Bitcoin price has continued to stay in the red today, hovering around the $96K mark following a short-term pump after the US job data gave some relief yesterday. Notably, the latest US job data indicates a cooling labor market, which could give more space to the Federal Reserve to move with their rate cut plans. However, amid this, top experts predict a potential BTC dip to $90k, while maintaining their bullish outlook on the long-term trajectory of the coin.

Bitcoin Price Likely To Hit $90K Before Targeting New ATH

Bitcoin price has hovered between $90K and $100K for some time as macroeconomic woes and other concerns have dampened market sentiments. Amid this, top market experts anticipate further BTC decline, which would give more buying opportunities for investors. In other words, despite the short-term woes, analysts remained bullish on the long-term trajectory of the coin.

For context, in a recent X post, top crypto analyst Michael van de Poppe identified $90,000 as an ideal buying zone for Bitcoin. According to his recent market analysis, BTC is currently in a “place of boredom,” with price movement stagnating. He believes that a dip to the lower boundary could be a prime entry opportunity for investors.

In addition, his analysis highlights $104K as a crucial resistance level. If Bitcoin breaks past this barrier, it could signal the start of a rally toward a new all-time high. “Test the highs again = likely new ATH on the horizon.” van de Poppe explained.

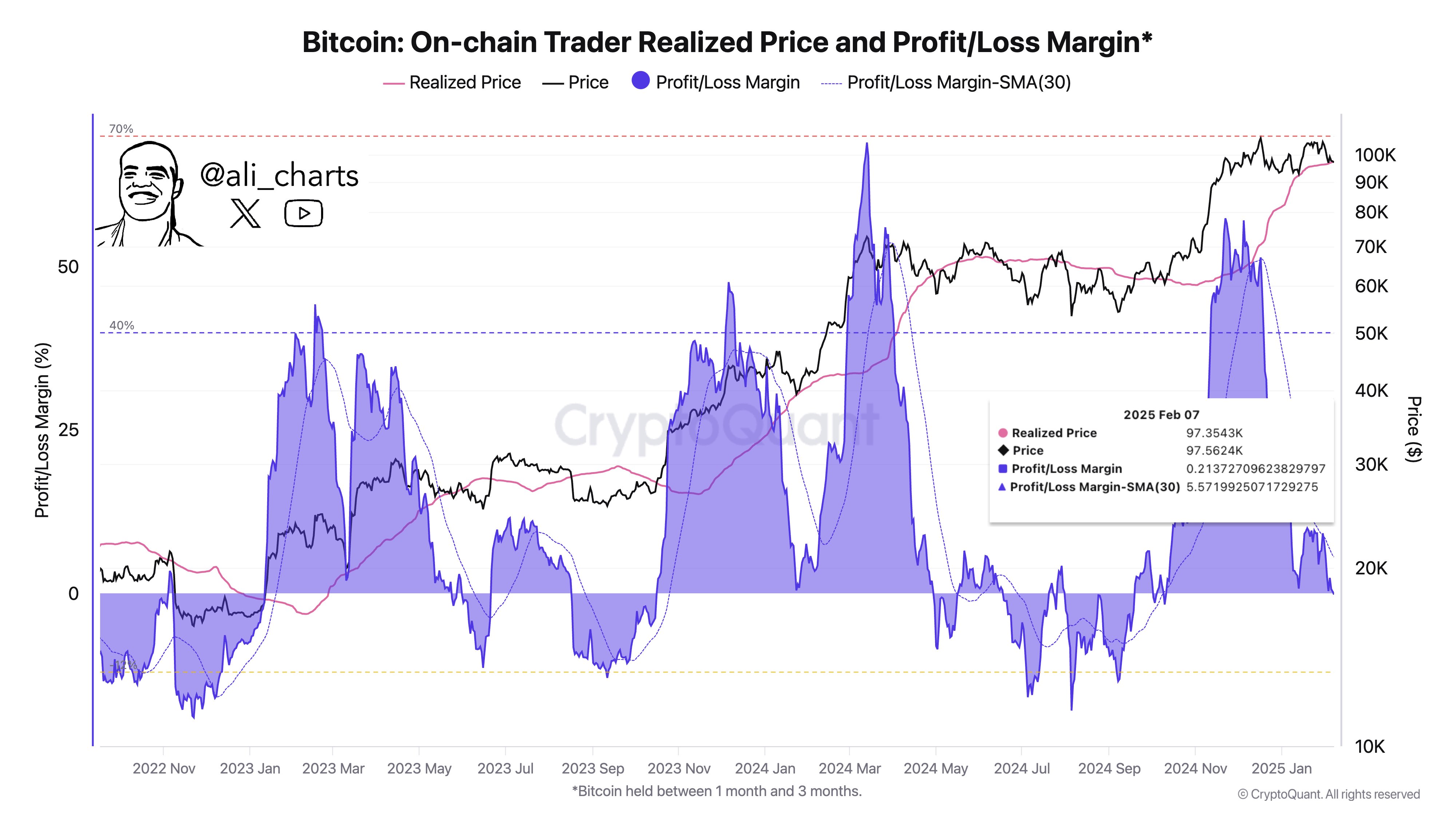

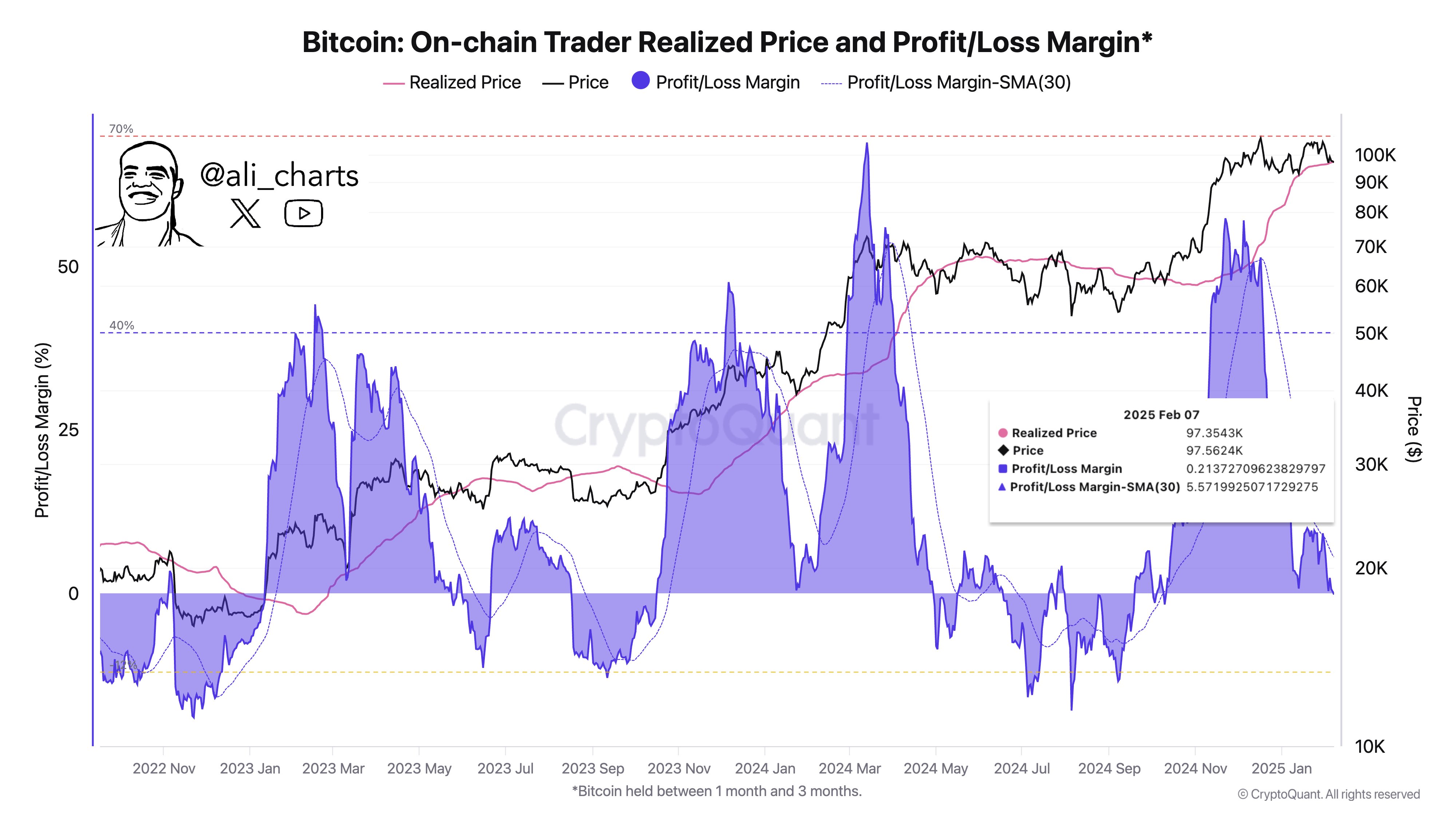

Echoing similar sentiments, market expert Ali Martinez pointed out that historically, the best buying opportunities for Bitcoin occur when traders face a 12% loss. At present, traders are still in profit by 0.21%, suggesting that BTC might still have room to drop before a significant uptrend.

Top Reasons Why Bitcoin Price Is Poised To Rally

Bitcoin Exchange Outflows Signals Bullish Momentum Ahead

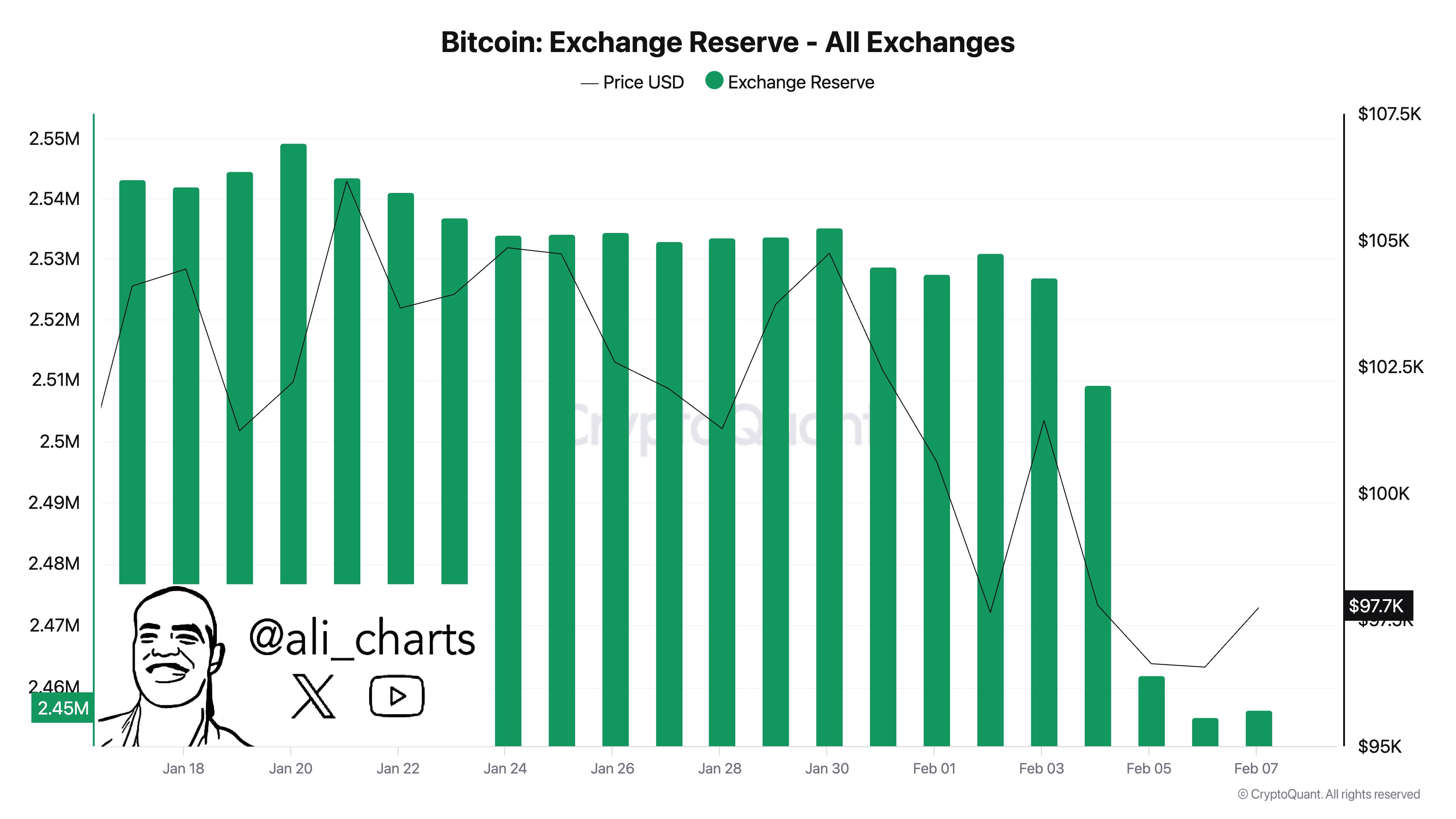

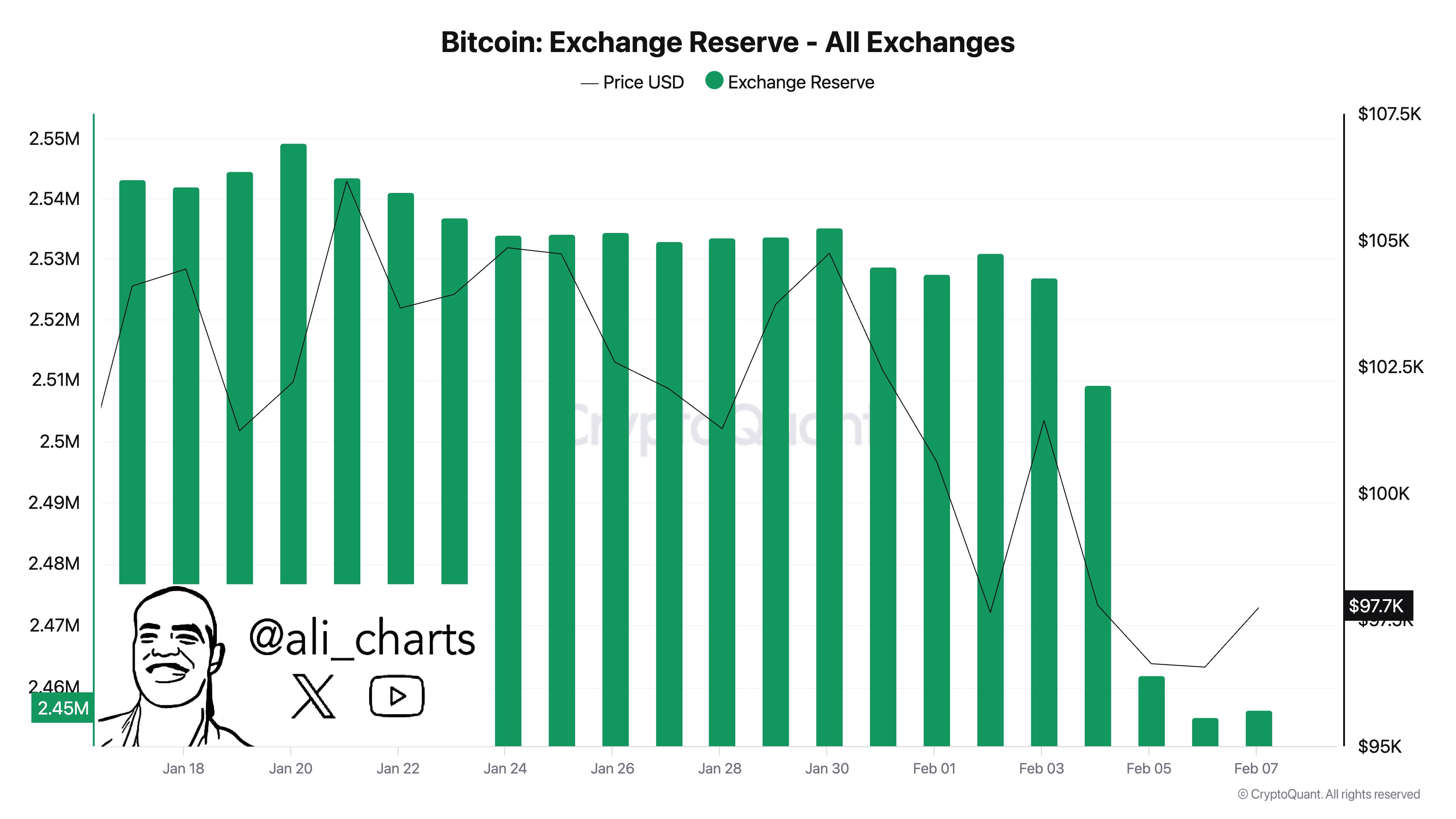

While short-term price predictions suggest a dip, on-chain data indicates growing long-term confidence among investors. Ali Martinez recently reported that over 70,000 BTC have been withdrawn from exchanges in the past week.

Notably, such large-scale withdrawals typically indicate that investors are moving their holdings to private wallets, reducing selling pressure in the market. This trend has often preceded major Bitcoin price rallies in the past.

US Job Data Fuels Sentiment

One of the key macroeconomic factors influencing Bitcoin price is the Federal Reserve’s stance on interest rates. However, the latest US job data suggests a cooling labor market, which could give the Fed more flexibility to implement rate cuts. Notably, BTC has soared past the $100K mark after the Labor market released this crucial data yesterday.

Meanwhile, lower interest rates generally boost risk assets like Bitcoin by making traditional investments less attractive. Having said that, if the Fed moves forward with its expected cuts, it could trigger renewed investor interest in BTC.

Crypto-Friendly Regulatory Environment And Bitcoin Reserve Speculations

Donald Trump’s presidency has proved to be bullish for the broader crypto market, let alone the flagship crypto. Having said that, experts are eyeing towards crypto-friendly regulatory environment in the US, which could help boost investors’ confidence towards digital assets.

In addition, a flurry of US states is already moving ahead with their Bitcoin Reserve plans. Besides, US crypto czar David Sacks recently said that the US administration is evaluating US Bitcoin Strategic Reserve plans. This development, if happens, could further trigger the global race for BTC adoption, which in turn could send the price to a new high.

How’s BTC Performing?

Bitcoin price today was down about 2% and traded at $95,943, and its one-day trading volume soared 11% to $50.8 billion. Notably, the crypto has touched a 24-hour high and low of $100,154.14 and $95,653 in the last 24 hours. Besides, the Bitcoin Relative Strength Index stayed at 41, indicating a strong momentum ahead.

Adding to the bullish sentiment, a top market analyst recently predicted BTC price to hit $150K, sparking further optimism. It’s worth noting that this analyst is widely followed by crypto market enthusiasts, given his reputation for accurately predicting the BTC bottom in 2022. Having said that, it appears that despite short-term volatility, Bitcoin price is poised to hit a new ATH soon.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: