The CBOE crypto exchange submitted a filing to the US SEC for trading options for the spot Bitcoin ETFs listed on Wall Street, on Thursday. After withdrawing the previous application, the exchange filed a fresh application making necessary regulatory changes.

Bitcoin ETF Options Trading

As the demand for spot Bitcoin ETFs spreads in the traditional financial market, there’s a greater push for the options trading of these investment products. Bloomberg ETF strategist James Seyffart stated that CBOE’s new filing is a more updated and detailed one that addresses some of the SEC’s concerns about position limits and market manipulation.

Interestingly, there was quite some movement in the market as three exchanges – Nasdaq, NYSE, and CBOE – withdrew their applications in an unexplained move on Thursday, August 8. Previously, the final deadline for the SEC decision was September 21. However, the new filing could reset the approval clock again. Speaking on the development, Seyffart noted:

“No way to know for certain if SEC is engaging with CBOE on this. One downside here is that I think this restarts the clock. So deadline would move to some time at the end of April (Apr 25th-ish) Buttt if SEC is engaging — the deadline might not actually matter? Time will tell”.

Another Bloomberg strategist Eric Balchunas also said that this refiling from CBOE is a good sign and the SEC would surely consider engaging with the exchange on this.

Earlier this week, NYSE American also filed with the SEC for options trading on three Ethereum ETFs despite all the FUD in the market.

Also Read: Wells Fargo Reportedly Plans To Offer Bitcoin ETFs After Morgan Stanley

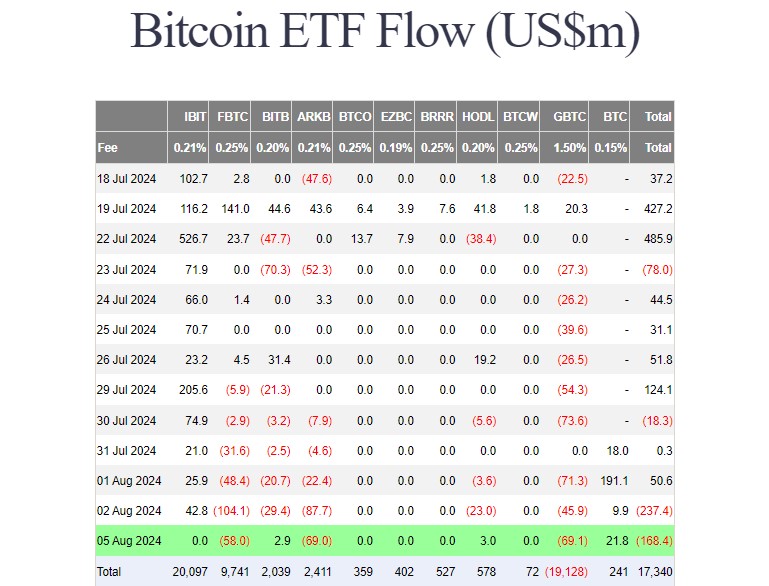

BTC ETF Inflows Surge

Inflows into spot Bitcoin ETFs have picked up pace once again with BlackRock’s IBIT leading the show. On Thursday, August 8, the total inflows into spot BTC ETFs were $201 million with IBIT seeing $164.5 million in inflows. Interestingly, WisdomFlow’s BTCW ETF came second with more than $118 million in inflows, per the data from Farside Investors.

On the other hand, the Bitcoin price rallied more than 8% shooting all the way to $61,800 levels in a solid bull recovery. However, the US recessionary fears continue to remain around the corner with economists citing caution.

Also Read: Breaking: Customers Bancorp Faces Enforcement Action From US Federal Reserve

BTC ETFs are seeing demand across the globe. A day before Standard Chartered subsidiary Digital bank Mox said that it started offering crypto ETFs to its clients allowing them to gain easy access to the asset class in a regulated environment. Thus, Mox joins other banks in Hong Kong offering similar investment products.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Crypto exchange Bitfinex’s latest Alpha report examines various key metrics, providing insights into whether bitcoin may be approaching a local bottom. “Overall, these metrics underline the deep bearish sentiment and stress among short-term investors, which usually occurs at local bottoms,” the report states. Bitfinex Report Analyzes Bitcoin’s Rebound and Potential Local Bottom Crypto exchange Bitfinex […]

Crypto exchange Bitfinex’s latest Alpha report examines various key metrics, providing insights into whether bitcoin may be approaching a local bottom. “Overall, these metrics underline the deep bearish sentiment and stress among short-term investors, which usually occurs at local bottoms,” the report states. Bitfinex Report Analyzes Bitcoin’s Rebound and Potential Local Bottom Crypto exchange Bitfinex […]