The flagship cryptocurrency, Bitcoin price is poised for a potential surge in April, according to insights shared by a prominent crypto market analyst. Notably, the analyst has cited historical patterns to predict the potential surge in BTC price.

Meanwhile, with historical data indicating a strong correlation between April and positive Bitcoin returns, investors are eyeing the coming month with anticipation amid a backdrop of market volatility and optimism.

Top Analyst Anticipates Bitcoin Rally In April

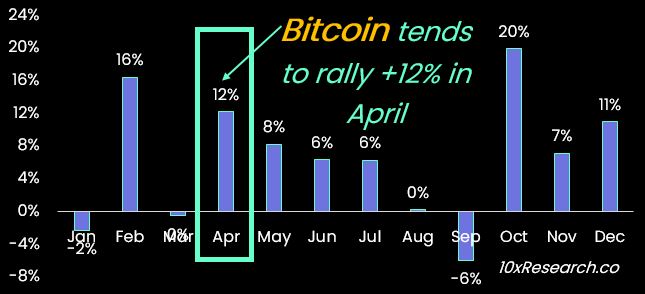

10X Research CEO Markus Thielen has recently shared an analysis on the X platform, suggesting a potential rally in Bitcoin price. Notably, the analysis sheds light on Bitcoin’s historical performance in April, suggesting a potential 12% rally for the cryptocurrency.

Drawing from past trends, Thielen highlights April’s tendency to yield positive returns for Bitcoin, with six out of the last ten years recording notable upticks in price. Despite recent volatility in the crypto market, characterized by fluctuations in Bitcoin’s price, analysts remain optimistic about the cryptocurrency’s trajectory.

Meanwhile, several analysts have attributed the ongoing volatility in Bitcoin price as part of the pre-halving phase. According to analysts like Rekt Capital, the pre-halving retracement phenomenon, observed in historical data, underscores the inherent volatility surrounding Bitcoin, often preceding significant price movements.

Moreover, the anticipation surrounding the upcoming Bitcoin Halving event adds to the market’s bullish sentiment. However, while historical data indicates a tendency for Bitcoin to rally post-halving, analysts caution against relying solely on past performance to predict future outcomes, emphasizing the unpredictable nature of the crypto market.

Also Read: VeChain Price- Top Reasons Why VeChain Is Trending

Market Confidence Boosted By ETF Inflows

Amid speculation over Bitcoin’s April rally, market confidence receives a boost from robust inflows into the U.S. Spot Bitcoin ETF. The growing interest in Bitcoin investment vehicles reflects a broader acceptance of cryptocurrencies among institutional investors, further solidifying Bitcoin’s position as a mainstream asset class.

Concurrently, the decline in outflows from Grayscale’s GBTC signals a shift in investor sentiment, with market participants expressing renewed confidence in Bitcoin’s long-term potential. As Bitcoin price continues to capture the attention of both retail and institutional investors, the stage is set for a dynamic month ahead, with April potentially marking another chapter in Bitcoin’s storied

Meanwhile, as of writing, the Bitcoin price plunged 1.24% to $69,959.56, with its trading volume from yesterday dropping 27.14% to $30.87 billion. Notably, the crypto has touched a high of $71,546.02 and a low of $69,725.77 in the last 24 hours.

Also Read: Fetch AI (FET) Price Rally to Continue As Open Interest Points Upwards

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: