Bitcoin price has rallied near the $65,000 mark today, noting its 30-day high while sparking market optimism over further rally. A flurry of macroeconomic factors and other market trends also supports this bullish outlook of several experts, who expect a potential rally for the flagship crypto in the coming days. For instance, a prominent crypto investor Anthony Pompliano has recently shared some key reasons that could aid in a BTC rally in the coming days.

Is Bitcoin Eyeing A ‘Uptober’ Rally?

According to several market watchers, BTC is gearing up for a potential rally, after a prolonged volatile trading over the last few weeks. So, here we explore some of the top reasons that may bolster the market sentiment, which in turn could boost the BTC price.

Market Liquidity To Aid In Bitcoin Surge

In a recent CNBC interview, Anthony Pompliano shared a bullish outlook for BTC citing several reasons. He noted that “Bitcoin is the most sensitive asset when it comes to global liquidity”. Having said that, he believes that the latest US Fed rate cut of 50 bps points and the anticipated cuts by the other global central banks could help rally the crypto price.

For instance, China has also recently revealed its plan to lower the policy rates to boost its economy. On the other hand, Pompliano also noted that the central banks would be shifting their focus towards “money printing”, which will again increase global liquidity.

Usually, the lower rates and increased liquidity raise the risk-bet appetite of the investors. In other words, the market participants generally shift their focus toward riskier assets like cryptocurrencies, stocks, and others, during rising market liquidity.

Considering that, Pompliano believes that it could make BTC an attractive asset in the coming days, which might also help in its price surge.

Latest ETF Inflow And Institutional Interests

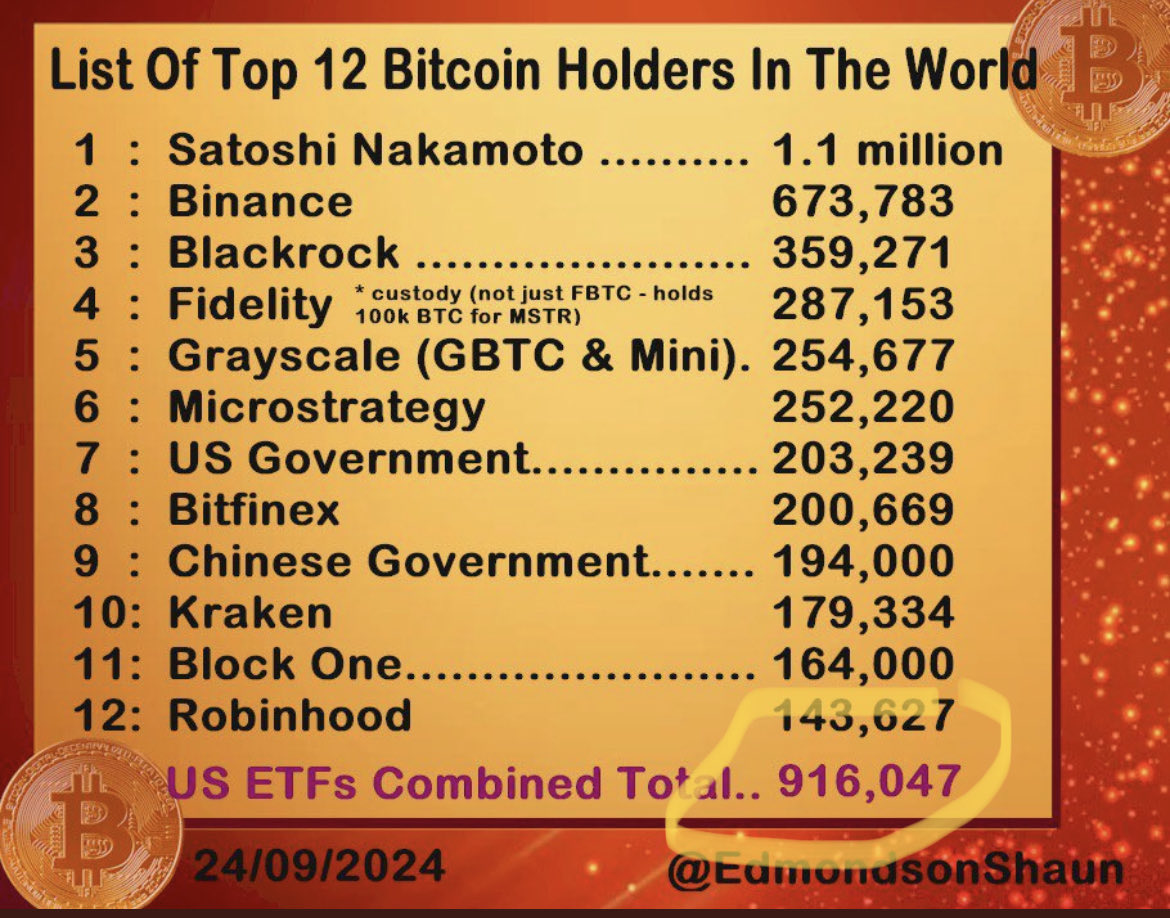

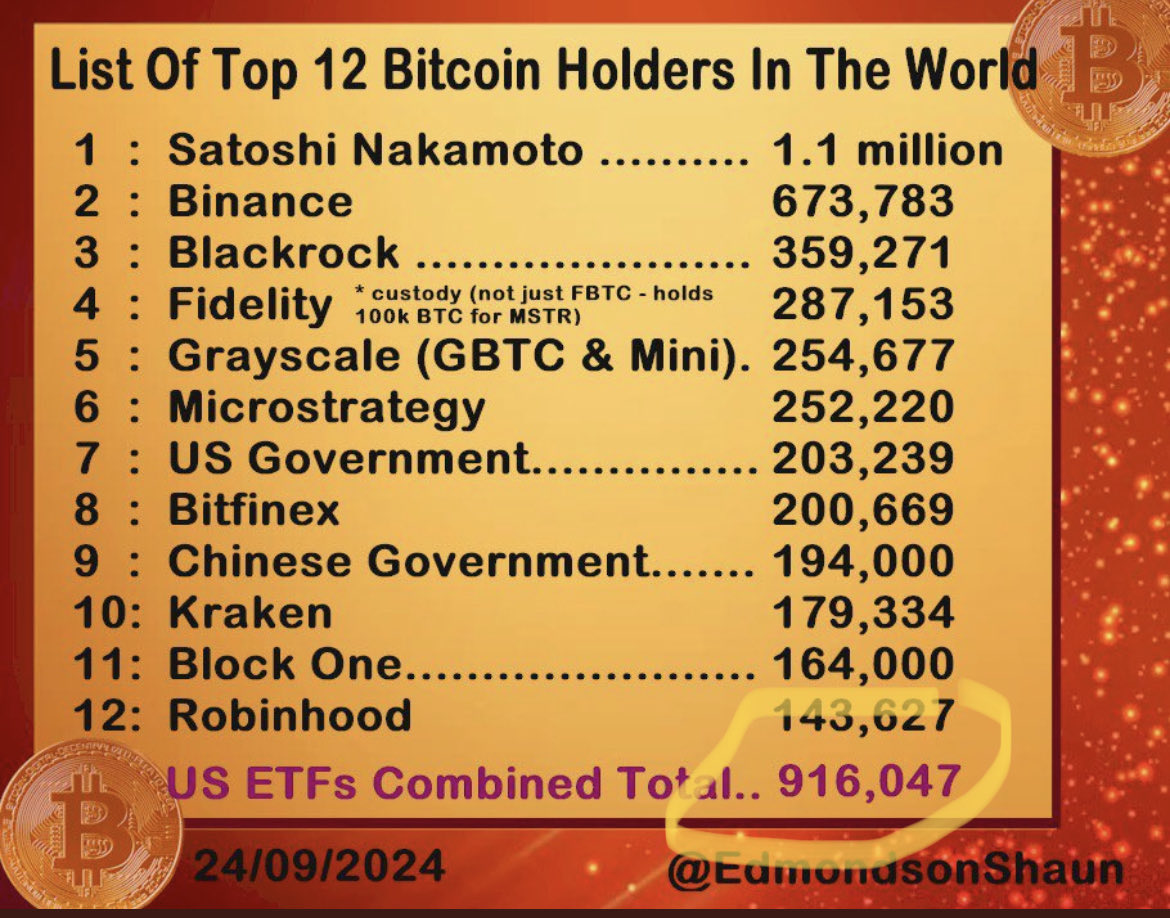

The latest Bitcoin ETF inflow and institutional demand also hint at a growing market interest in the flagship crypto. According to Farside Investors, the US Spot BTC ETF has recorded an inflow of over $140 million through September 23 and 24. Since September 12, the total inflow totaled $839.9 million, with only a one-day outflux of $52.7 million on September 18.

Meanwhile, in a recent X post, Bloomberg Senior ETF analyst Eric Balchunas highlighted that the US BTC ETF hit a new milestone. Through September 24, the total YTD influx into the investment instrument hit $17.8 billion, marking a new high.

Simultaneously, last week, Michael Saylor’s MicroStrategy increased its convertible senior notes offering from $700 million to $875 million. The company said that it plans to use the net proceeds from this offering to buy more BTC, reflecting the company’s consistent confidence in the crypto.

Bullish October Trend For Bitcoin

Another key reason that has boosted the market sentiment lately, is the historical October performance of BTC. According to CoinGlass data, the month has been bullish so far for Bitcoin, with last year the crypto noting a surge of 28.52% MoM.

In addition, October is often called Uptober by crypto market enthusiasts, combining the terms “Up” and “October”. The historical data indicates that BTC as well as the other top altcoins tends to showcase a positive momentum in October.

However, it’s worth noting that historical trends do not guarantee future trading. Despite that, many market experts remain bullish on the future trajectory of the market in the fourth quarter.

What’s Next For BTC Price?

As said earlier, the market enthusiasts are anticipating a bullish Q4 for the broader financial sector, let alone the crypto market. In addition, the upcoming US Presidential election in November is also expected to boost the market sentiment.

Although many are betting toward a Trump win to be a bullish factor for digital assets, many have argued that the victory of any party, whether Trump or Harris, will enhance the innovations in the sector. In addition, crypto has become a key part of the upcoming election, and considering that, the market is betting towards clearer crypto regulations and fostering market post the election.

Meanwhile, BTC price was up over 1% to $63,729 during writing, with its trading volume rising only 2% to $27.51 billion. Notably, the crypto has touched a 30-day high of $64,804 today, indicating the growing market confidence. On the other hand, the crypto has also noted a surge of 8% through September, when the month tends to showcase a bearish period for the crypto.

Furthermore, the BTC Futures Open Interest rose 1% to $35.09 billion, indicating a stable market sentiment despite the recent surge. Besides, the overall exchange outflow also indicates that the investors are accumulating the crypto. Meanwhile, a recent Bitcoin price prediction indicates that the crypto could soar past the $80K mark in October.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: