The US banking giant Morgan Stanley has recently revealed massive investments into the US Spot Bitcoin ETF in the second quarter of 2024. In the latest SEC filing, the banking behemoth disclosed that it held 5,500,626 shares of BlackRock iShares Bitcoin Trust as of June end, which was worth around $190 million. Notably, this filing comes just after Goldman Sach’s revelation of a large-scale investment into the Bitcoin investment instrument.

Morgan Stanley Reveals Massive Bitcoin ETF Investments

The latest Morgan Stanley SEC filing showed that the leading banking firm has invested heavily into BTC ETF through BlackRock’s iShares Bitcoin Trust (IBIT). The 13F filing showed that the bank holds around 5.5 million shares of IBIT, valued at $187.79 million as of June 30. This marks a new position for the banking giant, putting it on the top five holders list of IBIT.

Meanwhile, the decision to allocate such a massive part of its portfolio to Bitcoin through this ETF reflects the bank’s confidence in the crypto’s future potential. Besides, it also aligns with a broader trend among institutional investors who are shifting focus towards Bitcoin as a hedge against inflation and market uncertainties.

In addition, the recent disclosure comes a day after Goldman Sachs, another banking behemoth, revealed a substantial investment into Bitcoin ETF. According to their 13F filing, Goldman Sachs holds around 7 million iShares Bitcoin Trust and 1.5 million Fidelity’s FBTC shares. The timing of these latest disclosures from two of the leading financial institutions reflects the increasing focus on Bitcoin in traditional finance.

Institutional Interest In Bitcoin

Morgan Stanley’s latest investment into the Bitcoin landscape is not an isolated event. For context, the revelation comes just after the Wisconsin Investment Board revealed increasing its stake in BlackRock’s IBIT.

Meanwhile, these significant investments by major financial players suggest a shifting attitude towards Bitcoin and its role in the global economy. The trend of increasing exposure to Bitcoin through ETFs could signal the beginning of broader adoption of cryptocurrencies within the institutional investment community.

While Bitcoin has long been seen as a speculative asset, its inclusion in the portfolios of major banks like Morgan Stanley and Goldman Sachs indicates a growing recognition of its potential as a long-term investment. This shift is likely to have a ripple effect throughout the financial sector, encouraging other institutions to follow suit.

In addition, Morgan Stanley also recently started offering Bitcoin ETF to its qualified clients. This positions him as one of the first Wall Street banks to provide Bitcoin products to its selective clients.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

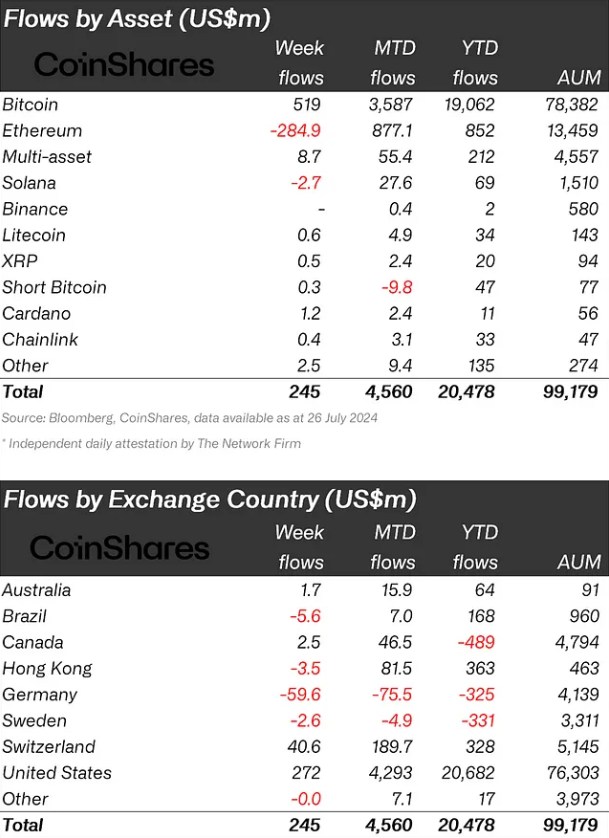

In a recent report, Coinshares and author Max Shannon examine the potential impact of the 2024 U.S. presidential election on bitcoin, with a focus on the policies and positions of former President Donald Trump and current Vice President Kamala Harris. Coinshares’ analysis suggests that the outcome could significantly influence the regulatory landscape for digital assets. […]

In a recent report, Coinshares and author Max Shannon examine the potential impact of the 2024 U.S. presidential election on bitcoin, with a focus on the policies and positions of former President Donald Trump and current Vice President Kamala Harris. Coinshares’ analysis suggests that the outcome could significantly influence the regulatory landscape for digital assets. […]