Key Takeaways

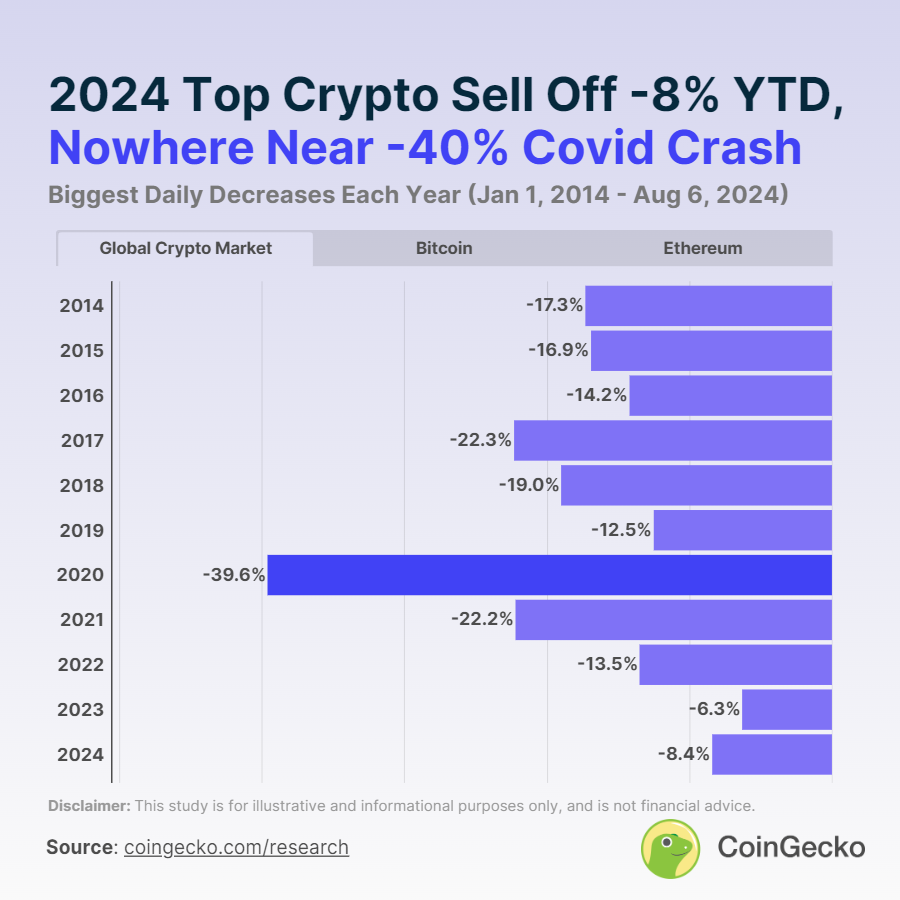

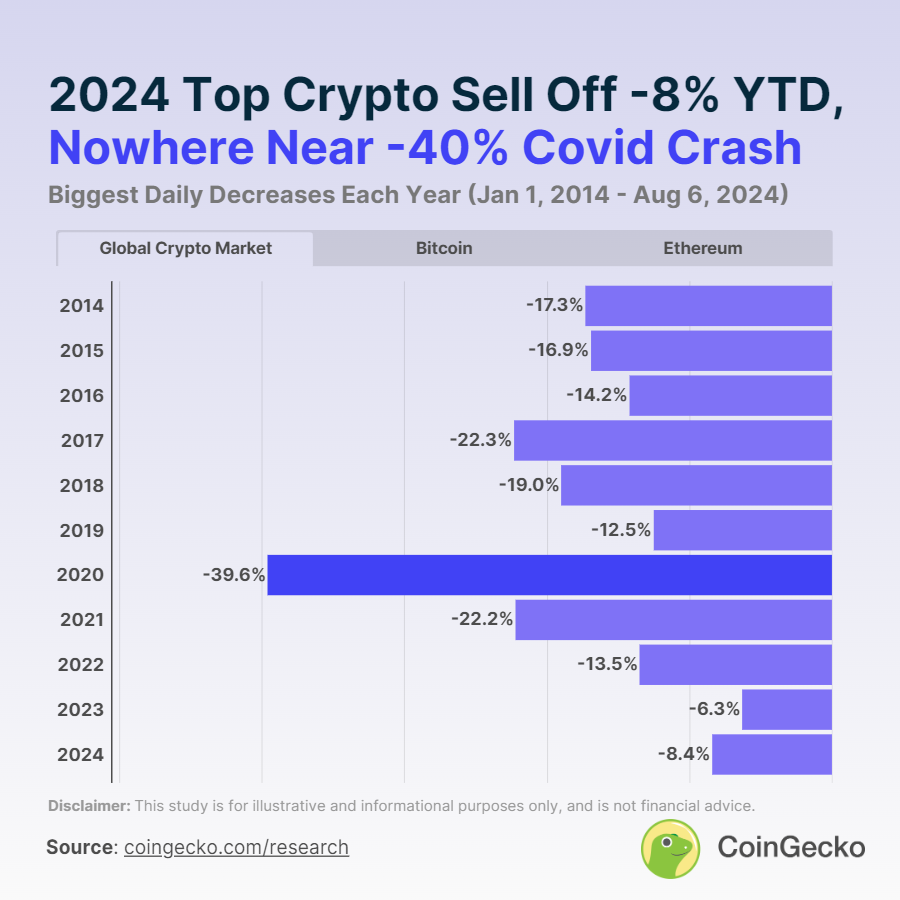

- The largest crypto market sell-off in 2024 was -8.4%, significantly less than the -39.6% Covid-19 crash.

- Crypto has not recorded a single day of market correction since the FTX collapse in November 2022.

Share this article

Despite Bitcoin’s (BTC) recent dip of 29% in two weeks, the crypto market has shown resilience in 2024, with no significant corrections compared to historical downturns. According to a CoinGecko report, the largest sell-off this year was a relatively mild -8.4% on March 20, 2024.

In contrast, the most severe crypto market correction in the past decade occurred during the Covid-19 crash on March 13, 2020. Total crypto market capitalization plummeted -39.6% day-over-day, from $223.74 billion to $135.14 billion, highlighted the report.

Bitcoin experienced its biggest price correction of -35.2% on the same day, while Ethereum saw its second-largest drop at -43.1%.

The crypto market has not recorded a single day of correction since the FTX collapse in November 2022. Over the past ten years, the longest crypto corrections have lasted at most two consecutive days, occurring only three times.

From 2014 to date, the global crypto market has experienced 62 days of market correction, representing just 1.6% of the time during this period, with the average crypto market correction being 13%.

Notably, 2023 saw zero days of correction for the overall crypto market, Bitcoin, and Ethereum. While the global crypto market and Bitcoin have avoided corrections in 2024 so far, Ethereum has experienced two days of price correction this year: -10.1% on March 20 and -10% on August 6, 2024.

Share this article