The current market seems quite confusing for traders and investors due to notable price fluctuations over the past few days. Amid this market uncertainty, a crypto whale was reported to have dumped a significant 149,999 Solana (SOL), worth $27.92 million, onto Binance, as tracked by the blockchain-based transaction tracker Whale Alert on X (formerly Twitter).

Crypto Whale Dump 149,999 SOL

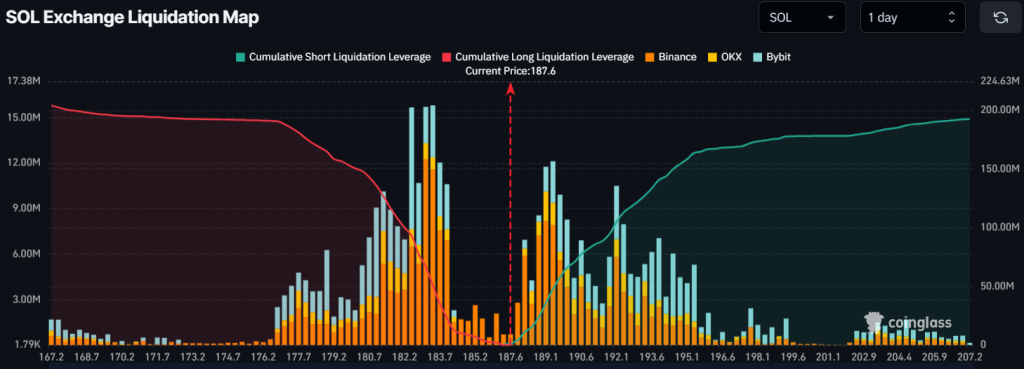

However, this notable dump on the exchange occurred as Solana’s on-chain metrics indicated bullish signs at a crucial support level of $185. Data from the on-chain analytics firm Coinglass revealed that traders betting on long positions outnumber those on short positions by more than double.

Bullish On-Chain Metrics Amid Whale Sell-Off

According to the data, traders are over-leveraged at the $182.5 level, with $93.01 million worth of long positions recorded in the past 24 hours. Meanwhile, the $189.4 level is another over-leveraged zone, where short sellers have accumulated an impressive $47.81 million in short positions.

This data indicates that bets on the long side are significantly higher than those on the short side, reflecting a bullish sentiment among traders.

In addition to traders’ participation, long-term holders appear to be accumulating tokens. Data from spot inflow/outflow reveals that exchanges have witnessed an outflow of a significant $50.51 million worth of Solana (SOL) in the past 24 hours.

In the cryptocurrency landscape, outflows are considered a movement of assets from exchanges to long-term wallet holders, indicating potential accumulation. Additionally, this on-chain metric can create buying pressure and drive an upside rally.

Solana (SOL) Price Action and Key Levels

All of this is happening while SOL is trading near a crucial support level of $183 and the 200 Exponential Moving Average (EMA) on the daily time frame. SOL’s daily chart reveals that since June 2024, the altcoin has not experienced any major price decline below the 200 EMA, making SOL an ideal buying opportunity.

The last time SOL reached this level, it experienced impressive upside momentum. Based on previous price movements, experts and analysts speculate a similar upward trend in the coming days. If this occurs, there is a strong possibility that SOL could soar by 18% to reach the $220 mark in the near future.

Current price Momentum

At press time, SOL is trading near $186 and has witnessed a price decline of modest 0.50% in the past 24 hours. Amid the prevailing uncertainty in the crypto market, SOL’s trading volume has dropped by 32.5% during the same period.