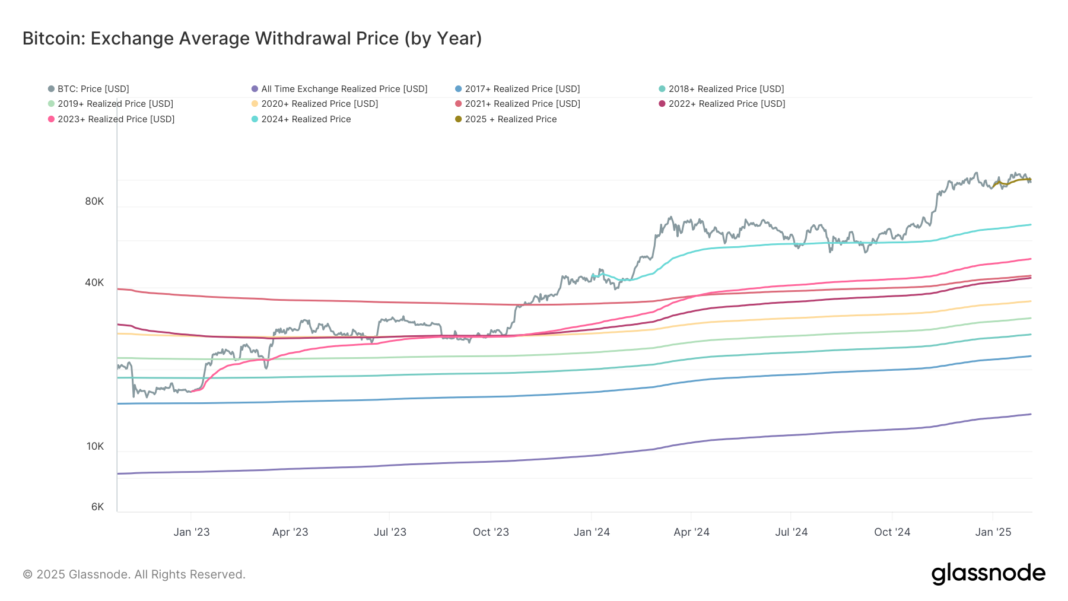

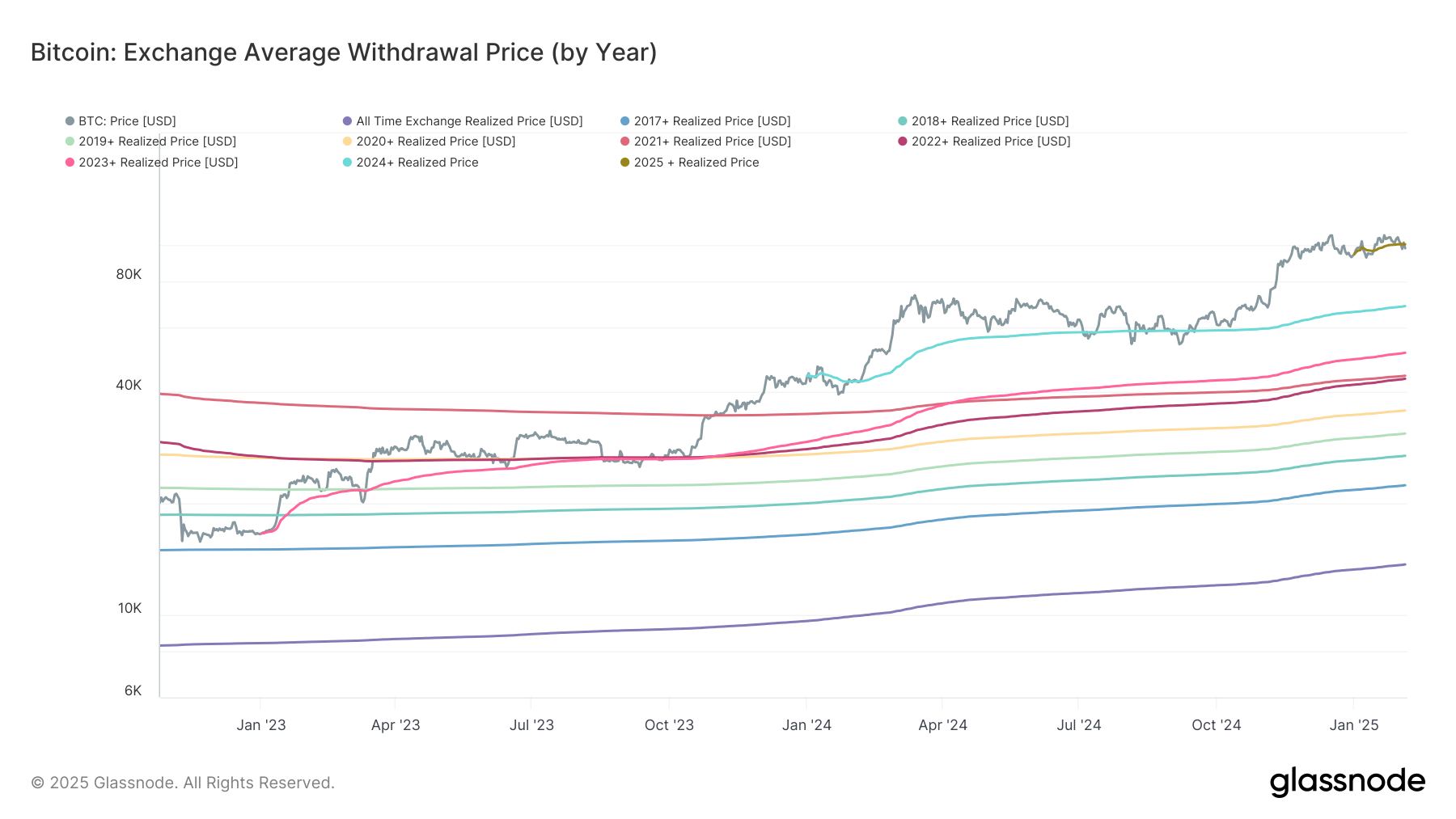

The average withdrawal price of bitcoin (BTC) from exchanges in 2025 currently stands at $100,356. At present, bitcoin is trading just below this level, hovering around $98,000.

The concern arises when bitcoin falls below the average withdrawal price for a sustained period of time, as this can often trigger continued selling and more downward price pressure. Historically, this metric has served as a strong support level for bitcoin.

Busting below this support, however, does not necessarily indicate a bear market or sustained declines, as bitcoin historically reclaims this price level quickly.

In 2024, for example, bitcoin repeatedly tested its average withdrawal price just below $60,000. The price indeed did briefly dip below this level multiple times, most notably in August during the yen carry trade unwind when it fell to $49,000. The price, though, managed to reclaim the support level within a few days.

Similarly, in 2023, the realized price provided key support on multiple occasions, including during the Silicon Valley Bank collapse in March ($20,000) and again in September, just before bitcoin’s Q4 rally.

According to Glassnode data, over 2.6 million BTC are sitting at a loss, one of the highest amounts this year. The longer it sustains a price below the 2025 average, the greater the chance further declines could be in order.