As Bitcoin surges past the $46,000 mark and heads towards $47,000, the U.S. Spot Bitcoin ETF has seen a significant inflow of $405 million on February 8, according to data from BitMEX Research. This single-day influx of funds, the highest in this week, into the Bitcoin ETF coincides with the ongoing rally in Bitcoin’s price, sparking interest and speculation among investors and enthusiasts alike.

Bitcoin ETF Attracts $405 Mln Inflow

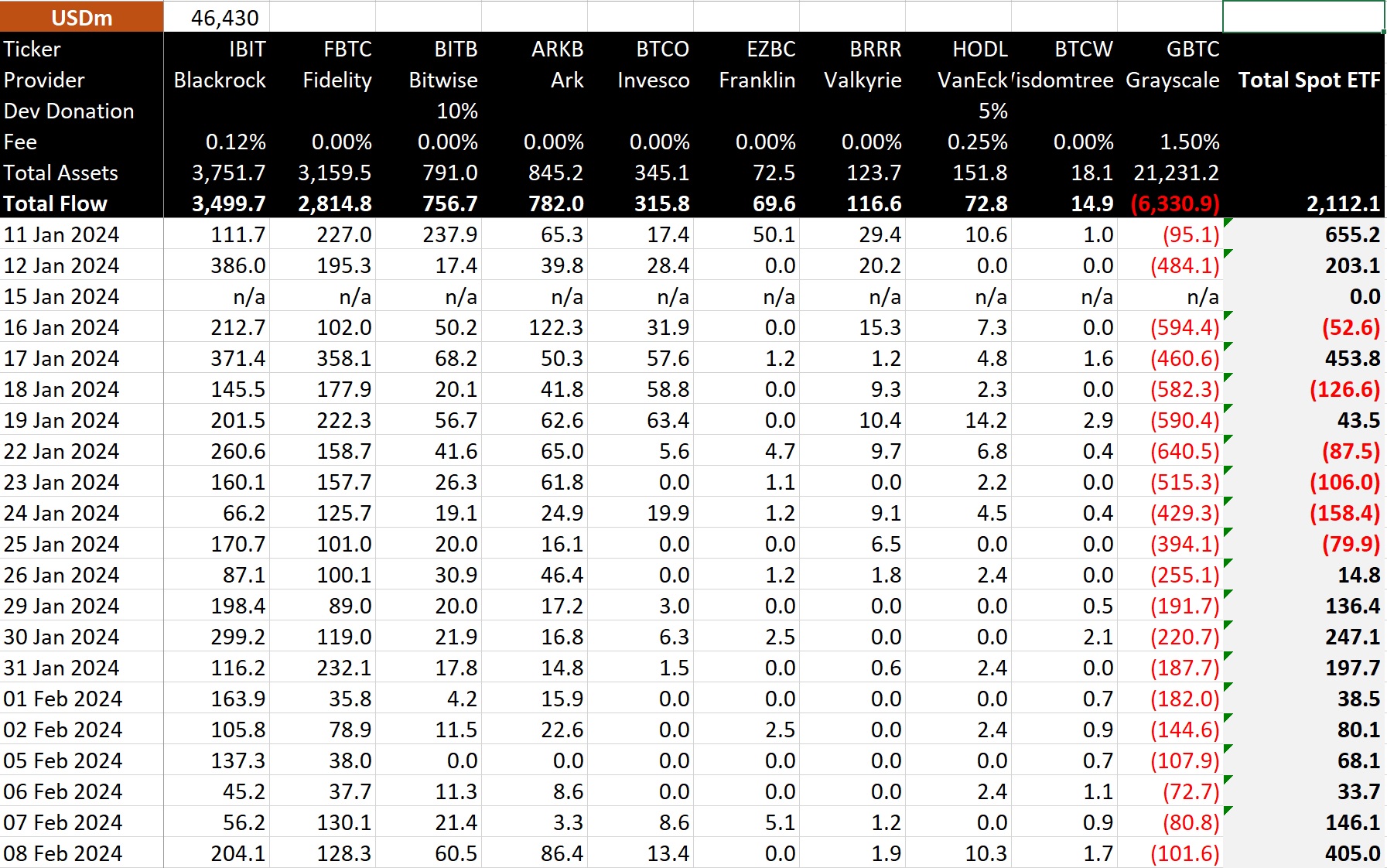

A recent report from BitMEX Research showed that the U.S. Spot Bitcoin ETF continued to attract notable inflow, despite facing challenges in the initial days. Meanwhile, data reveals that the Bitcoin ETF has garnered a total inflow of $2.11 billion since its launch on January 11.

Notably, on February 8 alone, the ETF saw an inflow of $405 million, equivalent to approximately 8,935 BTC. Leading the charge in terms of inflows are investment giants BlackRock (IBIT) and Fidelity (FBTC).

Since its inception, BlackRock ETF has attracted around $3.5 billion in inflows, while Fidelity has seen $2.81 billion flow into its ETF. On February 8, BlackRock noted an inflow of $204.1 million, with Fidelity recording $128.3 million in inflows.

However, the report also showed that the performance of Grayscale’s Bitcoin Trust (GBTC) has weighed on the overall market sentiment, with outflows totaling $6.33 billion since January 11 and $101.6 million on February 8.

Also Read: Space ID Crypto- Trader Moves 5 Mln ID To Binance As Price Soars 17%

Market Optimism Amid Bitcoin (BTC) Price Rally

The report of significant inflows into the Bitcoin ETF coincides with a period of heightened market optimism, as Bitcoin’s price rallies over 4% in the last 24 hours. Investors eagerly await the digital currency’s potential surge past the $47,000 mark. Notably, this recent rally has fueled speculation among enthusiasts, with some attributing it to a pre-halving rally.

Adding to the bullish sentiment is the surge in Bitcoin Futures Open Interest (OI), which has risen by 5.51% in the last 24 hours to reach 444.81K BTC or $20.74 billion, according to CoinGlass data. Leading the charge in OI growth is the CME exchange, which saw a surge of 9.79% to 117.23K BTC or $5.46 billion. Binance follows closely behind with a 5.78% increase to 109.76K BTC or $5.12 billion in the same timeframe.

As Bitcoin continues to capture the attention of investors and enthusiasts worldwide, the convergence of ETF inflows, price rallies, and increasing futures open interest underscores the growing confidence in the digital asset’s potential for further growth and adoption.

Meanwhile, the Bitcoin price was up 4.11% during writing and traded at $46,560.20 over the last 24 hours, its highest level since January 11. Its trading volume also witnessed a significant jump of 19% to $29.48 billion at the same time. Notably, the flagship crypto has touched a high of $46,712.05 and a low of $44,600.46 in the last 24 hours.

Also Read: Pi42 Launches DOGE, Cardano, AVAX, & LINK Pairs – What’s Next?

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: