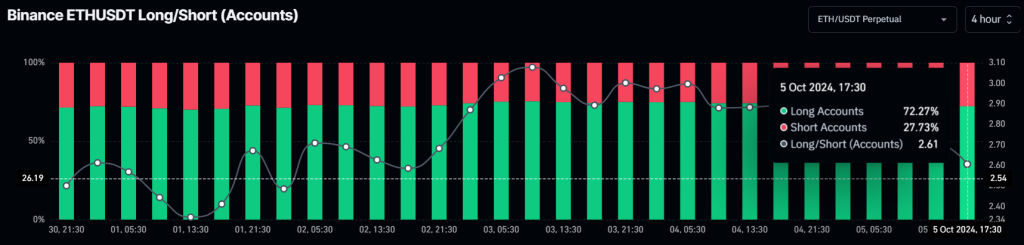

ETHUSDT traders are extremely bullish as bet on the long position skyrockets. According to the on-chain analytics firm Coinglass, 72.27% of Binance traders are going long on the ETHUSDT pair. It appears that traders have a strong conviction that the price of Ethereum will rise in the coming days.

Meanwhile, 27.73% of Binance traders are still holding short positions, believing that the price will drop in the coming days.

Ethereum (ETH) Technical Analysis and Upcoming Level

According to expert technical analysis, Ethereum remains in a position where it could soon skyrocket. Currently, ETH is supported by an ascending trendline and experiencing upward momentum. Based on the historical price momentum, there is a strong possibility that ETH could soar by 15% to reach the $2,815 level in the coming days.

However, ETH’s recent doji candle at the support level has shifted the sentiment slightly from a downtrend to an uptrend. Additionally, the Relative Strength Index (RSI) indicates that ETH is currently in an oversold zone, hinting at a possible price reversal.

This bullish thesis will only hold if ETH stays above the $2,330 level, otherwise, it may fail.

On-Chain Metrics

Despite this positive outlook, ETH’s other on-chain metrics signal weak market sentiment. Coinglass’s ETH future open interest has declined by 1.2% in the past 24 hours, indicating reduced trader conviction as they may hesitate to build new positions.

Ether Current Price Momentum

At press time, Ether is trading near $2,415 and has experienced a slight price decline of over 0.45% in the past 24 hours. During the same period, its trading volume dropped by 38%, indicating lower participation from traders amid ongoing price reversal.

Despite the mixed sentiment among traders, whales and institutions appear more confident, as they have started accumulating ETH following a recent price decline of 10%. On October 3, 2024, whales accumulated nearly 28,120 ETH worth $66 million, as reported by Coinpedia.