong BTC Recovery

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Bitcoin’s price climbed to $61,500 on Aug. 13 following the movement of $2 billion in Bitcoin tied to the long-defunct Mt. Gox exchange.

The rally, which saw the leading crypto jump by nearly 5% in just one hour, has ignited renewed optimism in the market.

Bitcoin gave up some of the day’s gains after a minor rejection from the daily peak. However, the flagship crypto was still up 3.75% over the past 24 hours and trading at $60,770 as of press time, based on CryptoSlate data.

Blockchain analytics firm Arkham Intelligence reported that over 33,000 Bitcoin, valued at approximately $2 billion, was transferred from a wallet associated with Mt. Gox to another address.

The latest on-chain activity sparked immediate reactions in the market. Bitcoin, which had been trading at around $59,500 earlier in the day, quickly climbed to $61,500, signaling a positive shift after a recent period of volatility.

The price remains below its all-time high of nearly $74,000, recorded in March, but the current rally has lifted Bitcoin out of its recent slump, where it briefly dipped below $50,000 last week.

The ongoing distribution of these recovered funds has previously led to concerns about potential sell-offs, contributing to downward pressure on Bitcoin’s price. However, today’s price increase suggests that the market is responding favorably to the news, with traders perhaps viewing the movement of funds as a sign that the long-awaited repayments are nearing completion.

The top altcoins saw similar gains for the day, with Ethereum (ETH) up 1.7% over the last 24 hours to $2,700 as of press time. The coin hit a daily high of $2,728.

Meanwhile, Solana (SOL) hit a daily high of $149.7 before giving up some of the gains. The coin was up 2.35% over the past 24 hours and trading at $147 as of press time.

BNB was also up roughly 2.2% over the past 24 hours and trading at $521.5 as of press time, while XRP was up over 3.22% to $0.58.

Toncoin (TON), Dogecoin (DOGE), and Cardano (ADA) recorded comparatively minor gains for the day — up 0.93%, 1.19%, and 1.38%, respectively.

At the time of press 8:21 pm UTC on Aug. 13, 2024, Bitcoin is ranked #1 by market cap and the price is up 2.27% over the past 24 hours. Bitcoin has a market capitalization of $1.2 trillion with a 24-hour trading volume of $31.16 billion. Learn more about Bitcoin ›

At the time of press 8:21 pm UTC on Aug. 13, 2024, the total crypto market is valued at at $2.12 trillion with a 24-hour volume of $69.16 billion. Bitcoin dominance is currently at 56.23%. Learn more about the crypto market ›

Legendary trader and BitMEX co-founder Arthur Hayes has shared his reflections on the crypto market’s future in his latest essay. Specifically, Hayes predicted that Bitcoin (BTC) and Ethereum (ETH) crossing key psychological price milestones could activate an epic surge in altcoins.

According to Arthur Hayes, the highly-anticipated full-fledged altcoin season won’t start until Bitcoin and Ethereum break through the $70,000 and $4,000 thresholds, respectively.

“The combination of a dollar liquidity-inspired Bitcoin and Ether rally into year-end will create a strong foundation for the return of a sexy shitcoin soiree,” Hayes wrote in his “Water, Water Every Where” Monday essay.

The Bitcoin OG, who now runs the Maelstrom Fund family office, also expects Solana to rocket above $250 but downplays its wider impact compared to Bitcoin and Ether, highlighting their bigger market values.

SOL is currently trading 43.5% down from its all-time high of $259.96, set almost three years ago in November 2021.

Hayes predicts the king of crypto will breach the $100,000 mark during this cycle. He names the issuance of U.S. treasury bills that could inject fresh liquidity into cryptocurrency markets as the possible catalyst:

“Therefore, taking Bad Gurl Yellen’s word, we know that $301bn of T-bills will be net issued between now and year-end. If this relationship holds true, Bitcoin will quickly retrace the dump caused by the yen strengthening. The next stop for Bitcoin is $100,000.”

Bitcoin is currently struggling to reclaim the psychologically important $60,000 mark. BTC is changing hands at $59,396 as of press time, according to CoinGecko data. Hayes, however, maintains a rosy long-term outlook for BTC, asserting that the $1 million price tag for Bitcoin was still his base case. He also predicted a parabolic bull rally heading into next year, adding: “The 2025 Sino-American crypto bull market shall be glorious.”

Nonetheless, the crypto market must first navigate the remarkably close U.S. presidential election. Hayes called Vice President Kamala Harris, the presumptive Democratic presidential candidate, a “first-class political muppet.” He claims Harris has an advantage over Donald Trump only because she “is not an octogenarian vegetable.”

Harris has yet to publicly indicate how she intends to approach the fledgling crypto sector if elected in November. Meanwhile, former President Donald Trump has become a huge champion of digital assets in recent months, though his administration was against the burgeoning technology when he was in office. As a result, some well-known industry CEOs have given him their support and money with hopes that a second Trump regime will reverse the harsh enforcement actions and compliance conflicts of the Biden-Harris administration.