3AC founders cited key crypto traders that led to the company’s collapse in a lengthy post-mortem that we are reading more about in today’s latest cryptocurrency news.

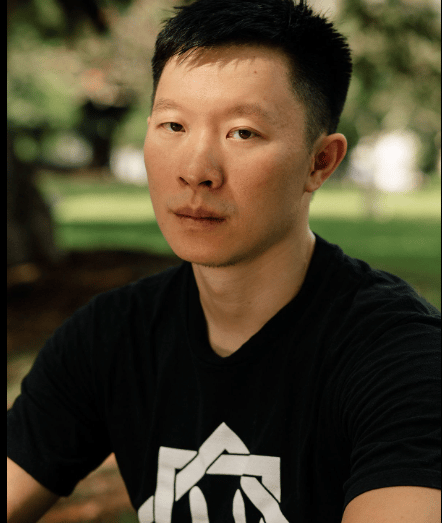

3AC founders cited that Terra, staked Ethereum, and Grayscale’s Bitcoin trust contributed to the company’s collapse. The two co-founders of the collapsed Three Arrows Capital, Kyle Davies, and Su Zhu broke their silence in the new interview with Bloomberg. Davies and Zhu attributed the 3AC rapid collapse to over optimisic speculations on their part with Zhu saying that they were in a position for a market that just didn’t happen and Davies noted that they believed in everything to the fullest.

Zhu said he wasn’t surprised that 3AC folded and filed for bankruptcy alongside Voyager and Celsius. They were not the only ones to feel the bear market. Lenders like BlockFi and Vauld also had liquditiy issues and some like OpenSea, Gemini, Coinbase, and Blockchain.com announced mass layoffs. Zhu added:

“We have our own capital, we have our own balance sheet, but then we also take in deposits from these lenders and then we generate yield on them. So if we’re in the business of taking in deposits and then generating yield, then that, you know, means we end up doing similar trades.”

Kyle Davies and Zhu attributed 3AC’s collpase to over-exposure to terra and staked ethereum. Zhu said that in the case of Terra, he didn’t see any red flags initailly:

“What we failed to realize was that Luna was capable of falling to effective zero in a matter of days and that this would catalyze a credit squeeze across the industry that would put significant pressure on all of our illiquid positions.”

He continued:

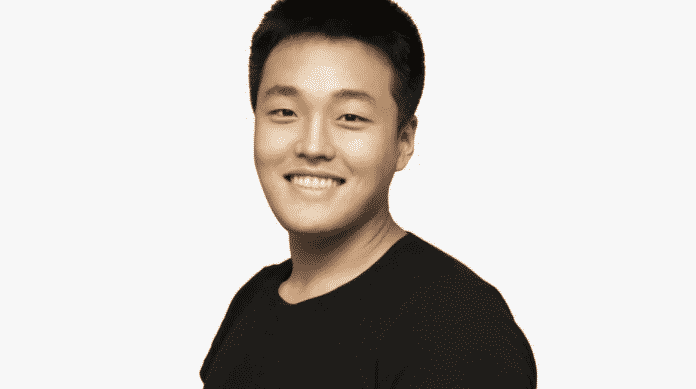

“We began to know Do Kwon on a personal basis as he moved to Singapore. And we just felt like the project was going to do very big things, and had already done very big things. If we could have seen that, you know, that this was now like, potentially like attackable in some ways, and that it had grown too, you know, too big, too fast.”

Another trade among the failing crypto companies was staked Ethereum and each stETH was in theory redeemable for one Etheruem after the network moves to the PoS consensus. Zhu also attributed the collapse to the exposure to Grayscale Bitcoin Trust. He alleged that the reason they remained silent was beucase they thought their lives were threatened.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]